An artificial intelligence (AI) tool has suggested that, despite Bitcoin’s (BTC) current bullish run, there is a plausible chance the asset could crash below $100,000 in the coming weeks.

According to OpenAI’s ChatGPT, Bitcoin, currently around $117,000, is hovering near critical support at $116,000. A breakdown below this level could send it to $105,000 and $108,000, with sub-$100,000 levels possible by August or early September 2025 if support fails.

The AI model highlighted key risks that could accelerate a Bitcoin sell-off, including a slowdown in spot ETF inflows and a broader U.S. market correction.

Notably, Bitcoin ETF inflows have been a key factor in the asset’s momentum, contributing to the record high of over $123,000. At the close of trading on June 25, the spot Bitcoin ETFs saw an inflow of $130.8 million.

At the same time, as reported by Finbold, Citi analysts predict a base case of $135,000 for Bitcoin by the end of 2025 if inflows persist; however, the bank also warned that the asset could crash to as low as $64,000.

ChatGPT also noted that both scenarios could put additional pressure on Bitcoin prices, especially as the cryptocurrency’s correlation with the S&P 500 has increased in recent months.

Further downside could also stem from unpredictable events such as exchange hacks or sudden regulatory crackdowns, which have historically triggered panic sell-offs.

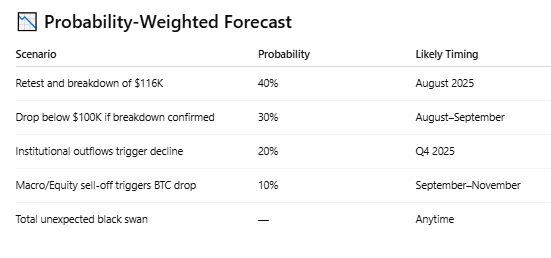

The AI model emphasized that, although the exact timing remains uncertain, investors should be aware of a 30% to 40% probability that Bitcoin could fall below $100,000 between August and September 2025.

Bitcoin’s key price level to watch

Meanwhile, cryptocurrency trading expert Michaël van de Poppe also highlighted the significance of Bitcoin holding above $116,000. In an X post on July 26, Poppe stated that the $116,800 level is the key battleground for bulls.

According to his analysis, maintaining support above this threshold could set the stage for a push toward new all-time highs in the coming week.

Notably, there is strong liquidity below the $116,000 level, which has been tested multiple times, suggesting buyers are actively defending the zone. Therefore, if Bitcoin can establish a stable base above $116,800, the market may target the $119,900 resistance zone.

However, if BTC dips, the $110,000 to $112,000 range is highlighted as a prime accumulation zone, offering a potentially strong risk-reward opportunity for long-term investors.

Bitcoin price analysis

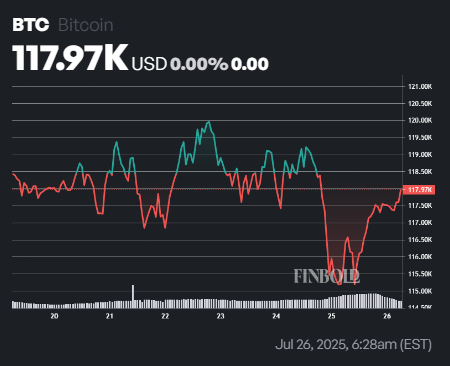

At press time, Bitcoin was trading at $117,970, having gained about 1% in the last 24 hours. Over the past week, the asset is down 0.76%.

As things stand, Bitcoin seems to be on track to reclaim the $120,000 mark after briefly facing the threat of dropping below $115,000 on July 25. Therefore, as long as the $115,000 support holds, there is room for the leading cryptocurrency to target higher prices.

Featured image via Shutterstock