Bitcoin Price Analysis: Major Pullback or Explosive BTC Breakout Next?

Bitcoin is grinding higher into a heavy resistance pocket while spot supply on exchanges keeps shrinking. Structurally, that’s a bullish backdrop, but technically, the price is pressing right into an area where profit-taking is expected. Therefore, either the price breaks and holds above this ceiling, or a corrective pullback into the mid-range would occur.

Bitcoin Price Analysis: The Daily Chart

On the daily chart, BTC has pushed back into the $95K resistance band, which lines up with the 100-day moving average. This is the same zone that rejected the asset on the previous bounces, so for now it still acts as a key supply area within the broader downtrend from the highs.

Daily RSI is also elevated but not at panic extremes anymore, signalling strong short-term momentum but still inside a larger corrective structure. As long as BTC trades below the 100-day moving average and the $95k resistance block, the move is best treated as a counter-trend rally, not a confirmed new uptrend.

But in case the level breaks to the upside, a rally toward the $106K zone and the 200-day moving average located nearby would be expected, which could spark the beginning of a new, more prolonged bull run.

BTC/USDT 4-Hour Chart

On the 4-hour chart, the price broke out from the ascending structure and is now consolidating right at the top of the pattern and at the higher-timeframe resistance. Momentum is clearly slowing: candles are getting smaller, and RSI has started to roll over from overbought after a bearish divergence, hinting at local distribution near the highs.

If buyers fail to defend the breakout area around $93K–$94K, a pullback toward the lower trendline of the pattern and the $90K region would be probable. Conversely, if BTC can hold above $93K–$94K and build a base there, another push toward the $98K–$100K psychological level becomes realistic. Yet, buyers need quick follow-through, or the breakout risks turning into a fakeout.

On-Chain Analysis

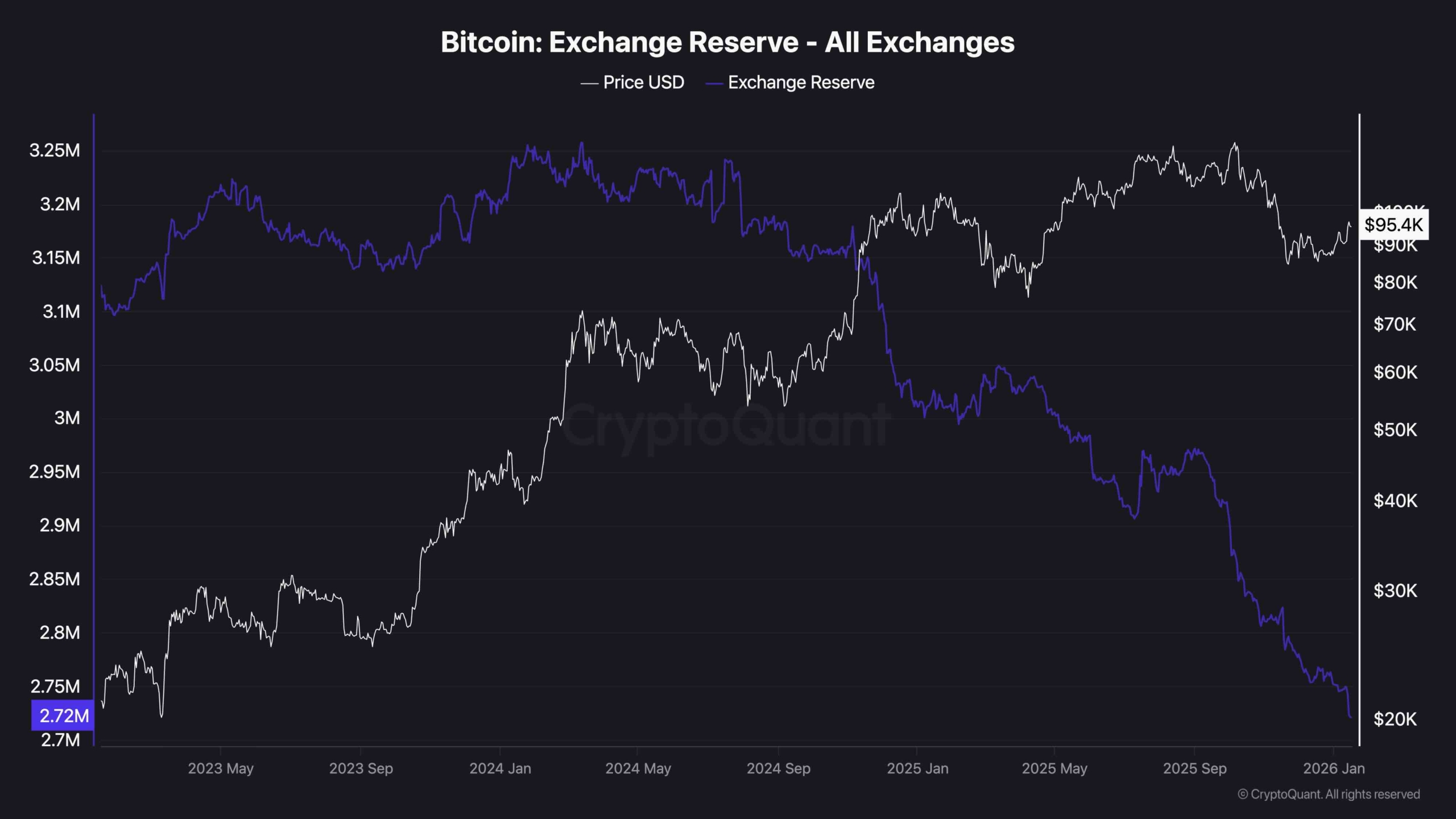

Exchange reserve data continues to trend lower while the price trades near the top of the local range. That means fewer BTC are sitting on exchanges and more are in cold storage or strong hands, which is typically a constructive, supply-tight backdrop.

This does not prevent short-term corrections when the price is pressing into technical resistance, but it does argue that deeper dips into the $80K–$90K range are more likely to be bought than to trigger a full distribution top. Unless a sharp spike of BTC flowing back to exchanges occurs, the on-chain picture still leans medium-term bullish even if the price experiences some near-term downside to reset momentum.

Leave a Reply

You must be logged in to post a comment.