Custody shuffle continues as 87,464 more Bitcoin leaves institution-tagged wallets in 24 hours

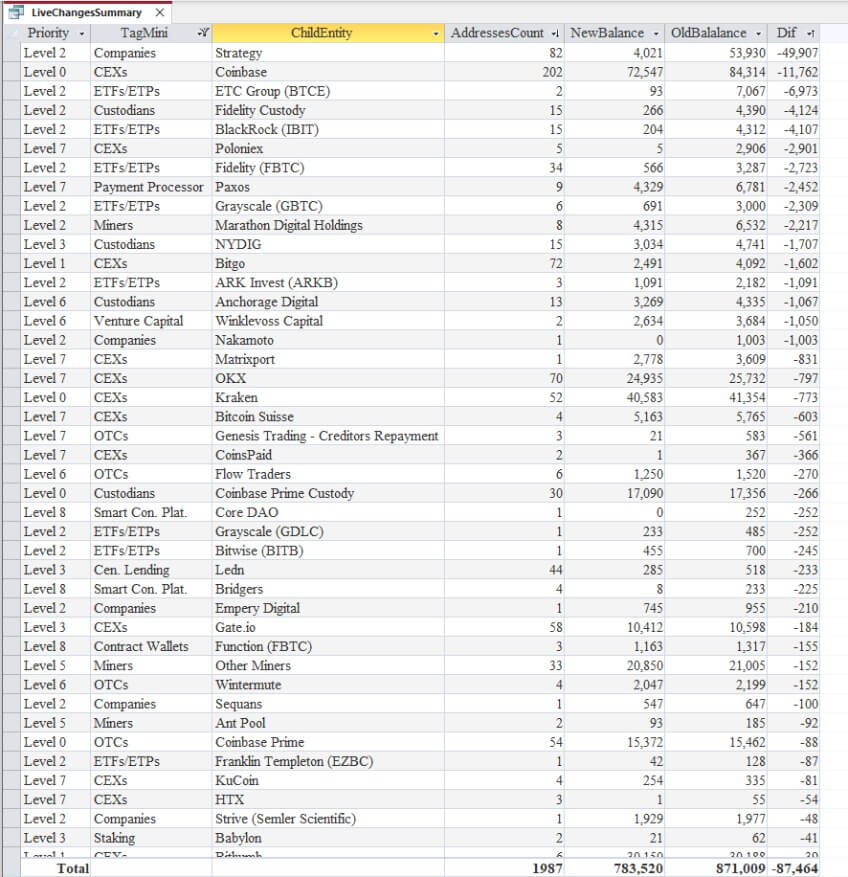

Timechain Index founder Sani reported 87,464 BTC flowing out of institution-tagged wallets between Nov. 21 and Nov. 22, adding that he hadn’t seen such movement in months.

The raw data showed over 15,000 BTC leaving tracked cohorts on Nov. 21 alone, the largest single-day outflow since June 26.

Yet, as Sani clarified in a note, the headline figure overstates actual selling pressure. Most of the movement represents internal reshuffling rather than institutions exiting Bitcoin positions.

Sani explained that pre-processed data can show extreme volatility when large holders move coins between custodians or wallets, but after reconciliation, the net flows often land near zero.

Strategy accounted for 49,907 BTC of the tracked outflows, but CEO Michael Saylor confirmed the company sold no Bitcoin that week. In fact, Strategy added 8,178 BTC last week, according to Bitcoin Treasuries data.

Sani’s assessment indicates that Strategy transferred holdings to new custodians to diversify risk, with some coins appearing in addresses linked to Fidelity Custody. Additionally, that’s the second time the firm has performed such a movement.

This is not unique to Strategy. Sani shared that BlackRock moved Bitcoins out of their known addresses twice as well. The first time happened last year, and the second occurred a few weeks ago, when they moved nearly 800,000 BTC to new addresses. Additionally, Coinbase also reshuffled a similar amount this weekend in a UTXO consolidation exercise.

Back to the over 15,000 BTC in outflows, Bitcoin ETFs bore the brunt on Nov. 21, shedding 10,426 BTC as issuers processed redemptions tied to $903 million in net withdrawals reported Nov. 20.

ETF outflows translate directly to liquidations, as fund managers must sell the underlying Bitcoin to meet shareholder exit requests. Still, the scale fell within normal bounds given the prior day’s redemption activity.

Timechain Index tracks 16 entity categories, including centralized exchanges, miners, ETFs, publicly traded companies, custodians, governments, OTC desks, and payment processors.

The platform aggregates known addresses for each cohort and monitors balance changes in real time.

Sani’s “LiveChangesSummary” data showed Strategy’s 49,907 BTC outflow, Coinbase’s 11,762 BTC outflow, and ETC Group’s 6,973 BTC outflow as the largest movements, with smaller flows across custodians, exchanges, and miners.

Routine custody operations vs. directional bets

The distinction matters because Bitcoin’s on-chain transparency makes wallet movements visible before context arrives.

When 87,464 BTC appears to leave institution-tracked addresses in a 24-hour window, the immediate read can suggest panic selling or a coordinated retreat from crypto exposure.

The post-processing showed the opposite: net institutional holdings remained stable after accounting for internal transfers and standard ETF mechanics.

Strategy’s custody diversification aligns with treasury management best practices for large holders.

Concentrating nearly 650,000 BTC with a single custodian creates operational risk, and spreading holdings across multiple qualified custodians reduces exposure to any single point of failure.

Bitcoin ETFs operate under different constraints. When investors redeem shares, authorized participants return creation units to the issuer and receive the underlying Bitcoin, which they then sell on the market to close out arbitrage positions.

The Nov. 20 outflow figure of $903 million corresponded to roughly 10,400 BTC at prevailing prices, matching the ETF-cohort outflow Timechain Index recorded the following day. The lag reflects settlement timing rather than discretionary selling.