Marathon Digital Accelerates Bitcoin Transfers While Mining Economics Worsen

Marathon Digital Holdings, one of the leading Bitcoin mining firms, has sent another 644 BTC to major exchanges, continuing its string of transfers in November.

The move comes amid mounting pressure on mining firms, with the hashprice index dropping to a record low.

Marathon Digital Continues Bitcoin Transfers in November

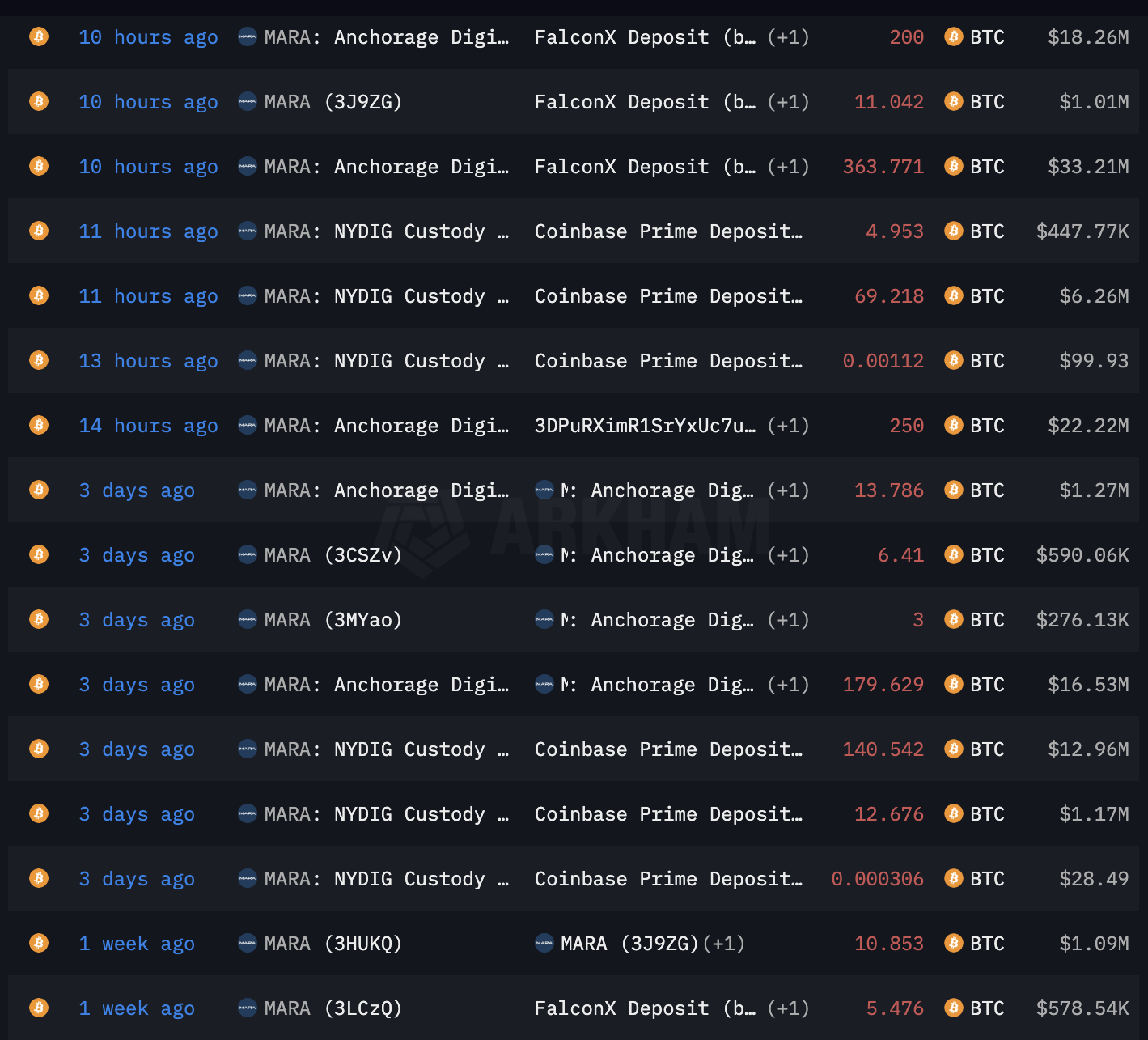

According to blockchain analytics firm Lookonchain, the company transferred 644 BTC, valued at approximately $58.7 million, in several separate transactions to FalconX and Coinbase Prime. The activity reflects a broader trend, as the firm continues to shift assets.

For instance, just three days ago, Marathon Digital sent more than 150 BTC to Coinbase Prime. Earlier this month, it moved a total of 2,348 BTC worth over $215 million at current market prices to FalconX, TwoPrime, Galaxy Digital, and Coinbase Prime.

These transfers do not, by themselves, confirm whether the firm is preparing to sell, adjust its treasury operations, or pursue other strategic uses of the assets. The purpose of such movements can vary depending on the company’s operational needs and market positioning.

The timing aligns with worsening mining economics. Hashrate Index data showed that the Bitcoin Hashprice Index has been declining since July.

According to the latest figures, it has dropped to an all-time low of $38. This metric gauges expected daily earnings per unit of mining power. The block reward is currently 3.15 BTC.

The firm’s Q3 financial report adds further context. The company reported $252 million in revenue, representing a 92% year-over-year increase. However, the makeup of that growth is drawing attention.

“This growth is primarily attributed to the change in the fair value of digital assets, particularly Bitcoin, which accounts for $113 million. They are now mining less Bitcoin than a year ago, down to 22.5 BTC/day from 23.3 BTC/day in Q3 2024. To compensate for the revenue loss, they adopted the Saylor playbook. 33% of Mara’s Bitcoin treasury, totaling 17,357 BTC out of 52,850, is loaned, actively managed, or pledged as collateral to seek yield,” analyst Bart Mol highlighted.

MARA Holdings CEO Weighs In On BTC’s Decline Below $90,0000

Meanwhile, the firm’s reliance on Bitcoin exposes it to cyclical pressures. BTC has been trending downwards since October, even dropping below $90,000 this week.

At press time, it traded at $91,697, representing modest daily gains of 0.36194%.

Fred Thiel, CEO of MARA Holdings, said Bitcoin’s drop below $90,000 reflects a “perfect storm” of macro pressure and investor profit-taking. He pointed to the Federal Reserve’s hawkish shift as a major catalyst, causing expectations for a December rate cut to drop from 97% to 44%.

That shift, he said, drained liquidity from high-beta assets such as Bitcoin. Thiel added that the six-week US government shutdown intensified uncertainty by creating a “data vacuum” at a crucial moment for markets.

“We’re also seeing classic four-year cycle behavior play out…As we approached what many viewed as an October 2025 cycle peak, long-term holders and institutions began exiting positions. Spot Bitcoin ETFs posted $866 million in outflows on November 13th alone, and long-term holders have distributed over 815,000 BTC in the past month, the most aggressive selling we’ve seen since 2024.,” Thiel told BeInCrypto.

He described the sell-off as “textbook profit-taking” after a strong rally, worsened by thin liquidity and elevated leverage. Thiel also pointed to Bitcoin’s tight correlation with tech stocks, which have fallen about 9% this month amid earnings warnings and fading AI enthusiasm. According to him, this reinforces Bitcoin’s current role as a high-beta risk asset.

“When you combine persistent selling pressure with reduced market depth and the broader pivot toward historically safer assets like equities and gold, the move below $90,000 was a logical outcome given these converging factors,” he added.

Thiel concluded that with markets adjusting to the prospect of higher-for-longer interest rates, digital assets are experiencing the impact more acutely.

The post Marathon Digital Accelerates Bitcoin Transfers While Mining Economics Worsen appeared first on BeInCrypto.