2 Key Metrics Show Bitcoin Selling Pressure Is Easing – Will BTC Rally?

Bitcoin’s (BTC) price has dipped nearly 1% again today, extending its broader downtrend, which has seen it drop 3.6% so far this month. However, 2 key metrics now hint at an easing of selling pressure.

Despite this, some analysts caution that buying power remains weak, restricting the chances of a significant price rally at least in the short term.

Key Metrics Show Reduction in Bitcoin Selling Pressure

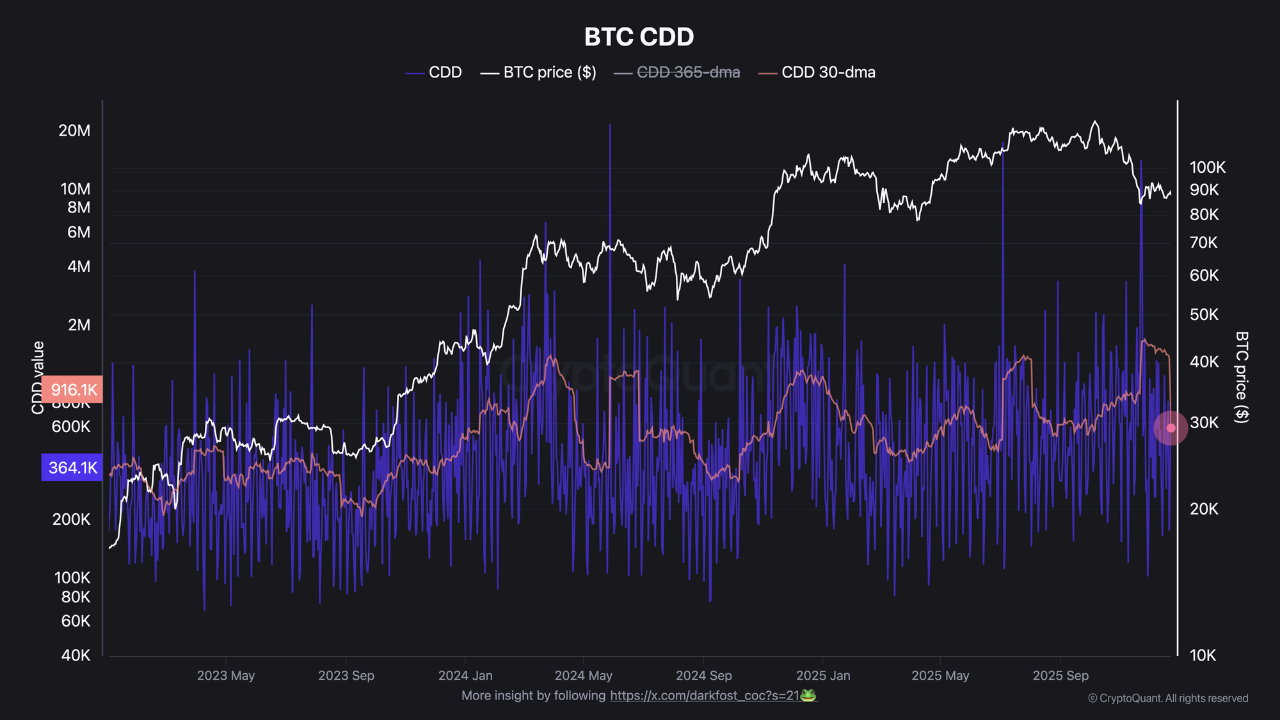

According to data from CryptoQuant, Bitcoin’s Coin Days Destroyed (CDD) metric has experienced a significant decline. For context, CDD tracks how long Bitcoin remains unspent before it is moved.

When older coins are transferred, more coin days are destroyed, often signaling distribution by long-term holders. Elevated CDD levels are typically associated with selling pressure from these investors, while lower readings suggest that long-term holders are staying put.

“We are now more than a month past the large BTC move from Coinbase. As a result, all averaged data is gradually returning to normal levels. Looking at Coin Days Destroyed (CDD), we can clearly observe a sharp decline following that event. What’s particularly interesting is that this decrease has reached a level well below the previous spike,” Darkfost wrote.

According to the analyst, this shift indicates that long-term holder activity is cooling. Bitcoin is changing hands less frequently among older wallets. Darkfost added that this shift could have broader implications for the market.

“This decline in CDD is a positive signal, as LTHs still represent the largest potential source of selling pressure, given they hold the biggest share of the total supply.”

The analyst also emphasized that the sustained decline in long-term holder selling pressure helps alleviate overall market stress and, if the trend persists, may contribute to the formation of a market bottom.

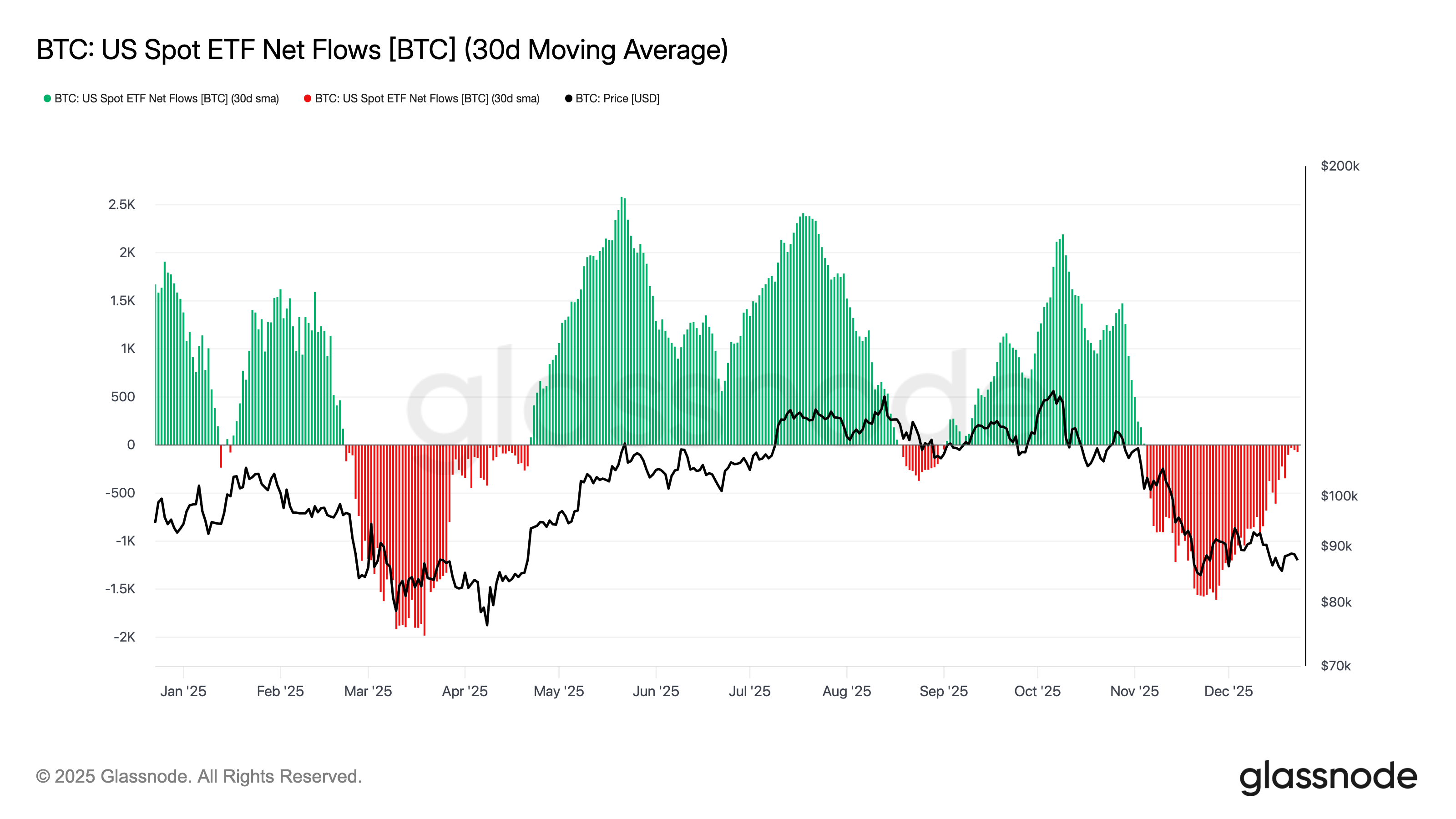

Another sign is emerging from Bitcoin exchange-traded fund (ETF) flows. Since early November, the 30-day moving average (30D-SMA) of net inflows into Bitcoin ETFs has remained in negative territory, reflecting persistent net outflows.

However, the magnitude of these negative readings has been gradually decreasing. The 30D-SMA is now moving closer to zero, suggesting a decline in ETF outflows compared to earlier levels.

Data from SoSoValue further reflects this trend. On December 15, total net outflows reached $357.69 million. This figure narrowed to $277.09 million on December 16 and $161.32 million on December 18.

Outflows continued to ease to $158.25 million on December 19 and $142.19 million on December 22. Still, it’s worth noting that while daily figures have decreased, this does not confirm a clear directional shift.

Meanwhile, analysts at 10x Research note that market conditions are changing. The firm, which has been bearish since October, observes that shifts in derivatives, ETFs, and technical signals are underway.

“After Being Bearish, This Is the Day, and the Exact Hour, We Will Buy Bitcoin. The largest Bitcoin options expiry on record is approaching, with strikes and open interest revealing where stress and opportunity may be building. At the same time, past year-end patterns suggest that periods of extreme caution can quietly give way to sharp sentiment reversals once calendars and risk budgets reset. Technical conditions are also evolving, hinting that the balance between downside exhaustion and upside optionality is becoming more nuanced,” the post read.

Despite these signals, a potential rally would likely require a stronger and more consistent return of demand. BeInCrypto reported that stablecoin reserves on major exchanges have declined significantly, with capital outflows totaling nearly $1.9 billion over the past 30 days.

The reduction suggests lower immediate buying capacity and continued caution among market participants. Additionally, CryptoQuant CEO Ki Young Ju has noted that a recovery in market sentiment might take several months to develop.

The post 2 Key Metrics Show Bitcoin Selling Pressure Is Easing – Will BTC Rally? appeared first on BeInCrypto.