Bitcoin risks deeper drop if whale exchange deposits stay high: Analyst

Continued selling pressure from Bitcoin whales could result in the asset falling further, cautioned analysts at CryptoQuant.

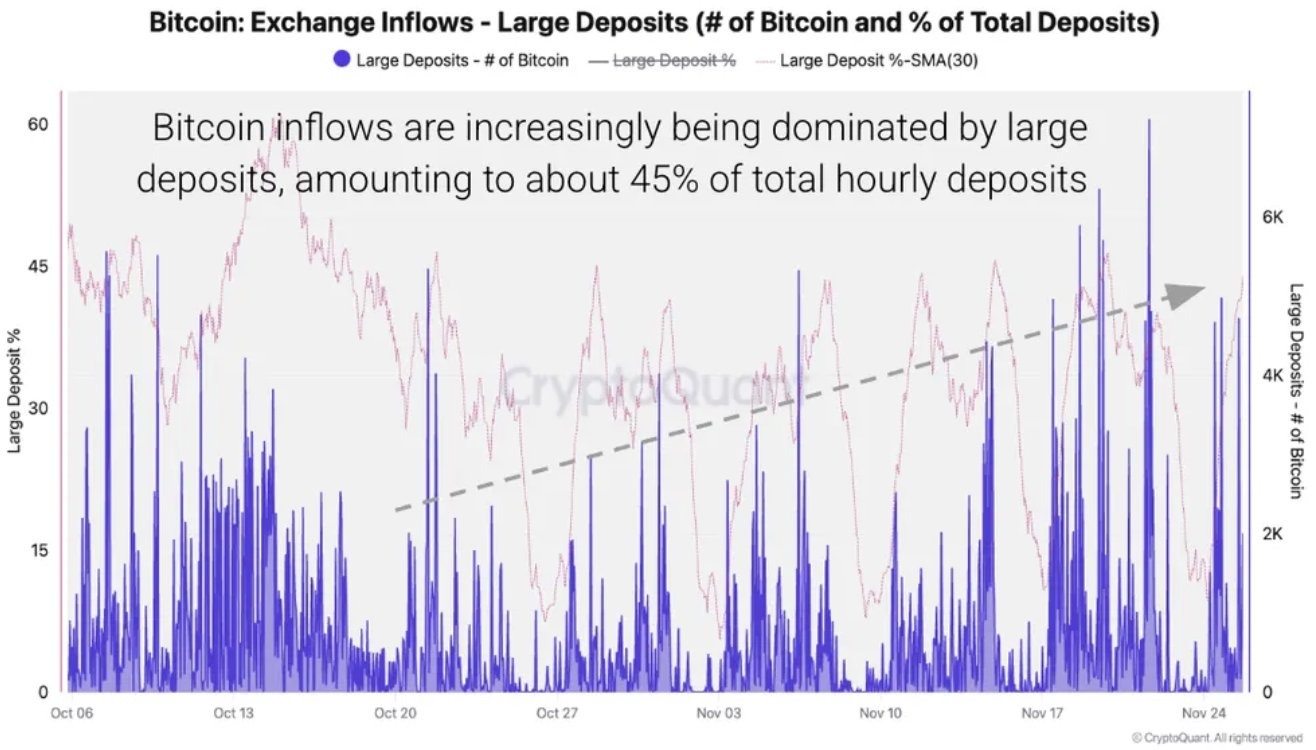

Bitcoin (BTC) exchange inflows reached a peak of 9,000 on Nov. 21 as the price of Bitcoin declined to $80,600 on Coinbase, its lowest in seven months, it said in a market summary on Wednesday.

When crypto exchange inflows increase, it is often a sign that investors are preparing to sell, while the opposite is the case when exchange outflows are increasing.

CryptoQuant data indicates that 45% of the total BTC sent to exchanges originated from large deposits of 100 BTC or more, reaching as high as 7,000 BTC on a single day. This implies that the whale cohort has been sending coins to exchanges in preparation to sell.

“This indicates that investors and traders continue to sell Bitcoin in the context of the current price drawdown, putting further downward pressure on the price.”

This brought the average BTC deposit value to 1.23 BTC in November, the highest level in a year, it added.

Binance stablecoin reserves hit peak

CryptoQuant also noted on Wednesday that Binance’s stablecoin reserves just hit a record $51 billion, the highest in its history, while BTC and Ether (ETH) inflows climbed to $40 billion this week, led by Binance and Coinbase.

High stablecoin reserves on exchanges indicate rotation from Bitcoin and altcoins into dollar-pegged assets, where capital often sits until market participants are ready to re-enter.

Related: Bitcoin’s Sharpe ratio is nearly at zero, a rare risk-reward signal

Earlier this week, analyst James Check flagged remaining leverage that had yet to be flushed from markets. “We wouldn’t be too surprised if we wick into the $70k-$80k zone to flush the final leverage pockets,” he said.

Meanwhile, BitMine chairman Tom Lee has softened his $250,000 Bitcoin target, now saying that even returning to an all-time high by year’s end is now just a “maybe”.

A similar inflow pattern for Ether and altcoins

The analytics platform observed a similar deposit exchange inflow trend for Ether, “although total inflows have not spiked much.”

Other altcoin inflows to exchanges also increased this month as the sell-off intensified, pushing many of them back to bear market lows.

Earlier this week, 10x Research stated that Bitcoin’s “tactical, oversold rebound is still playing out,” targeting $92,000 and $101,000 as the key resistance zones to watch.

BTC has reclaimed $90,000 and is currently trading slightly above it at the time of writing.

Magazine: Bitcoin $200K soon or 2029? Scott Bessent hangs at Bitcoin bar: Hodler’s Digest