Why Options Traders Are Suddenly Targeting $200K Bitcoin Strikes

Bitcoin is hovering around $117,826 on Wednesday as open interest in futures and options markets pushes into record territory, signaling intense institutional and speculative activity.

The Data Behind Bitcoin’s Quiet Power Shift on Derivatives Exchanges

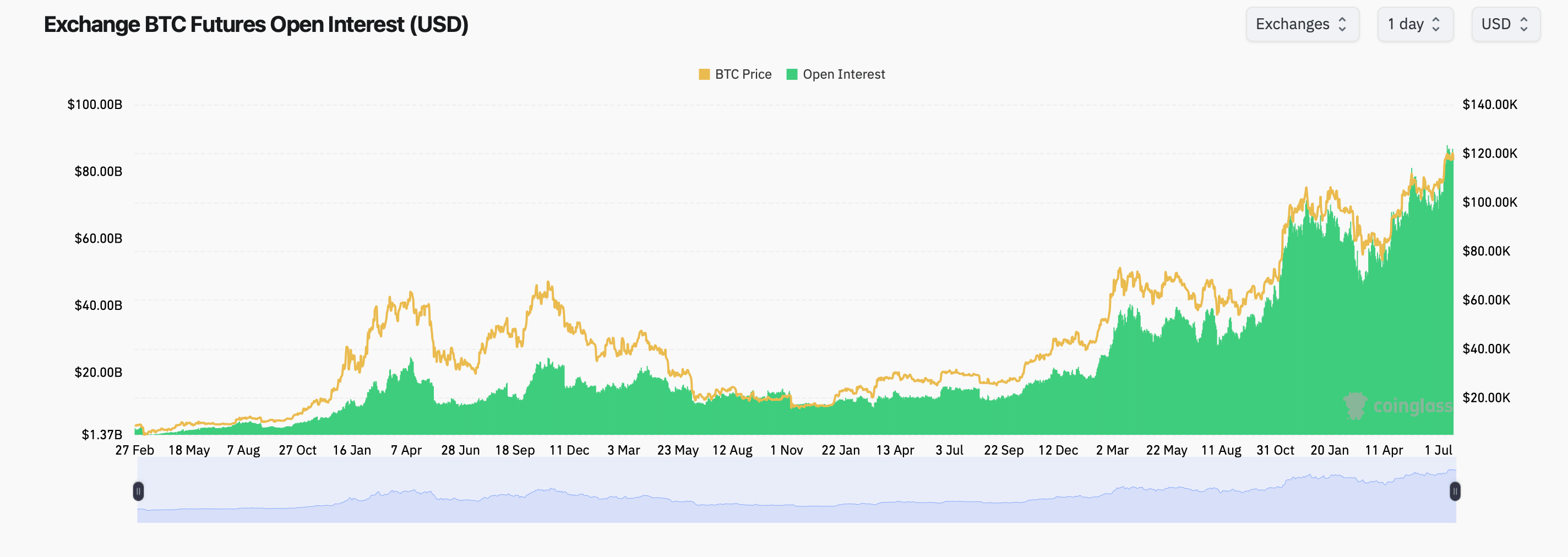

Open interest (OI) in bitcoin derivatives continues its climb as traders allocate capital toward both futures and options amid heightened market momentum. According to Coinglass data, total futures OI has reached a massive $84.83 billion across platforms, with CME topping the list at $18.49 billion, followed by Binance and Bybit.

Bybit recorded the most bullish short-term activity with a 2.06% increase in OI over the last four hours, while BingX showed a staggering 3.87% rise over the same period. However, MEXC posted the largest drop, falling 3.14% in 24-hour OI change. Notably, Kucoin’s 3.4% daily increase in OI suggests renewed retail speculation on its venue.

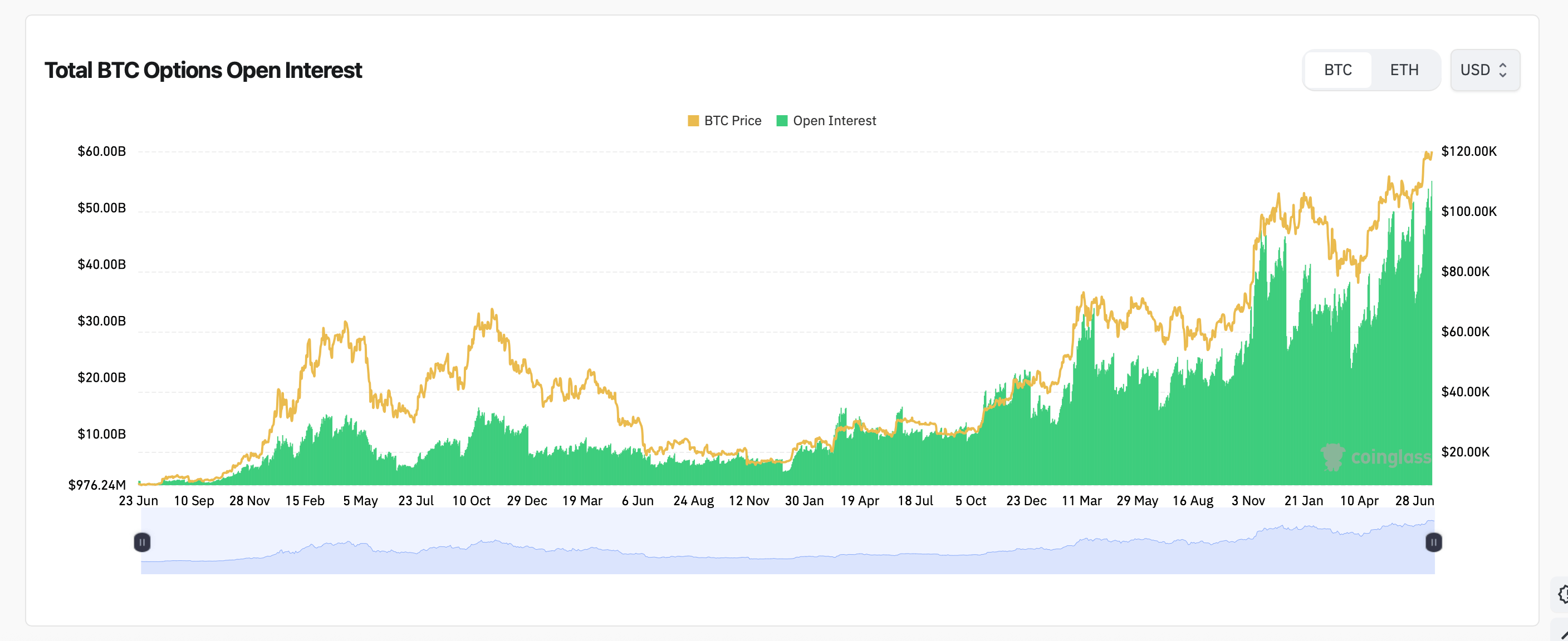

In the options market, Deribit remains the dominant player. The platform’s OI rankings show traders are heavily favoring call contracts, particularly those with strike prices of $120,000 to $140,000. The highest concentration of OI sits with the Dec. 26, 2025, $140,000 call at 10,706 BTC, followed closely by a $200,000 call with 8,586 BTC.

Volume metrics from the past 24 hours show the July 25, 2025, $120,000 call leading with 4,446 BTC traded. Puts, while active, are outpaced by calls in both volume and OI. Currently, 60.76% of OI is skewed toward calls, totaling 257,518 BTC, compared with 166,341 BTC in puts.

This options data paints a significant bullish tilt, supported by strike concentration just above current market levels. The July 25 expiry also sees intense clustering around the $115K to $120K range, where implied volatility (IV) ranges between 31% and 38%.

With both futures and options showing expansion in capital commitment, bitcoin’s derivatives landscape continues to reflect a growing appetite for directional bets and structured positioning at higher valuations. Traders are clearly preparing for significant price movement in 2025’s final months.