Bitcoin price officially enters correction mode; Here’s what's next

With Bitcoin (BTC) losing the $115,000 support amid a broader market correction, a trading expert has suggested that the asset has officially entered correction mode.

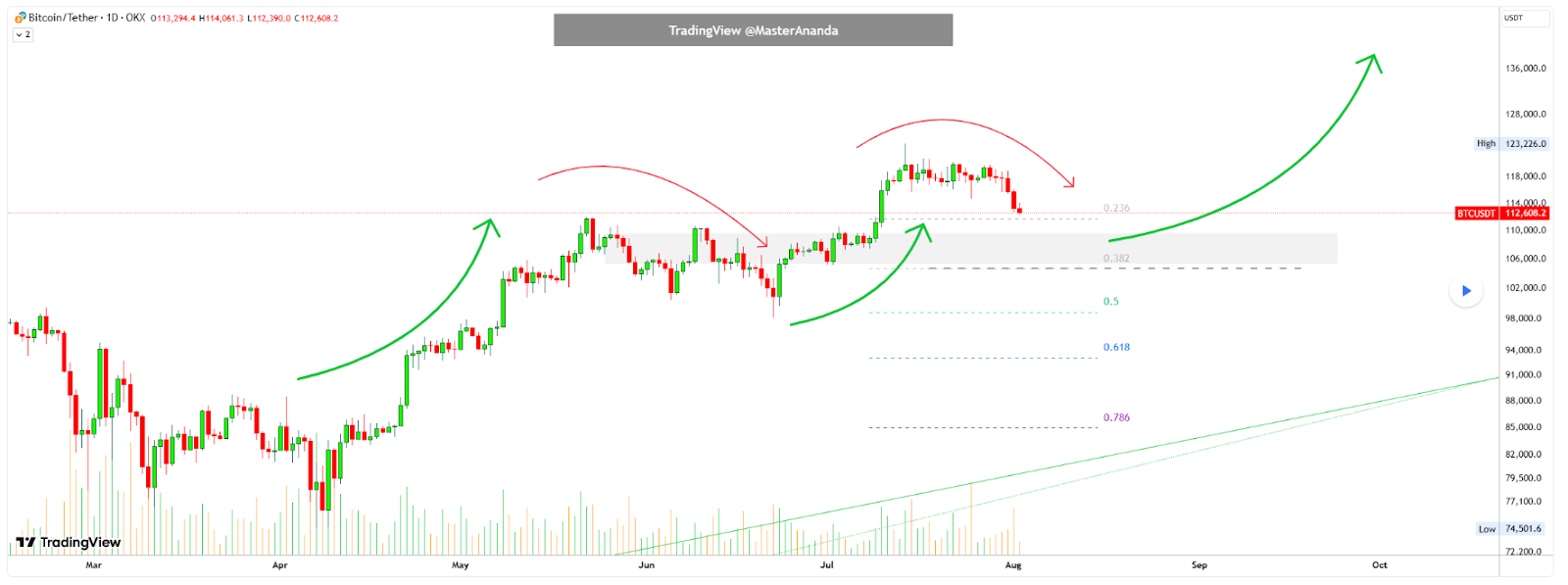

According to Master Ananda, Bitcoin’s corrective phase is evident in its nearly 10% decline from mid-July record highs, with the price now testing key support near the previous all-time high.

In an August 2 TradingView analysis, Ananda noted that despite the current bearishness, Bitcoin remains within a healthy bullish cycle, characterized by recurring upward momentum followed by expected pullbacks.

Therefore, the current correction appears to be part of a broader pattern of price fluctuations that historically set the stage for new highs. If past trends hold, this consolidation could pave the way for a renewed rally toward fresh all-time highs.

Key Bitcoin price levels to watch

The analyst highlighted strong support between $110,000 and $100,000, with $100,000 acting as a key technical and psychological level.

Additional pullback zones are marked by Fibonacci retracement levels, with the 0.382 level around $106,000 and the 0.5 level near $102,000.

As long as Bitcoin stays above $100,000, the long-term bullish trend remains intact. A weekly or monthly close below that level would prompt a reassessment. Past cycles suggest a period of sideways consolidation before a renewed uptrend.

It’s worth noting that Bitcoin took a hit alongside the equities market as investors were rattled by disappointing July jobs data and uncertainty stemming from sweeping U.S. trade tariffs.

Meanwhile, according to another cryptocurrency analyst, Ali Martinez, in an August 2 X post, Bitcoin is finding strong support at $107,160, where over 111,000 BTC have been accumulated, based on Glassnode data.

This level marks the largest buy zone below the current price, reinforcing it as a critical floor. Martinez also noted that resistance is building at $117,400, where 88,000 BTC were purchased.

As things stand, for Bitcoin to avoid further losses, the asset needs to hold above the $110,000 support zone, as a drop below this level could trigger an extended decline.

Featured image via Shutterstock.