Bitcoin whales switch to buying as retail dumps on ‘extreme fear’

The number of Bitcoin whale wallets has spiked as the price of Bitcoin has struggled this week, sinking as low as $89,550 on Tuesday.

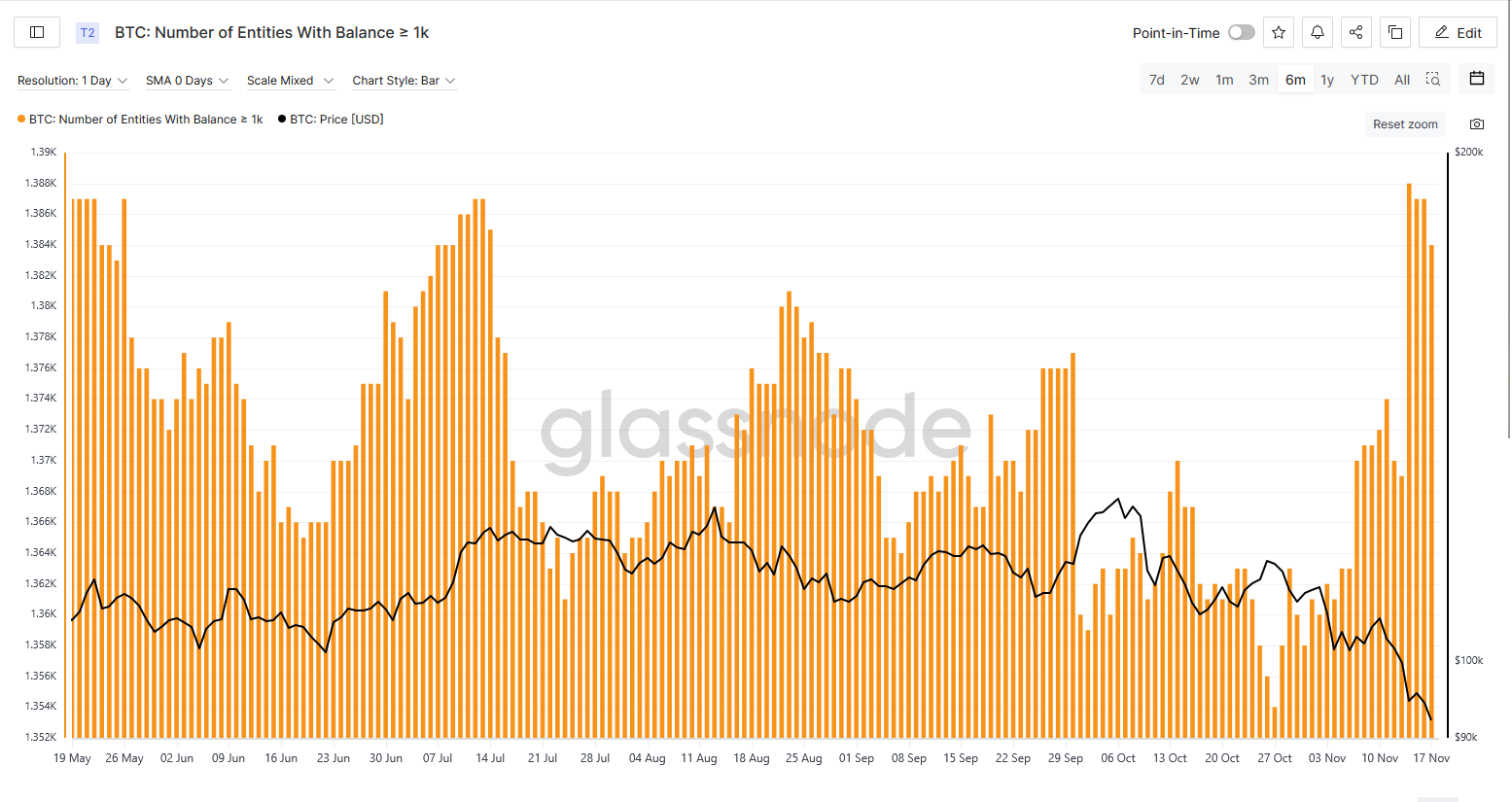

Data from the crypto analytics platform Glassnode shows that whales have been accumulating since late October, with a notable spike in the number of Bitcoin whale wallets holding above 1,000 BTC starting Friday.

Whale wallets’ numbers fell to a yearly low of 1,354 on Oct. 27 — when BTC was trading at around $114,000 — but as of Monday, this number has spiked 2.2% to sit at 1,384, in levels not seen in four months.

At the same time, Glassnode data indicate that small holders with 1 BTC or less have been feeling the pressure of the recent price slump.

The total number of these small wallets has decreased from 980,577 on Oct. 27 to hit a yearly low of 977,420 on Nov. 17.

This data indicates a common market pattern in crypto in which smaller investors become prone to panic-selling amid market crashes, while whales swoop in to accumulate.

It could also contradict a recent narrative around “OG dumping,” which argues that older investors have been driving the price of Bitcoin down lately by taking profits.

Bitcoin drops below $90K

Bitcoin dipped below a crucial psychological level on Monday, and is currently trading at around $89,900. This has seen the Crypto Fear & Greed Index drop down to the “extreme-fear” zone with a score of 11 out of 100.

While some may be feeling the pressure, executives from firms such as Bitwise and BitMine have tipped BTC selling pressure to subside and hit a bottom this week.

Speaking with CNBC on Monday, Bitwise Asset Management chief investment officer Matt Hougan argued that current price levels are a “generational opportunity.”

Related: Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?

“I think we’re nearing a bottom. I look at this as a great buying opportunity for long-term investors. Bitcoin was the first thing to turn over before this broader market pullback. It was sort of the canary in the coal mine signaling that there was some risk in all sorts of risk-on assets,” Hougan said.

Elsewhere, while “working at McDonald’s” memes are making a comeback on X, execs like Gemini crypto exchange co-founder Cameron Winklevoss have taken a more positive spin, posting that this “is the last time you’ll ever be able to buy Bitcoin below $90k!”

Another crypto analyst on X, including TheCryptoDog, has also argued that BTC is due “for a bounce soon” given current metrics.

“If things play out clear and simple, $BTC tags ~87.7k – Some high TF MA support & horizontal support from previous resistance (the break of which triggered a rally in May),” they wrote.

Magazine: Big Questions: Did a time-traveling AI invent Bitcoin?