Bitcoin final leverage flush below $80K is possible, warns analyst

The pain may not be over yet for Bitcoin investors, according to one crypto analyst, arguing that there’s still more leverage that could be flushed out.

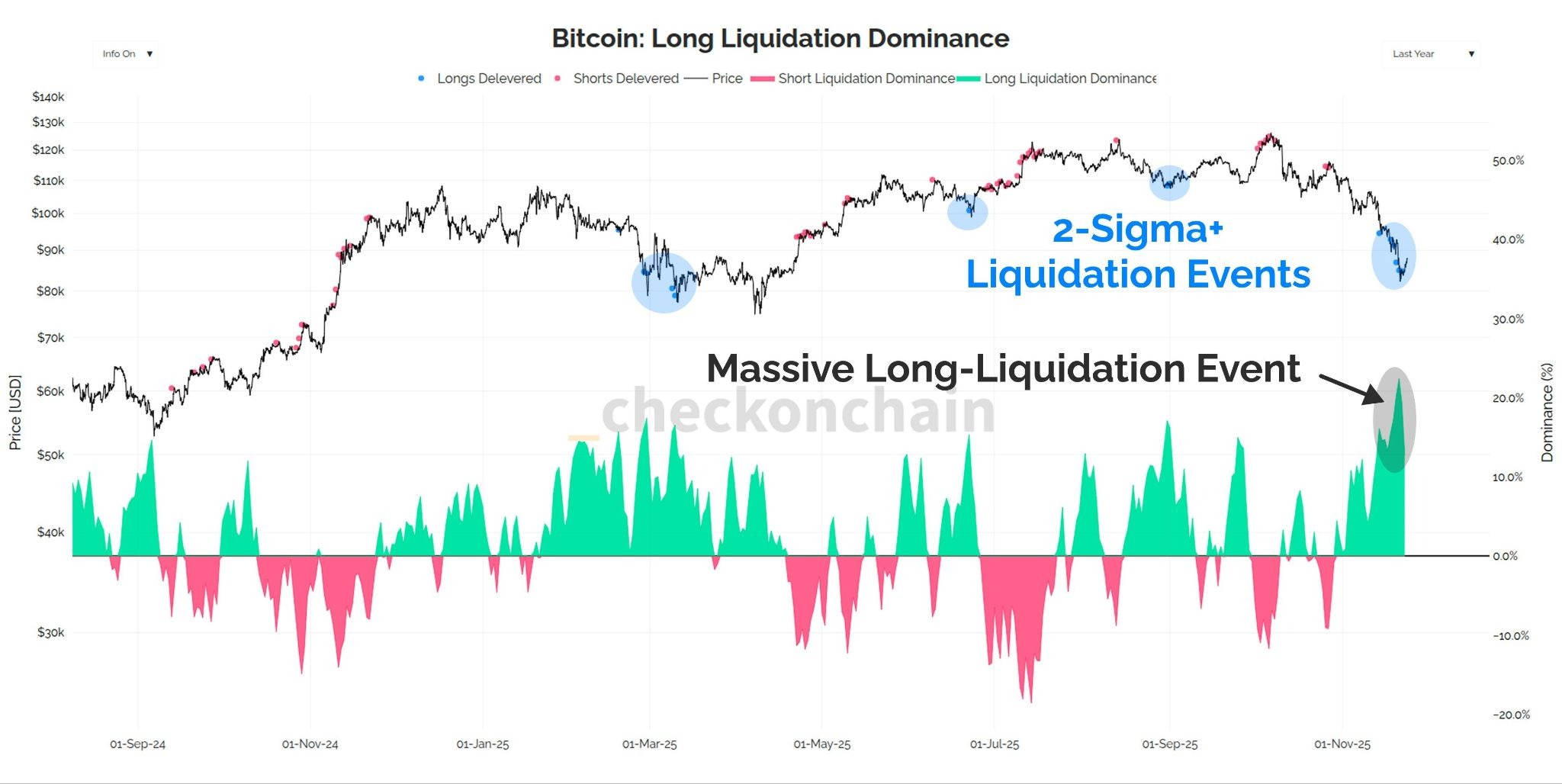

Crypto analyst James Check described the recent market meltdown as a “2-sigma long liquidation event,” which wiped out a “chunk of degen gamblers.”

Most of the leverage is gone, but the market “has an incredible nose that can sniff out the final hold-outs,” he added, cautioning that a further flush out could be on the cards.

“We wouldn’t be too surprised if we wick into the $70k-$80k zone to flush the final leverage pockets.”

A 2-sigma liquidation event in crypto refers to a significant market movement that triggers mass liquidations of leveraged positions, with “2-sigma,” or two standard deviations, indicating the statistical magnitude of the price swing.

Bitcoin shed over $24,000 in just ten days, dropping to a seven-month low of around $82,000 on Nov. 21.

Bitcoin has found a local bottom

The crypto markets showed tentative signs of stabilization after last week’s dramatic sell-off, and may have found a local bottom, Augustine Fan, head of insights at crypto trading software service provider SignalPlus, told Cointelegraph.

“Markets are currently so oversold from both sentiment and technical perspectives (such as Bollinger Bands), and prices are likely to have seen local lows for now, absent any new exogenous factors (such as DAT forced selling),” she said.

Related: Bitcoin’s Sharpe ratio is nearly at zero, a rare risk-reward signal

Fan expects prices to range between $82,000 and $92,000 and identified the next significant price support around the $78,000 area.

“A sustained break below would open up further significant downside, but is not the base case scenario for now,”

Bitcoin whales are still distributing BTC

Analysts at blockchain data provider CryptoQuant identified a local bottom that could lead to a more sustained rebound.

“On-chain data shows a market shaped by institutional redistribution, structural weakness, and a rebound that may signal a local bottom,” said analyst Carmelo Alemán on Tuesday.

However, the crucial 1,000 to 10,000 BTC whale cohort is still selling, which prevents a full confirmation of the trend reversal, he added.

“The recovery is promising, but the end of the bearish phase requires a clear shift in whale behavior.”

Magazine: Bitcoin $200K soon or 2029? Scott Bessent hangs at Bitcoin bar: Hodler’s Digest