Bitcoin Price Rejection Drama: Will the $84K Safety Net Hold?

Bitcoin’s price sits at $89,764 on Thursday morning with a market cap of $1.79 trillion and a 24-hour trading volume that just grazed $47.55 billion. The coin strutted through a price corridor of $89,774 to $92,125 in the last day, testing traders’ patience and perhaps their caffeine tolerance.

Bitcoin Chart Outlook

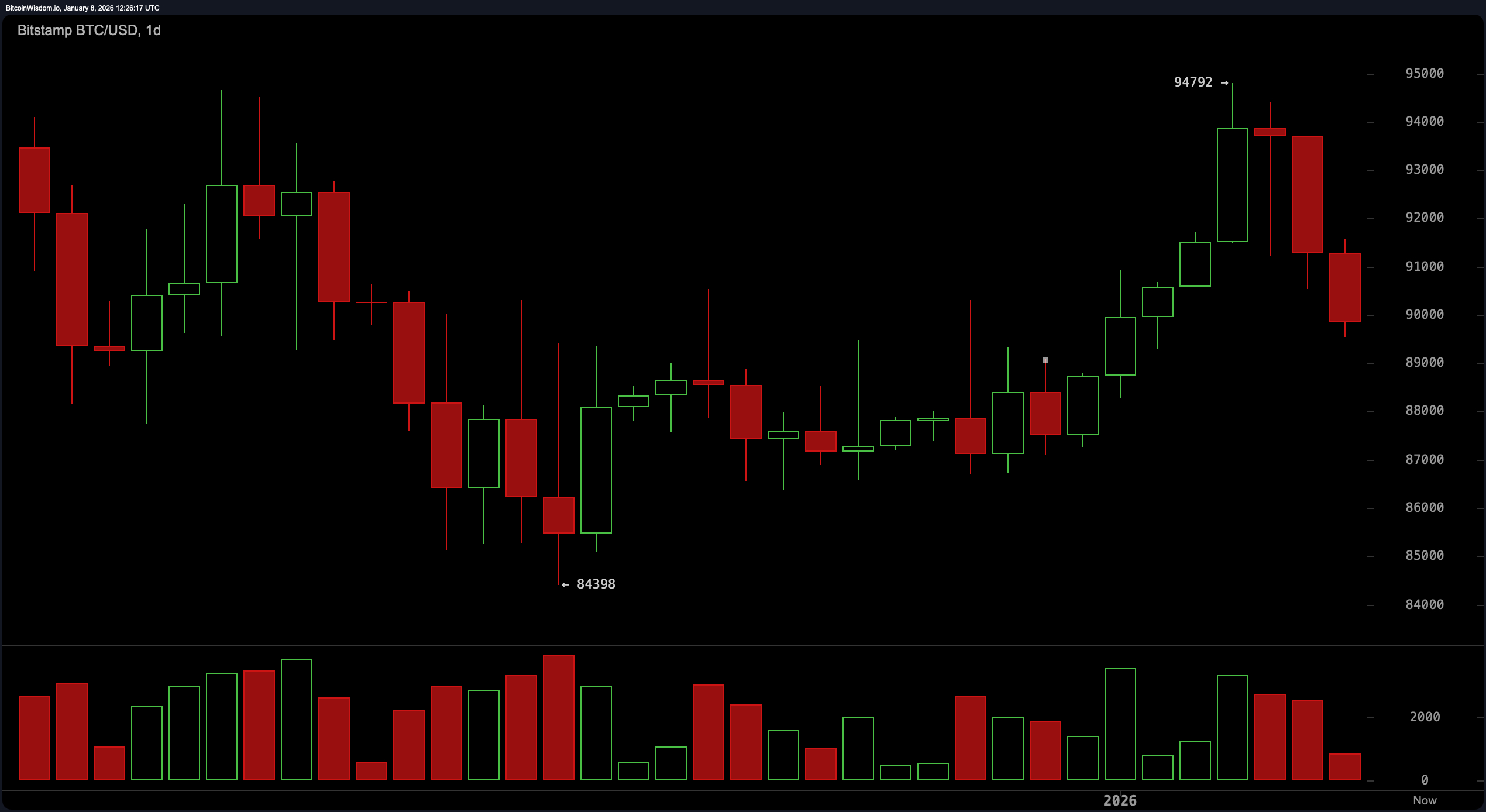

On the daily chart, bitcoin finds itself nursing a hangover after a wild rally to $94,792, now facing stiff resistance at that level. The psychological barrier at $90,000 is being flirted with, but not convincingly claimed. With red candles stacking like a game of bearish Jenga and volume swelling during the pullback, the price action signals unease.

If the current trend fails to regain $90,000, the next dance floor is down at $87,000 or even $84,400—a level recently shown to offer support. For now, the trend has slipped into bearish territory, and optimism is waiting on the sidelines for a proper reversal cue.

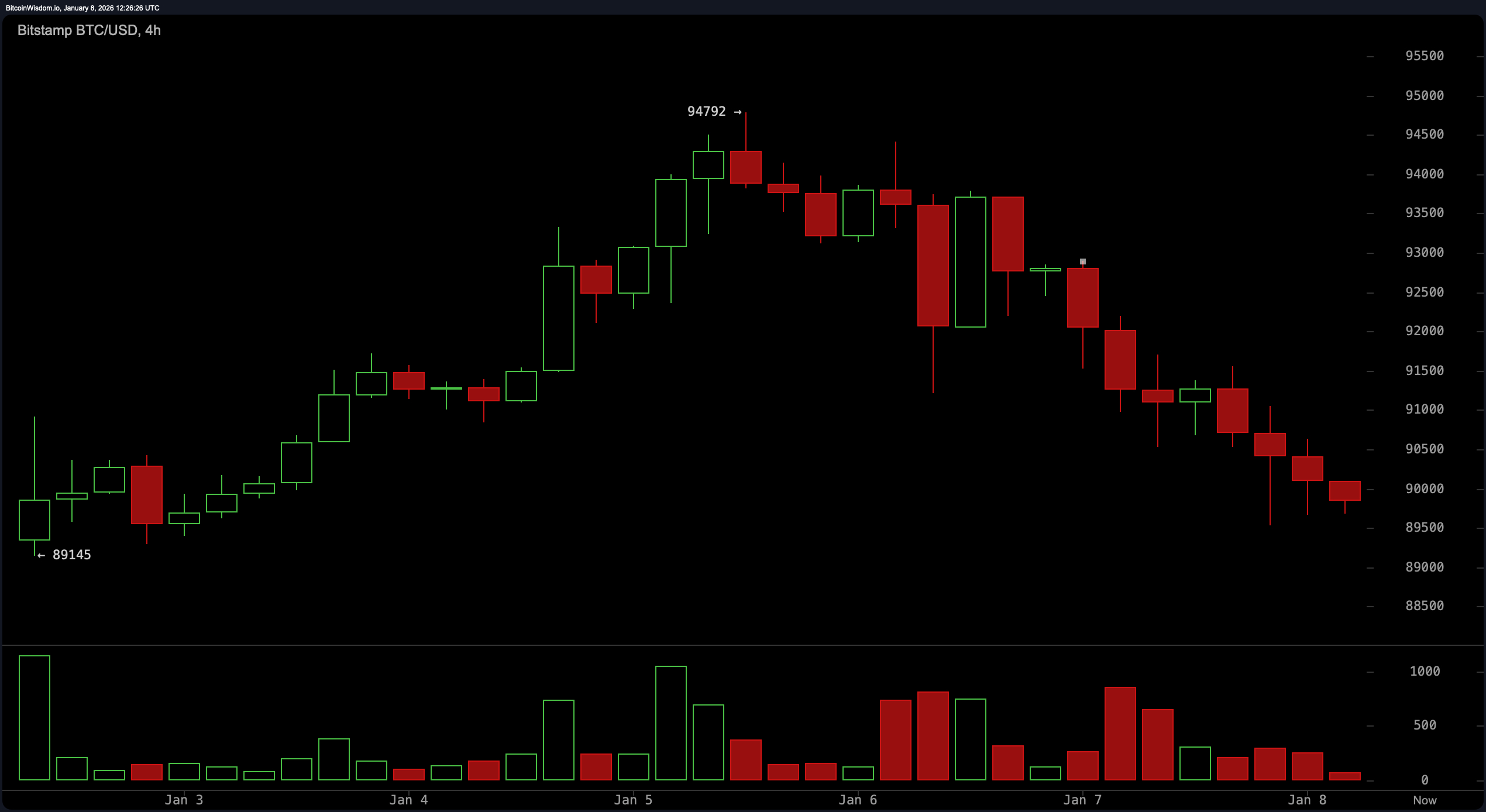

The 4-hour chart tells a story of distribution after the euphoric high. The peak near $94,792 wasn’t just a ceiling—it was a trapdoor. Since January 6, the momentum has leaned sharply downward, showing virtually no evidence of bullish pressure. Candlestick formations lack conviction, and the accompanying volume confirms that sellers still have the louder voice. Price action between $89,000 and $90,000 is crucial, but any close below this band could open the floodgates toward $84,000. Until then, every bounce appears more like a whimper than a war cry.

Zooming into the 1-hour chart, the picture doesn’t brighten much. The microstructure of the downtrend remains intact with a recent low of $89,530 showing how close bitcoin is skirting its current support. Buyers have yet to make a credible appearance—no bullish engulfing patterns, no significant volume on the upticks, just meek attempts to reverse that scream indecision. A short-term bounce may be technically possible, but it’s fighting the current. Unless the market breaks past $91,000 with strength, the bias remains firmly skewed toward caution.

Oscillators across the board are either playing it safe or sending mixed messages. The relative strength index ( RSI) stands at 50, the Stochastic oscillator at 61, and the commodity channel index (CCI) at 49—all sitting squarely on the fence. The average directional index (ADX) at 24 adds little conviction, pointing to a weak trend either way. While the momentum indicator leans toward downside pressure, the moving average convergence divergence ( MACD) is the lone optimist among the bunch. It might be seeing green shoots others don’t—but with no follow-through from volume or structure, its solo parade may be short-lived.

Moving averages (MAs) paint a more definitive picture—and it’s not one you’ll want to frame. The 10, 20, 30, 50, 100, and 200-period exponential moving averages (EMAs) are all above the current price and signaling pressure from above. Only the 20 and 30-period simple moving averages (SMAs) are slightly more forgiving, hinting at potential short-term cushions. Yet, with the 200-period simple moving average towering above at $106,489, any dreams of immediate upside are, frankly, premature. Until a bullish structure shows up like it means business, traders would be wise to stay alert—and maybe keep the champagne on ice.

Bull Verdict:

Should bitcoin reclaim and hold the $90,000 level with convincing volume and a reversal candlestick—preferably something with spine like a hammer—it could signal a short-term bottom. Combine that with a shift in momentum indicators and a cooperative MACD, and bulls may just wrestle back control for a climb toward $91,500 or even retest $94,800. But right now, hope is speculative and confirmation is key.

Bear Verdict:

With a sea of red on lower timeframes, a glaring lack of buyer conviction, and moving averages stacking resistance like a fortress, the bears are still firmly in charge. If bitcoin closes below $89,500 with volume, it’s likely heading straight to the $87,000 or $84,400 support levels. Until structure or sentiment flips decisively, the path of least resistance is still down.

FAQ ❓

- What is bitcoin’s price today? Bitcoin is trading at $89,764 as of January 8, 2026.

- What is bitcoin’s current market cap?The market capitalization of bitcoin stands at $1.79 trillion.

- What is bitcoin’s 24-hour trading volume?The 24-hour trading volume for bitcoin is $47.55 billion.

- Is bitcoin in a downtrend now?Yes, technical indicators on 1-hour and 4-hour charts show short-term bearish momentum.

Leave a Reply

You must be logged in to post a comment.