Attention Bitcoin Bulls: BTC is Now at Levels Preceding FTX-Era Extremes

Bitcoin is showing one of the deepest momentum breaks of the cycle, with several onchain indicators now printing signals last seen during the industry’s most violent washouts.

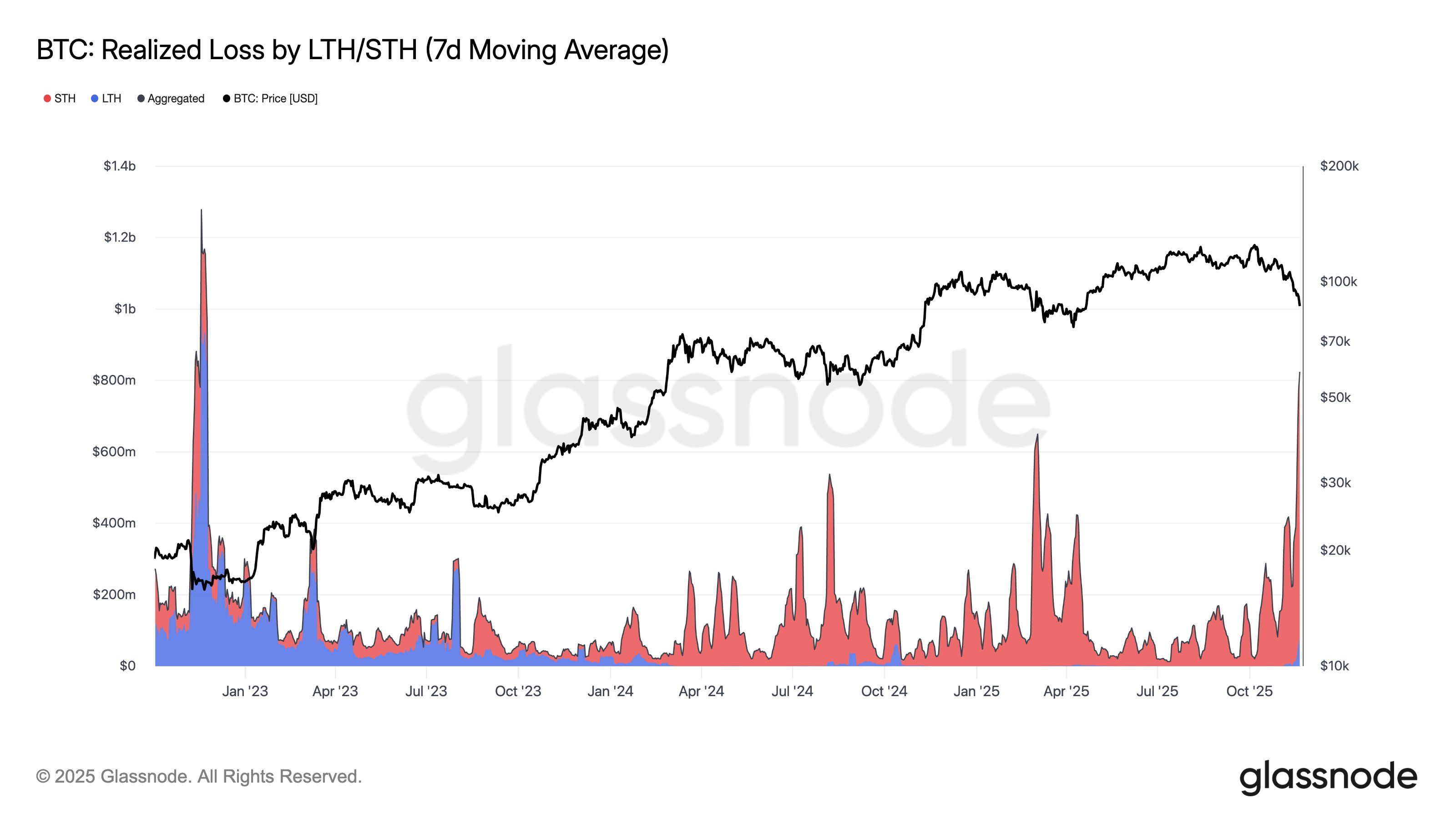

Data from Glassnode shows realized losses have surged to levels comparable to the November 2022 capitulation around the FTX collapse. The spike is being driven almost entirely by short-term holders, a colloquial term for wallets that bought within the past 90 days, unwinding at scale as BTC extends its fall below the 200-day moving average.

Short-term realized-loss dominance is typical of market stress, but the magnitude this week stands out. The current cluster is the largest since early 2023, and one of only a handful in the past five years to reach a $600 million to $1 billion daily run-rate.

Market structure indicators tell a similar story. Independent analyst MEKhoko noted that BTC is now trading more than 3.5 standard deviations below its 200-day moving average.

That kind of displacement has occurred only three times in the past decade: November 2018, the March 2020 pandemic crash, and June 2022 during the Three Arrows Capital/Luna crisis.

btcusd is beyond 3.5 standard deviations from its 200dma

other occasions:

Nov 2018

Mar 2020

Jun 2022— mekhoko (@MEKhoko) November 20, 2025

This week’s drawdown matches the same behavioral pattern: A sharp expansion in spot selling, collapsing funding rates, and a measurable retreat of marginal buyers who previously leaned on momentum.

With BTC now deeply stretched below trend, washed-out short-term holders, and sentiment pinned in extreme fear, market positioning is approaching levels historically associated with short-term bottoms.

But without a clear macro catalyst, traders warn that volatility around these levels is likely to remain elevated.