Bitcoin prices hit two-month high, but U.S. demand lags, key signal shows

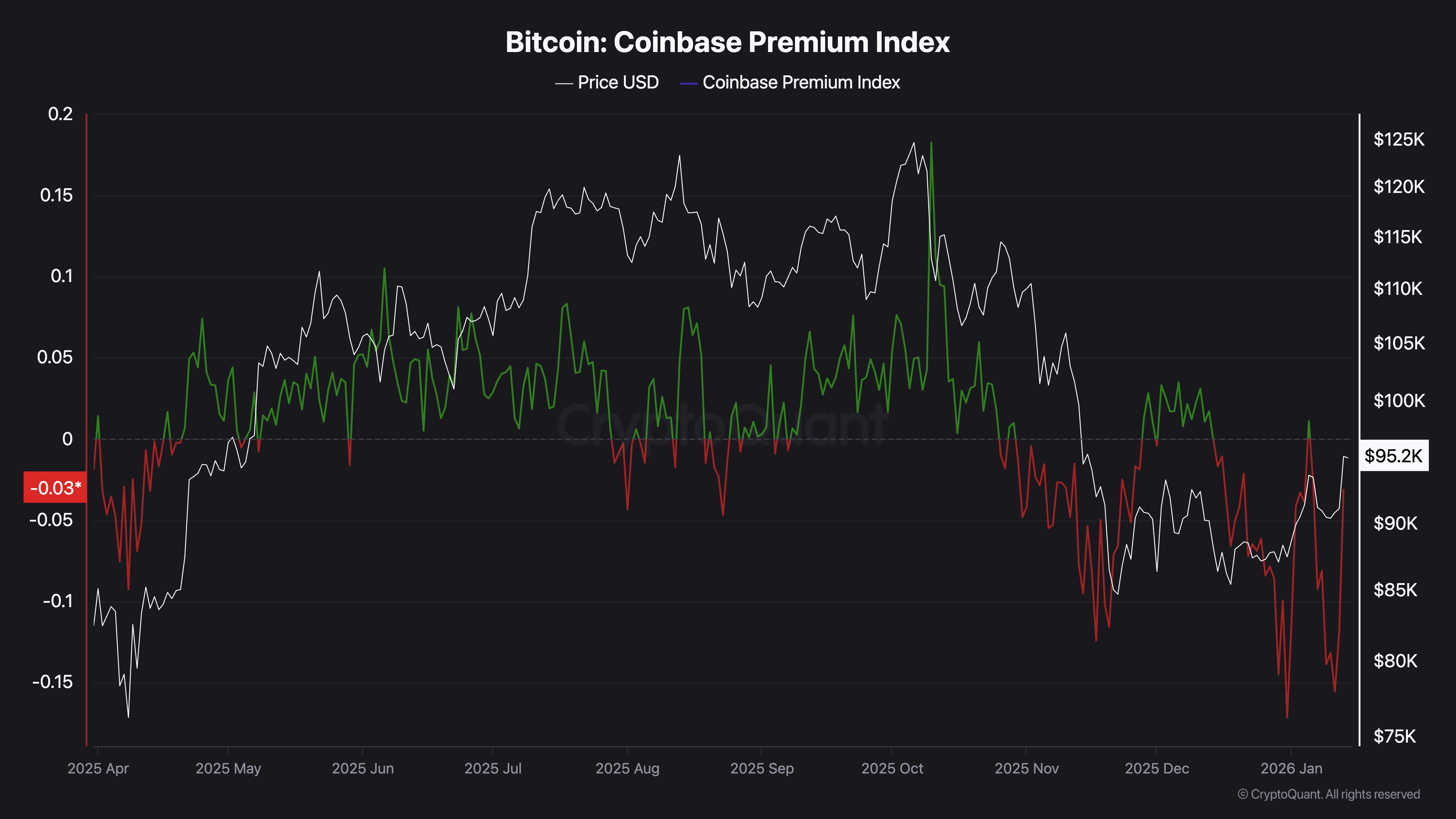

Bitcoin’s BTC$95,174.77 price hit two-month highs abov e $95,000 on Tuesday, but U.S. investors aren’t buying as much as people overseas. A key measure called the “Coinbase Premium” shows this gap clearly.

This metric compares bitcoin prices on the Nasdaq-listed cryptocurrency exchange Coinbase with prices on offshore giant Binance. Right now, bitcoin costs less on Coinbase than on Binance, the world’s largest exchange by volume and open interest, even as prices rise overall. That means more Americans might be selling than buying.

“A negative premium suggests lower Bitcoin prices on Coinbase compared to the global average, indicating strong selling pressure and potential capital outflows from the U.S. market,” Singapore-based crypto exchange Phemex said in a blog post.

Historically, U.S. demand has led major bitcoin price rallies, driving the market higher. This trend strengthened after President Trump’s reelection in November 2024, followed by positive regulatory moves under his administration.

The chart shows the Coinbase premium indicator peaked in October along with bitcoin’s price and flipped negative in early November. Since then, it has largely remained negative, highlighted weak U.S. demand.

U.S. investors may be holding back, waiting to see if the Clarity Act, a proposed law to clarify crypto rules, gets passed. The Senate has pushed back the crucial mark up of the act to the last week of January to secure bipartisan support.

Some analysts expect bitcoin to hit a new high in case the act is signed into a law.

Leave a Reply

You must be logged in to post a comment.