Coinbase Premium Shows First Signs of Recovery as US Selling Pressure Finally Eases

Bitcoin’s most important reversal signal may finally be forming. After three weeks of relentless sell pressure from US spot markets and record ETF outflows, a rare cluster of metrics is shifting in unison.

The Coinbase Premium is recovering, whales are going long aggressively, funding rates have flipped negative, and fresh ETF inflows have reappeared. Analysts say it is the first coordinated improvement in Bitcoin’s market structure since early November.

US Selling Pressure Suddenly Cools After 22 Days of Pain

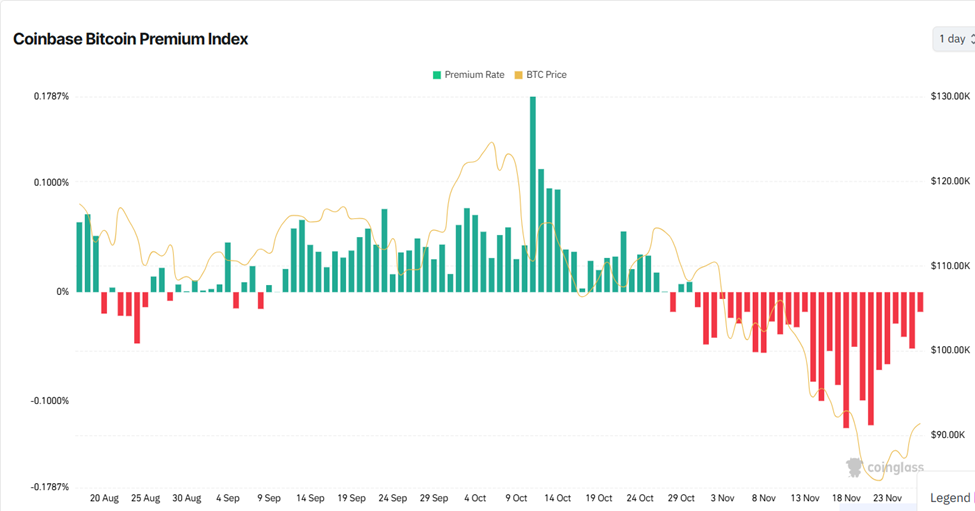

For most of November, US-based entities drove the price of Bitcoin lower. The Coinbase Premium Index, which compares BTC prices on Coinbase Pro (heavily used by US institutions) versus global exchanges, remained negative for 22 consecutive days, marking the longest discount window of 2025.

Coinbase Premium Index has been negative for 22 straight days.

No mercy from U.S. entities. pic.twitter.com/nYCVzv7VKS

— Crypto Rover (@cryptorover) November 25, 2025

Analyst Crypto Goos added that every time this indicator turns “deeply red,” Bitcoin dumps, recognizing the budding change this week. Now it’s starting to cool off, which could signal the beginning of a reversal.

Dark Fost, who reportedly monitors the indicator daily, said the same selling cohort, institutions, professionals, and US whales, has sharply reduced pressure since the panic peak on November 21.

“The selling pressure from these actors has significantly decreased…if the trend continues, it should give the market some breathing room,” wrote Fost.

Elsewhere, analysts note that the most significant shift is occurring in position data, with whales going long on Bitcoin more aggressively than individual investors for the first time in history.

With the Coinbase Premium rising again, funding rates falling, and retail showing hesitance, analysts say such conditions often precede sustained uptrends.

“The uptrend will probably continue for a while longer. Maybe until the end of the year,” analyst Para Muhendisi suggested.

In the same tone, analyst Daan Crypto Trades confirmed the spot dynamic improving underneath, citing a steadily returning Coinbase premium with funding rates turning negative. In his view, even small improvements matter because the prior sell pressure was extreme.

Macro Flips Risk-On: Dollar Rejects, Yields Break Lower, and ETF Flows Finally Turn Green Again

However, others observe key catalysts emerging from the macro level, with MV Crypto highlighting a series of market-wide shifts.

“Rate-cut probabilities jumped from 30% to 84% in one week, bullish for the broader market… DXY is rejecting a crucial resistance… the 10-year yield is falling below 4%,” they stated.

Against this backdrop, the prevailing sentiment is that it may be time to adopt a bullish stance rather than a bearish one, thanks to macroeconomic conditions turning positive for the crypto market.

Large transfers and associated flow signals add credence to this line of thought, with SpaceX moving $105 million worth of Bitcoin to Coinbase Prime for custody.

SpaceX(@SpaceX) transferred out another 1,163 $BTC($105.23M) 2 hours ago, possibly to Coinbase Prime for custody.https://t.co/zW62EKM2RD pic.twitter.com/vrbu6tPGR4

— Lookonchain (@lookonchain) November 27, 2025

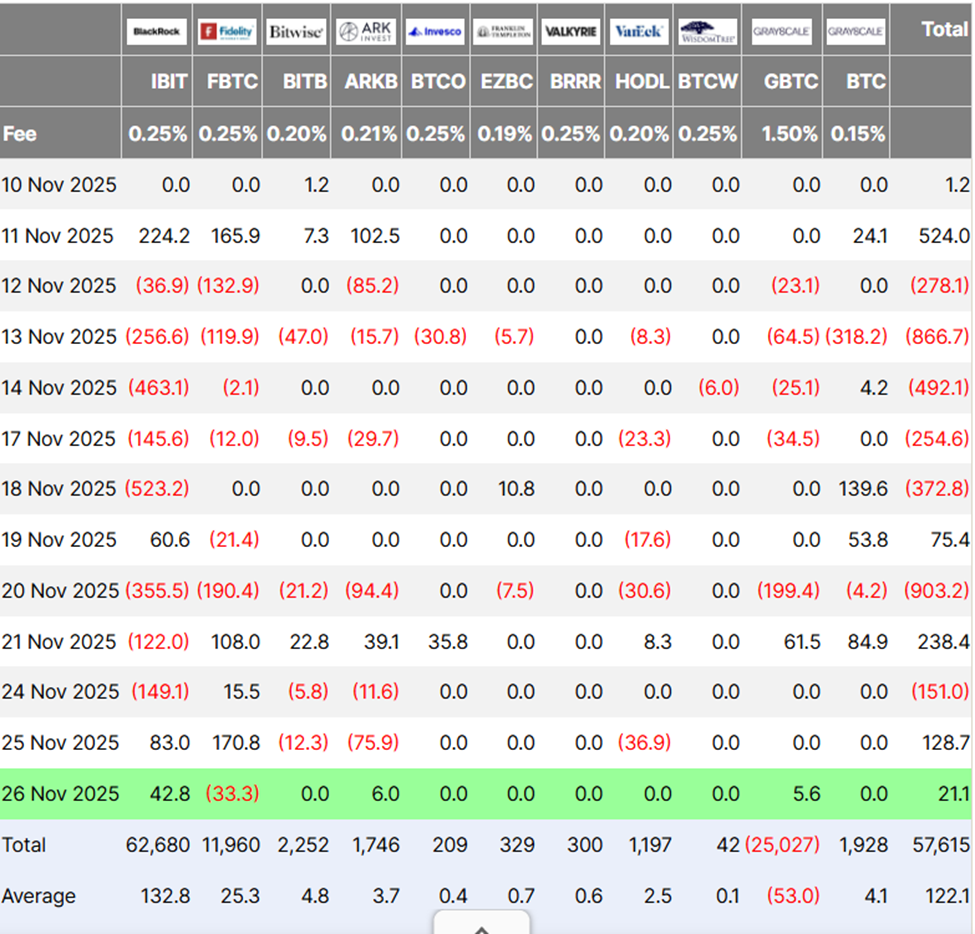

Additionally, after one of the worst ETF outflow months on record, November 25 and 26 finally posted positive inflows.

Historically, Bitcoin performs best when ETF inflows and the Coinbase Premium rise in tandem, signaling broad US demand across both institutional products and spot exchanges.

Coinbase Premium is finally turning back up —

buyers on U.S. spot are stepping in again.

This shift usually appears near local bottoms,

and it aligns with the rebound we’re seeing now.Still early, but the direction is clear:

U.S. spot demand is returning.#ETH #BTC #Crypto pic.twitter.com/ednhY8GQW8— Neil (@neil_cryptonova) November 26, 2025

Analyst Ted has, however, issued a more cautious tone, indicating that even though the Coinbase Bitcoin premium is recovering now, until this trajectory stabilizes in favor of the upside, most BTC rallies will be sold.

Perhaps that is exactly where the market sits, a state that is not fully reversed, but no longer bleeding. This aligns with a recent BeInCrypto analysis that highlighted lingering liquidity concerns despite the Bitcoin price climbing over $90,000.

With whales increasing longs, US sell pressure cooling, funding rates going negative, macro flipping bullish, and ETF inflows reappearing, analysts say Bitcoin is entering its first legitimate window for upside since early November.

The post Coinbase Premium Shows First Signs of Recovery as US Selling Pressure Finally Eases appeared first on BeInCrypto.