Corporate digital asset treasuries (DATs) added a net 260,000 Bitcoin to their balance sheets over the past six months, far outpacing the estimated 82,000 coins mined over the same period.

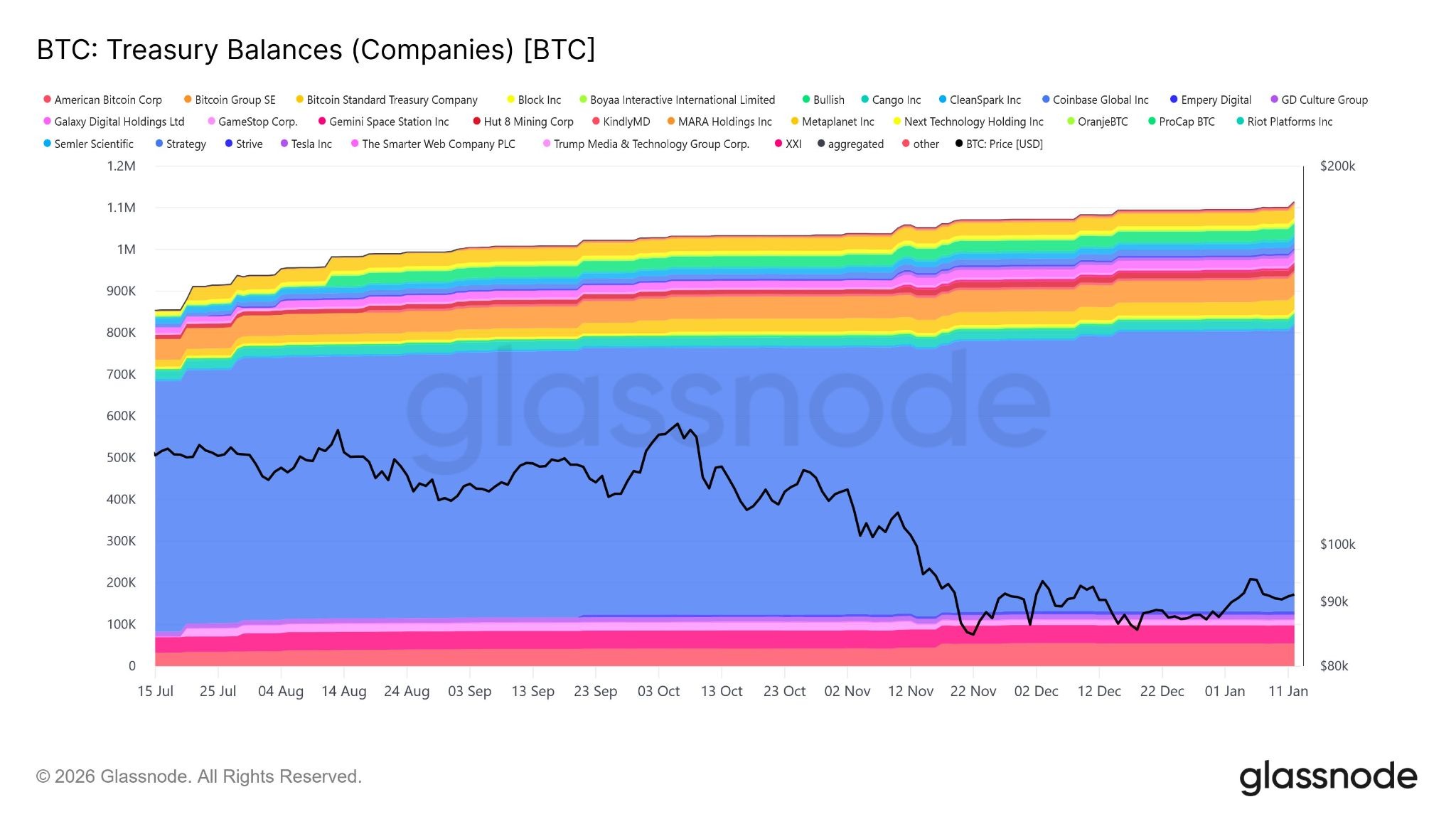

Over the past six months, Bitcoin (BTC) treasuries held by public and private companies have increased from approximately 854,000 BTC to 1.11 million BTC, on-chain analytics provider Glassnode reported on Tuesday.

This equates to an expansion of around 260,000 BTC, worth roughly $25 billion at current market prices, or 43,000 BTC per month.

The growth in treasuries highlights “the steady expansion of corporate balance-sheet exposure to Bitcoin,” stated Glassnode.

Bitcoin miners, which produce on average 450 BTC per day, mined around 82,000 coins over the same period, which could indicate a favorable supply-demand dynamic at play.

Strategy has 60% of the total BTC balance

The lion’s share of the 1.2 million BTC held in public and private company treasury balances is held by Michael Saylor’s Strategy.

Strategy currently holds 687,410 BTC, or 60% of the total, worth around $65.5 billion at current market prices.

The firm resumed its purchases this month after a brief hiatus, revealing that it acquired an additional 13,627 BTC between January 5 and 11 in its largest purchase since July.

The second-largest corporate Bitcoin DAT is MARA Holdings with 53,250 BTC worth around $5 billion, according to Bitcoin Treasuries.

Bitcoin ETFs could add to demand

Spot Bitcoin exchange-traded funds could add to this supply-and-demand dynamic if the inflow trend continues this year. “Bitcoin’s price will go parabolic if ETF demand persists long-term,” said Bitwise chief investment officer Matt Hougan on Tuesday.

“Since ETFs debuted in Jan 2024, they’ve been buying more than 100% of the new supply of bitcoin. But the price hasn’t gone parabolic, because existing holders have been willing to sell. If ETF demand persists — and I think it will — eventually, these sellers will run out of ammo.”

Spot BTC ETFs in the US saw net inflows of almost $22 billion in 2025, with BlackRock’s iShares Bitcoin Trust (IBIT) taking the lion’s share.

However, they have had a mixed start to 2026 with current data showing $1.9 billion inflows and $1.38 billion outflows, resulting in a net aggregate inflow of just over $500 million.

Leave a Reply

You must be logged in to post a comment.