Whales Buy the Dip: Institutional Demand Surges for BTC, ETH

On-chain data suggests that institutional investors aggressively bought Bitcoin and Ethereum during the recent market dip.

This surge in institutional activity points toward a potential stabilization and reversal of the recent bearish trend.

Bitcoin Demand Sees Record Surge in 48 Hours

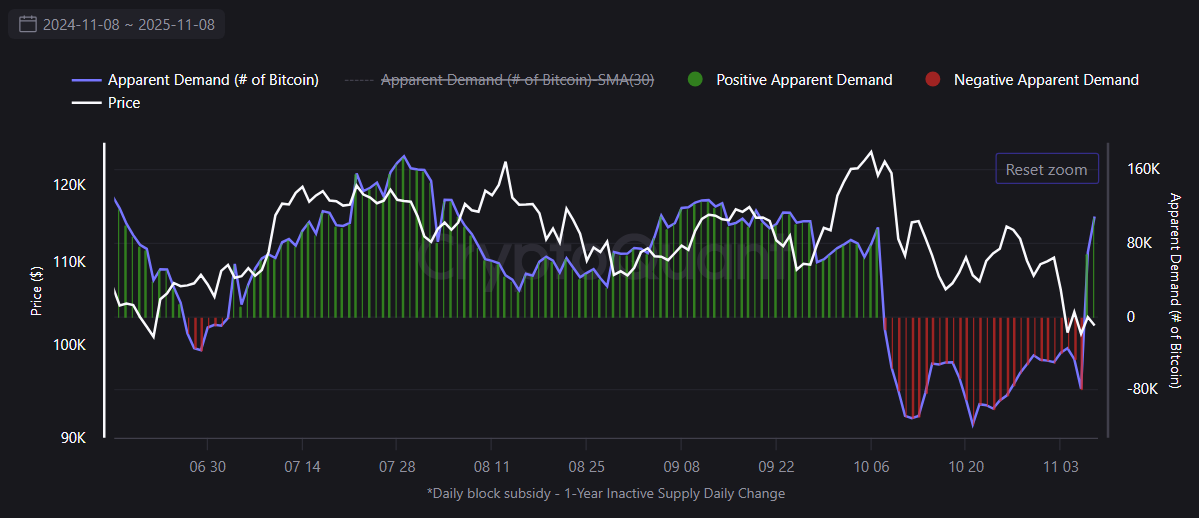

According to CryptoQuant’s “Bitcoin: Apparent Demand (30-day sum)” metric, Bitcoin’s net buying demand surged dramatically from -79.085k BTC on November 6 to +108.5819k BTC two days later. This steep increase is the sharpest movement recorded in the indicator all year.

The ‘Apparent Demand’ metric compares Bitcoin production (supply) with the behavior of Long-Term Holders (LTHs). This comparison measures the true strength of net buying demand.

It tracks the cumulative net demand over the past 30 days, using on-chain movements of spot BTC. This methodology helps analysts distinguish between speculative, price-driven flows and genuine, structural accumulation. This is because deep-pocketed investors use it to identify activity.

Historically, a flip from negative to positive is known as a “demand pivot.” This event signals the entry of new institutional capital and is often a precursor to a substantial price rebound or the establishment of a robust support base.

The stronger the indicator’s value changes, the higher the probability that large-scale whale demand was involved. Notably, the indicator had remained negative since turning sour on October 8, just before the October 10 crash, until its reversal to positive on November 7.

Whale Activity Spikes at Ethereum Lows

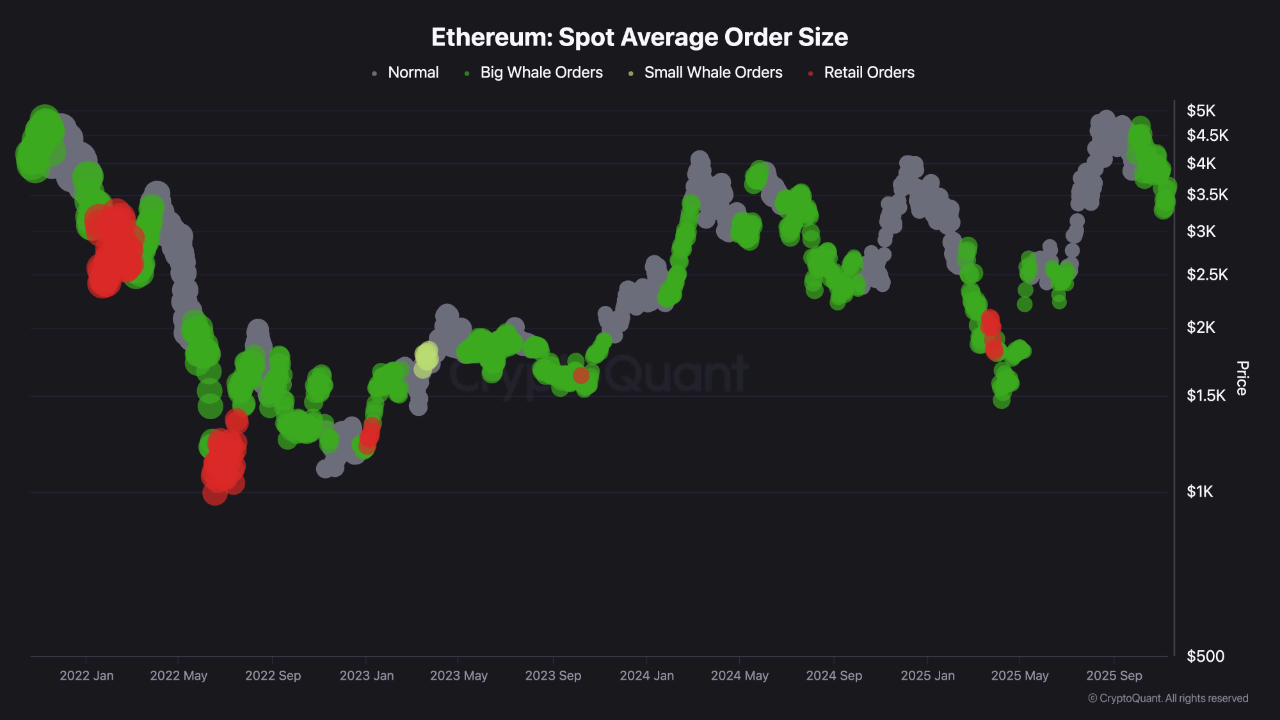

Evidence of institutional purchasing was also captured in Ethereum’s on-chain data. CryptoQuant analyst ShayanMarkets revealed in a Monday report that a brief surge in whale-led activity was detected during ETH’s decline to the $3.2K level.

The analysis shows that whale order activity (green) had previously concentrated at the short-term low in April. A similar pattern was observed during the recent drop from $4.5K down to $3.2K.

ShayanMarkets assessed this shift: “This change implies that larger market participants are re-entering exposure at discounted prices, while retail traders remain cautious.”

The analyst further suggested a bullish path forward. He stated that if this behaviour persists and the $3K–$3.4K region holds as structural support, Ethereum may be entering a low-volatility accumulation zone, setting up for a potential final bullish impulse toward the upper range of $4.5K–$4.8K.

The post Whales Buy the Dip: Institutional Demand Surges for BTC, ETH appeared first on BeInCrypto.