BTC accumulation trend persists despite recent price slide below $100K

The BTC accumulation trend persists despite the recent price slide. More accumulation wallets are storing coins, undisturbed by the volatility on derivative markets.

BTC is still relatively scarce, with more coins landing in accumulation addresses that rarely move coins or sell. Despite the recent signs of selling, there are also buyers for the available BTC, continuing with spot accumulation.

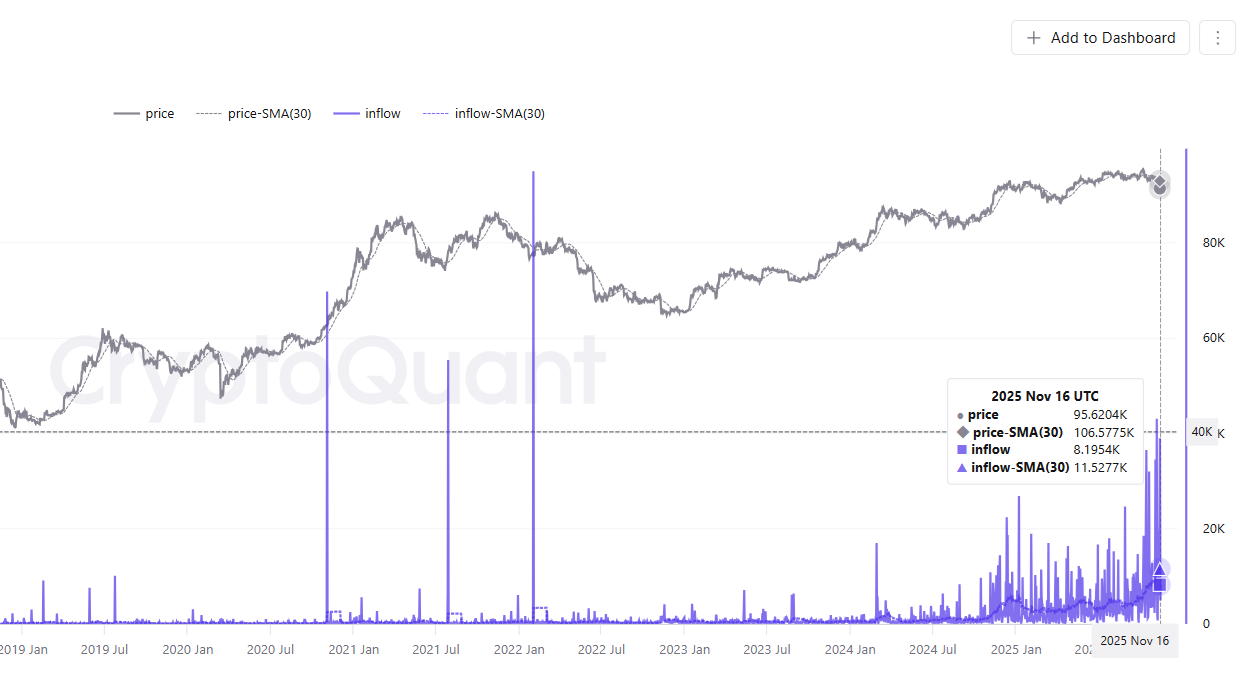

The recent buying shows BTC is still in a period of accumulation since late 2024. Whales are now returning with more buying. The new spot buying also shows little regard for short-term profit, with continued buying even as BTC dipped under $100,000.

The accumulation continued as BTC traded around $95,473.41. The Bitcoin Fear and Greed Index also remained near a multi-month low, signaling extreme fear at 17 points. The index reflects derivative trading positions, but did not affect the accumulation trend.

BTC held in accumulation addresses reaches a record

The BTC balance on accumulation addresses is at a record of over 2.86M coins. The recent buying also reflects the turnover between older wallets taking profits, and renewed accumulation or shifting reserves.

Accumulation addresses have a realized price of $79K per BTC, and can continue accumulating comfortably. The addresses are still not categorized or known, as buyers range from private whales to institutions and treasury companies.

Inflows to accumulation addresses also accelerated since September, from a few hundred coins to over 8K BTC daily.

The recent period of accumulation is also the most consistent one in the history of BTC, with significant turnover between wallets. BTC is more actively traded, with both accumulation and whale deposits to exchanges. The ratio of whale deposits also increased in the past few months, signaling either profit-taking or spot trading.

Moving coins to exchanges reflected a shift to the more conservative spot trading markets, after a series of futures liquidations.

BTC is traded through short-term wallets

In the past month, the HODL waves reveal a trend of storing BTC across wallet cohorts. Most of the trading comes from short-term, newly created wallets.

All other wallet cohorts have increased their storage, including wallets aged up to 1 month and 1-3 months. The relatively new wallets show no signs of capitulation, despite the market downturn.

BTC now trades below previous levels of support, but has not yet caused a deeper capitulation from spot sellers. The market is also swayed by whale moves rather than retail selling.

The strongest accumulation trend is for wallets holding 100 to 1,000 BTC. The network added over 3,000 shark wallets in the past year. Shrimp wallets are also growing, those with holdings under 0.01 BTC.

The ongoing accumulation is seen as a sign that the BTC cycle may not be over, and wallet holders still have long-term confidence.