MicroStrategy Solves Private Equity’s 2 Biggest Problems With Bitcoin

MicroStrategy continues to rewrite the rules of private equity and capital markets, leveraging Bitcoin to achieve what traditional funds have pursued, and largely failed to do, for over a decade.

According to Chaitanya Jain, MicroStrategy’s Bitcoin Strategy Manager, the company has successfully addressed two persistent challenges in private equity.

MicroStrategy Turns Bitcoin into Perpetual Capital, Outpacing Traditional Private Equity

Jain explains that MicroStrategy (now Strategy) has raised capital directly from retail investors and established permanent, perpetual funding structures.

“Since the last decade, Private Equity has been trying to (i) raise directly from retail and (ii) build continuation or perpetual funds,” Jain said. “Strategy has achieved both. Permanent capital via publicly listed securities on Nasdaq. Digital Equity and Digital Credit backed by $BTC.”

By leveraging publicly listed securities instead of closed-end PE structures, MicroStrategy has effectively democratized access to alternative investment products. At the same time, it has created a funding model that does not rely on cyclical capital raises.

Central to this approach are what Jain calls “Digital Equity” and “Digital Credit.” Both products are backed by Bitcoin, repositioning the pioneer crypto as an institutional-grade collateral.

Digital Equity allows investors to gain leveraged exposure to Bitcoin through MicroStrategy’s capital structure. Meanwhile, Digital Credit provides BTC-backed credit facilities.

In essence, the company has converted its Bitcoin reserves into a perpetual capital engine that functions like a public-equity version of a private equity continuation fund.

Jain describes 2025 as “Year 0” for Digital Credit, a period focused on building, launching, and scaling BTC-backed credit products during a tepid Bitcoin market.

2025 marked Year 0 for Digital Credit.

Innovating, launching, and scaling.

All in a tepid $BTC year.2026 is Year 1. pic.twitter.com/0h7Eoum2aX

— Chaitanya Jain (@CJ_Bitcoin) January 3, 2026

In 2025, Strategy raised approximately $21 billion through a combination of common equity issuances, preferred stock offerings (including a notable $2.5 billion perpetual preferred stock issuance described as the largest US IPO by gross proceeds that year), and convertible debt.

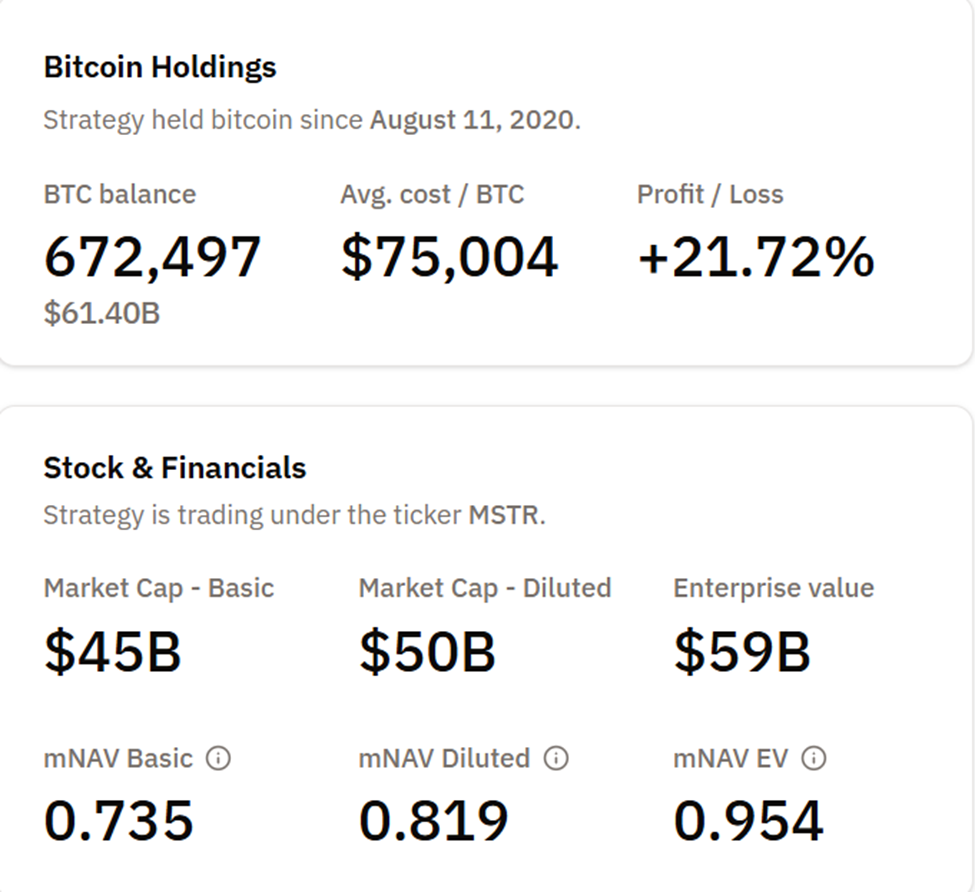

These funds supported aggressive Bitcoin acquisitions. As of this writing, Strategy holds 672,497 BTC, acquired at a total cost of approximately $50.4 billion (with an average price of around $75,000 per BTC), and has a market value of roughly $61.4 billion (based on Bitcoin prices near $91,000).

The company employs significant leverage through debt and preferred stock (totaling approximately $15–16 billion across various sources), creating a highly leveraged exposure to Bitcoin. This explains why analysts say the firm could trigger the next black swan of crypto in 2026.

Nonetheless, the model has transformed Strategy from a traditional software company into what analysts widely describe as the world’s largest corporate Bitcoin treasury company or a leveraged Bitcoin investment vehicle. It uses perpetual capital raises to continuously accumulate BTC while offering investors varying degrees of exposure to its performance.

According to Jain, 2026 marks “Year 1” for MicroStrategy, signaling a transition from experimentation to full-scale deployment.

The shift reflects growing Bitcoin liquidity, a stronger market infrastructure, and increasing investor familiarity with crypto-backed financial instruments.

By bridging the gap between retail access and permanent funding, MicroStrategy is challenging the private equity orthodoxy and demonstrating how crypto can underpin sustainable, institutional-grade investment models.

Nevertheless, even as the firm enters this next phase, MicroStrategy’s potential MSCI exclusion remains an overhanging concern.

The post MicroStrategy Solves Private Equity’s 2 Biggest Problems With Bitcoin appeared first on BeInCrypto.

Leave a Reply

You must be logged in to post a comment.