A historical price comparison between Bitcoin (BTC) and gold suggests that the cryptocurrency could rally by 35% in the fourth quarter.

Notably, analysis by Ted Pillows projects a major upward move for Bitcoin, suggesting the digital asset could mirror gold’s historical breakout pattern. If the analogy holds, BTC may trade above $160,000 by Q4, he said in an X post on July 26.

The comparison draws on analysis of gold and Bitcoin’s market behavior, identifying phases of accumulation, distribution, and re-accumulation before each asset entered a strong rally.

Notably, gold’s rally, from under $2,000 to over $3,300, followed a prolonged re-accumulation phase. According to Pillows, Bitcoin appears to be nearing the end of a similar structure.

The analyst suggested Bitcoin’s market cycle is currently transitioning from re-accumulation to a rally phase. This final leg could significantly push the cryptocurrency’s price higher, potentially exceeding $160,000 before year-end.

It’s worth noting that in 2025, gold has delivered a standout performance as investors turned to the precious metal for its safe-haven appeal amid growing concerns over a potential economic downturn.

There is indeed potential for Bitcoin to reach these levels, especially as some analysts argue that holding key technical indicators will be crucial to its success. For instance, as reported by Finbold, crypto trading expert Ali Martinez noted that as long as Bitcoin holds above the $110,000 spot level, there is room to reach a new all-time high at $130,000.

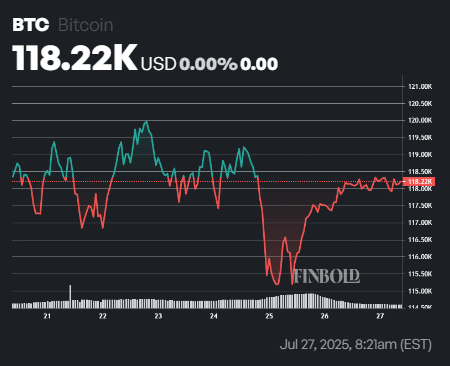

Bitcoin price analysis

As of press time, Bitcoin was valued at $118,216, posting modest gains of less than 0.1% in the past 24 hours. Over the last seven days, however, BTC is down 0.45%.

Meanwhile, Bitcoin’s technical structure remains bullish, with the 50-day simple moving average (SMA) at $110,580 and the 200-day SMA at $90,392, both pointing upward as the current price exceeds them.

The 14-day Relative Strength Index (RSI) stands at 60.43, indicating that the market is approaching overbought conditions but has not yet reached them.

Featured image via Shutterstock