Time is running out for Bitcoin’s parabolic rally, warns analyst

Bitcoin’s (BTC) ability to mount a parabolic rally may be fading based on its technical indicators, according to a trading expert.

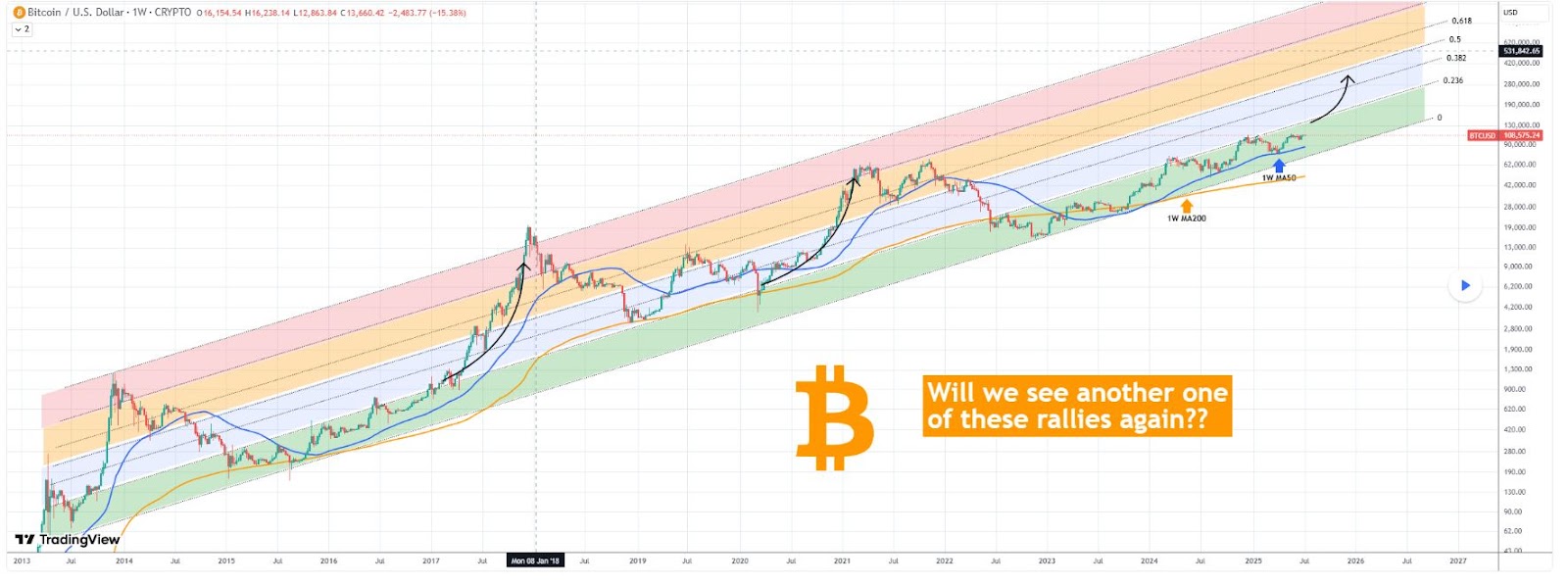

In this line, analysis by TradingShot suggests that another major rally could be limited by Bitcoin’s position within a well-defined long-term uptrend that has yet to produce the kind of rallies seen in the past cycles.

In a TradingView post on July 9, the analyst noted that since bottoming in November 2022, Bitcoin has traded within an upward channel that closely aligns with a Fibonacci channel guiding price movements since 2013.

Despite short-term pullbacks, the overall trend remains intact and is technically targeting a new higher high.

Notably, most of this cycle has occurred in the ‘buy zone’ of the Fibonacci channel. Historically, major rallies have followed breakouts from this zone.

For instance, in the 2017 and 2021 cycles, such breakouts triggered rapid, exponential moves into the upper Fibonacci bands, delivering significant gains.

So far, TradingShot stressed that this cycle has not produced a similar breakout. To this end, Bitcoin recently tested resistance near its all-time high but failed to hold above it.

What’s next for Bitcoin?

At the same time, the expert warned that if Bitcoin is to follow its traditional four-year cycle pattern, driven by the supply shock from the halving time, it may be running out of time to deliver a comparable parabolic move before the cycle matures.

“So far, we haven’t got such rally on the current Cycle and with time running out (assuming the 4-year Cycle model continues to hold), do you think we will get one this time around?” the analyst said.

The analysis suggested potential price targets between $280,000 and $530,000 if Bitcoin can replicate its historical breakout pattern, with key technical indicators aligning with the 50- and 200-week moving averages (MA).

Bitcoin price analysis

At press time, Bitcoin was trading at $108,777, up approximately 0.25% in the last 24 hours, having largely remained in a state of consolidation over the past week.

At its current price, Bitcoin’s 50-day simple moving average is $106,755, indicating a slight upward trend. The 200-day simple moving average is $88,209, reflecting strong long-term growth. Meanwhile, the 14-day relative strength index (RSI) is 56.58, within the neutral range, showing no signs of overbought or oversold conditions.

Featured image via Shutterstock