From $140K Call to $80K Put: Bitcoin (BTC) Positioning Reverses Completely

Bitcoin BTC$90,470.56 options have flipped the script with a full 180-degree shift from last year’s uber bullish bets to a sharply bearish stance.

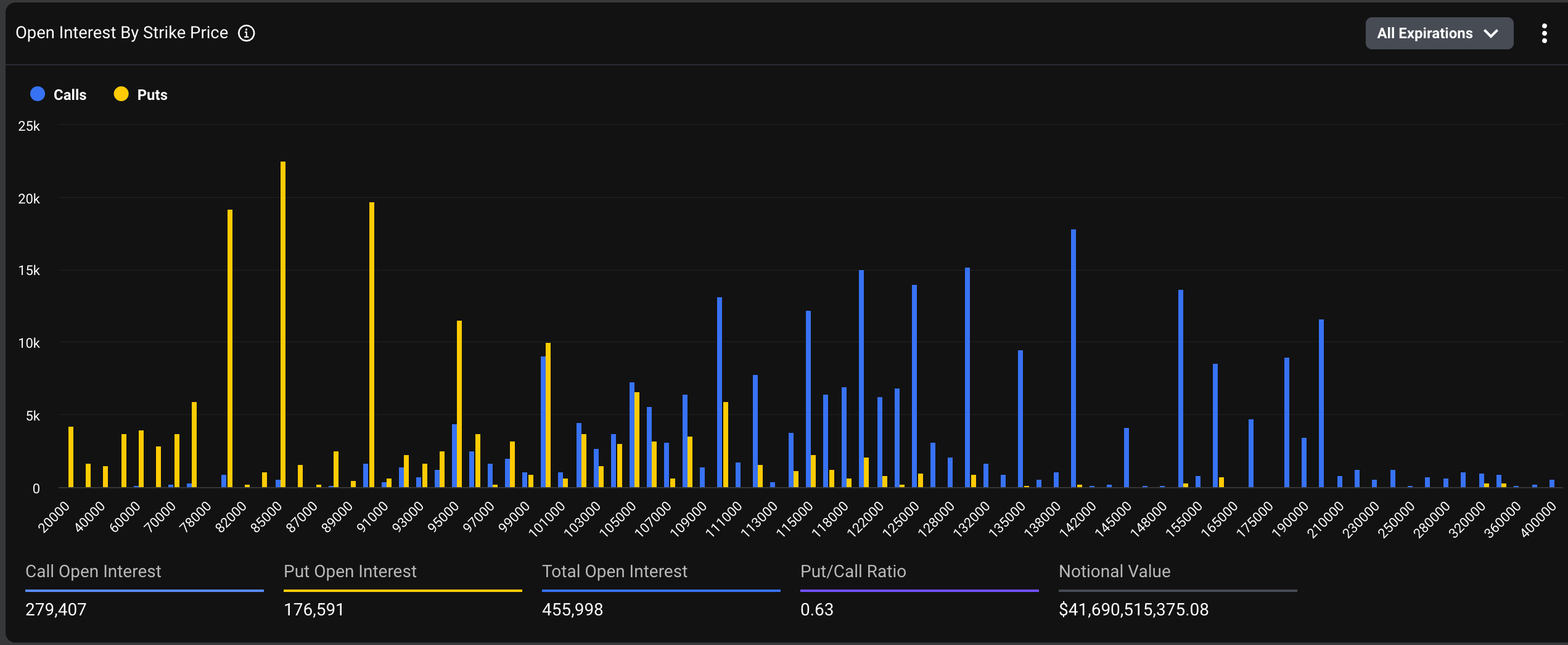

Since late last year, traders were aggressively chasing bullish moves by piling into call options at strikes of $100,000, $120,000, and $140,000 on Deribit. Up until recent weeks, the $140,000 call was the most popular on Deribit, with notional open interest (OI), or the dollar value of the active contracts, consistently above $2 billion.

Now, that’s changed. The $140,000 call’s open interest stands at $1.63 billion. Meanwhile, the $85,000 put has taken the lead with $2.05 billion in open interest. Puts at $80,000 and $90,000 strikes also now eclipse the $140,000 call.

Clearly, the sentiment has shifted decisively bearish, and not surprisingly so, as BTC’s price has collapsed over 25% to $91,000 since Oct. 8, CoinDesk data shows.

Put options give the purchaser the right, but not the obligation, to sell the underlying asset at a predetermined price at a later date. A put buyer is implicitly bearish on the market, looking to profit from or hedge against expected price slides in the underlying asset. A call buyer is bullish.

The chart shows the distribution of open interest in BTC options at various strike price levels across expiries. Clearly, OI is getting stacked at lower strike puts, the so-called out-of-the-money put options.

While the number of active calls is still notably higher than puts, the latter are trading at a significant premium (or skew), reflecting downside fears.

“Options reflect caution heading into year-end. Short-dated puts with strikes at $84K to $80K have seen the largest trading volumes today. Front-end implied volatility sits around 50%, and the curve shows a heavy put skew (+5%-6.5%) for downside protection,” Deribit Chief Commercial Officer Jean-David Pequignot said in an email.

Options activity on decentralized exchange Derive.xyz paints a similar bearish picture, with the 30-day skew falling to -5.3% from -2.9%, a sign of traders increasingly paying up for downside insurance, or put options.

“Looking ahead to year-end, there’s now a sizeable concentration of BTC puts building around the December 26 expiry, particularly at the $80K strike,” Dr. Sean Dawson, head of research at leading onchain options platform Derive.xyz, told CoinDesk.

With ongoing concerns about the resilience of the U.S. job market and the probability of a December rate cut slipping to barely above a coin toss, there’s very little in the macro backdrop giving traders a reason to stay bullish into the close of the year, Dawson explained.

What next?

While the path of least resistance appears to be on the downside, the selling may soon run out of steam as technical indicators point to oversold conditions and sentiment is at bearish extremes.

“With a Fear & Greed index around 15 and an RSI nearing 30 (oversold but not yet extreme), whale wallets (>1,000 BTC) have increased notably in the past week, hinting at smart-money accumulation at undervalued levels,” Pequignot said.

“Overall, downside fears are justified in the short term and the path of least resistance remains lower for now, but extreme setups like this have rewarded the bold in crypto’s past,” he added.

Read: Bonds Hint at Rebound: Crypto Daybook Americas