Crypto market roars back with $170 billion inflow in 24 hours

The cryptocurrency market roared back to life on Monday, adding roughly $170 billion in value within 24 hours as renewed optimism flooded global markets.

At press time, the total crypto market capitalization stood at $3.58 trillion, up from $3.41 trillion the previous day, according to CoinMarketCap data.

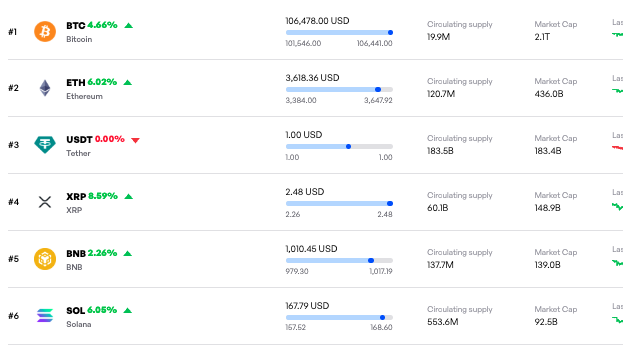

Bitcoin (BTC) led the rebound, rising 4.66% to $106,478, pushing its market capitalization past $2.1 trillion. Ethereum (ETH) followed with a 6.02% jump to $3,618, while XRP surged 8.59% to $2.48. Binance Coin (BNB) advanced 2.26% to $1,010, and Solana (SOL) extended its rally with a 6.05% rise to $167.79.

Why the crypto market is rallying

The surge came after reports that U.S. lawmakers had reached a bipartisan deal to end the 40-day government shutdown, easing fears that had rattled global markets for weeks.

The shutdown had drained liquidity and delayed the release of key economic data, leaving investors uncertain about the Federal Reserve’s next policy moves.

With the prospect of government operations resuming and fresh fiscal spending on the horizon, traders rushed back into risk assets, including digital currencies.

Adding to the optimism, a new proposal by President Donald Trump to use tariff revenues to fund $2,000 dividend payments to Americans helped lift sentiment further.

The plan, which includes allocating tariff proceeds to partially cover healthcare expenses, is widely viewed as a form of fiscal stimulus likely to boost consumer spending and liquidity, both favorable conditions for risk assets like cryptocurrencies.

The comeback follows weeks of heavy outflows from crypto exchange-traded funds (ETFs), with over $2.1 billion withdrawn from spot Bitcoin products and $579 million from Ethereum funds over the past eight trading sessions.

Indeed, the downturn saw Bitcoin fall below $100,000, with analysts warning that the major digital asset could correct further. However, as things stand, Bitcoin’s next target remains reclaiming the $110,000 mark, provided it holds onto the $105,000 support.

Featured image via Shutterstock