Bitcoin outlook bullish as whales, sharks buy retail sell-off: Santiment

Bitcoin accumulation by whales and recent profit-taking by retail traders could be seen as bullish and lead to more upward market momentum, according to Santiment.

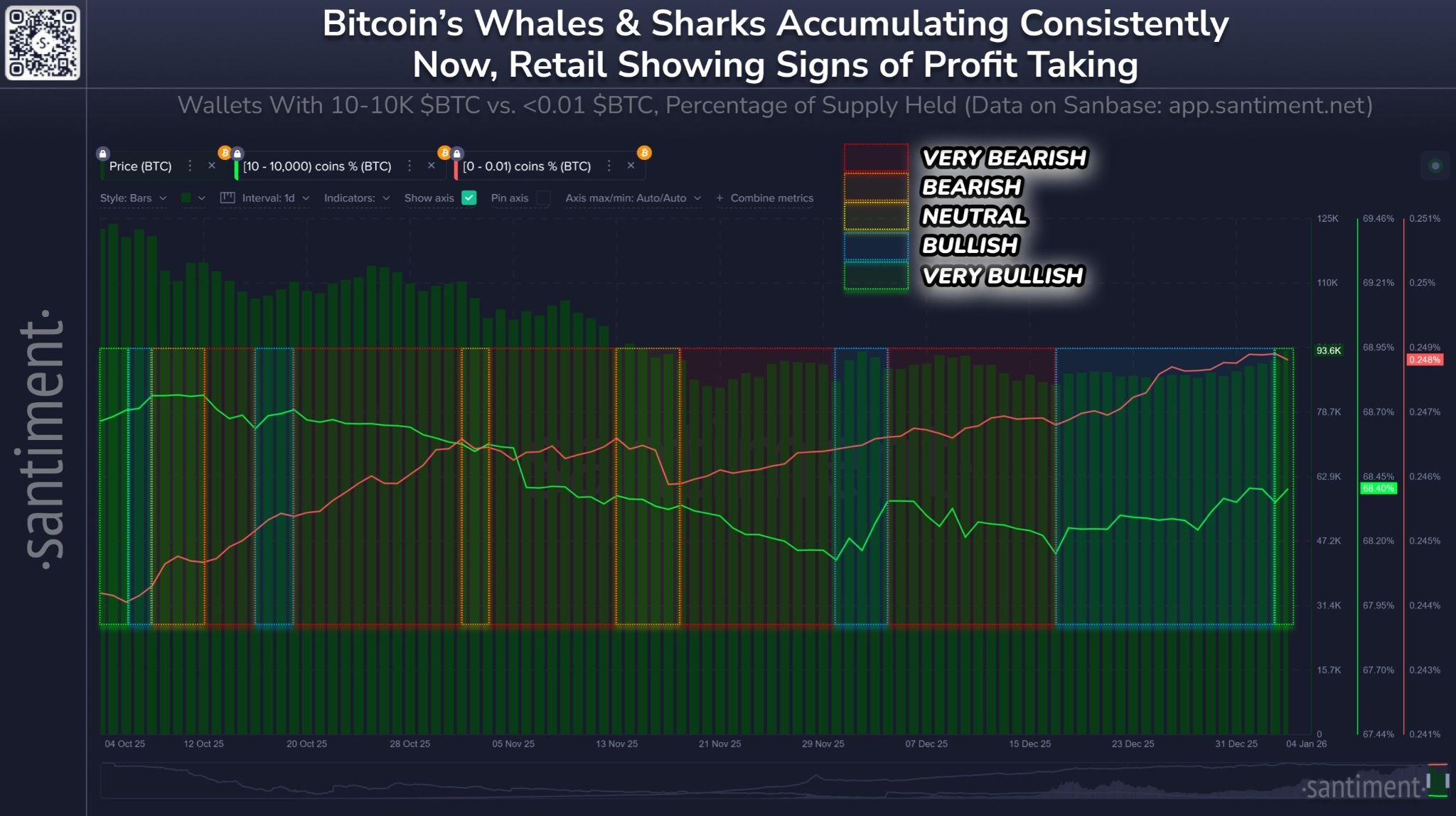

Crypto markets “typically follow the path of key whale and shark stakeholders, and move in the opposite direction of small retail wallets,” said on-chain analytics platform Santiment on Monday.

Whales and sharks are defined as the cohort holding between 10 and 10,000 BTC, while retail traders have wallets with less than 0.01 BTC.

Since mid-December, whales and sharks have collectively accumulated 56,227 more BTC, according to Santiment.

“This marked crypto’s local bottom. And even though markets stayed relatively flat, the bullish divergence from their accumulation was bound to produce at least a minor breakout,” it added.

Over the past 24 hours, “things have gotten even better” because retail traders are now taking profit with the “expectation that we are in a bull trap/fool’s rally,” it stated.

Santiment concluded that due to these dynamics, “we have a higher probability than usual to continue to see market cap growth throughout crypto.”

Bitcoin breakout could be imminent

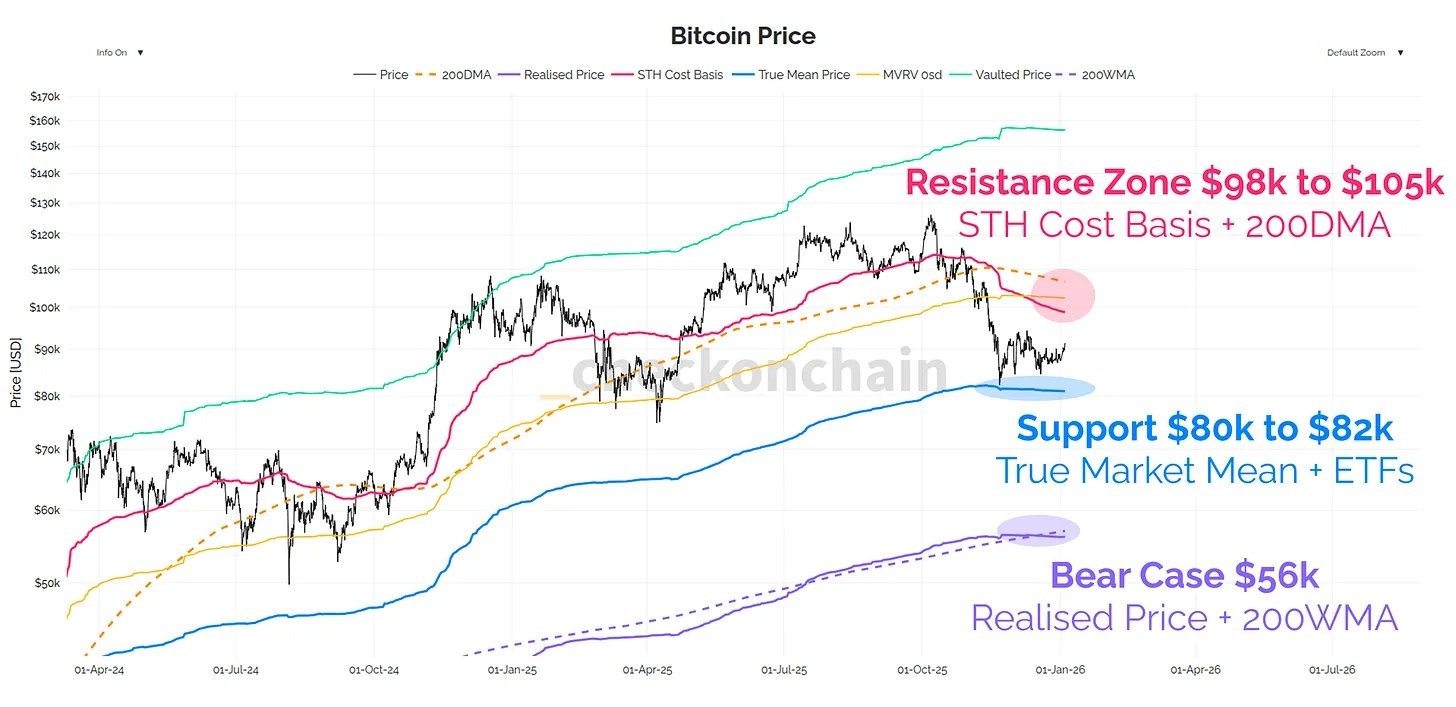

Bitcoin (BTC) has been trading mostly sideways for six weeks, rangebound between around $87,000 and $94,000 since mid-to-late November.

It is currently at the upper bound of this range, having tapped a seven-week high of $94,800 on Coinbase in late trading on Monday, according to TradingView.

Related: Can BTC avoid bull trap at $93K? 5 things to know in Bitcoin this week

Analyst James Check observed on Tuesday that Bitcoin is kicking off 2026 with a rally to $94,000, “but the real story is the massive supply redistribution happening under the hood.”

He noted that the “top-heavy supply” has rebalanced from 67% to 47%, profit-taking has “dropped off a cliff,” and futures markets are seeing a short-squeeze, but overall market leverage remains low.

A bullish consolidation phase

“Bitcoin remains in a bullish consolidation phase,” Andri Fauzan Adziima, research lead at the Bitrue crypto exchange, told Cointelegraph.

“Key upside resistance lies at $95,000 to $100,000, with heavy call option interest around the $100k strike for January expiry. Immediate support sits at $88,000 to $90,000; a break below could trigger a deeper correction,” they added.

Magazine: Kain Warwick loses $50K ETH bet, Bitmine’s ‘1000x’ share plan: Hodler’s Digest

Leave a Reply

You must be logged in to post a comment.