Bitcoin ETFs have logged six straight days of outflows, the longest streak since April, mounting pressure on Bitcoin’s short-term outlook.

According to on-chain and market analytics platform Santiment, the $1.2 billion outflow marks the longest withdrawal streak since early April, and it highlights growing pressure on Bitcoin’s short-term price performance.

The firm attributes much of the recent turbulence to retail traders, whose shifting sentiment appears to be steering ETF flows, in contrast to previous institutional-led outflows. These outflows have resulted in Bitcoin’s current volatility. Notably, Bitcoin trades at $110,067, a 1.8% loss in the past day, increasing the weekly loss to 4.3%.

However, that optimism was short-lived. Just days later, the market experienced one of its most aggressive redemption phases, with August 19 standing out as the heaviest single day of withdrawals, totaling more than $523 million across ETFs.

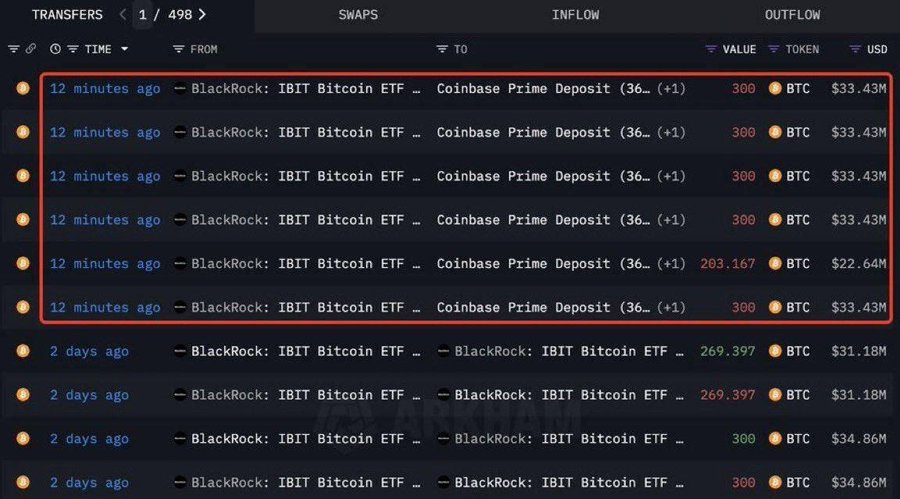

BlackRock’s IBIT and Fidelity’s FBTC accounted for the bulk of these exits, while Ark’s ARKB and Grayscale’s GBTC also posted significant redemptions, reinforcing the breadth of the selloff.

The outflow pressure spilled into August 20 and August 21, with combined outflow exceeding $510 million. IBIT lost $220 million on August 20, while Ark shed $75.7 million, contributing to a $315.9 million net outflow that day. Another $194.4 million exited the ecosystem on August 21, led by IBIT and FBTC.

Flows briefly stabilized on August 22, when ETF outflows collectively posted a near-flat $23 million. Fidelity’s FBTC attracted $50.9 million and Ark gained $65.7 million, while BlackRock’s IBIT still faced $198.8 million in redemptions.

Meanwhile, momentum turned decisively positive yesterday, with broad-based inflows across major issuers. IBIT took in $63.4 million, Fidelity added $65.6 million, Bitwise brought $15.2 million, and Ark gained $61.2 million. Valkyrie’s BRRR also saw $6.3 million, bringing total inflows for the day to $219.1 million, the strongest rebound since mid-month.

April Outflows Provide Historical Comparison

The present sell-off is not without precedent. A similar cluster of outflows occurred between April 3 and April 10, when Bitcoin ETFs recorded $839 million in redemptions. Notably, macroeconomic concerns, particularly tariff-related headlines, drove the selloff. After that, the Bitcoin price rebounded.

Santiment flagged the April sell-off as an “ideal buy spot,” arguing that ETF-driven withdrawals can sometimes signal local bottoms. This raises the question of whether the current trend could set up a comparable recovery once selling pressure subsides.

Ethereum ETFs Stabilize as XRP and Others See Positive Flows

In a contrasting development, Ethereum ETFs experienced sharp swings this month. They saw record inflows of over $1 billion on August 11, led by BlackRock and Fidelity, but that momentum quickly reversed with steep outflows around mid-month.

The pressure eased soon after, as renewed demand helped funds rebound with strong inflows in the following days. That positive streak continued yesterday when ETFs collectively pulled in $443.9 million.

Meanwhile, XRP, Solana, and Cardano have attracted steady investor demand. CoinShares data showed XRP leading with $25 million in inflows last week, lifting its year-to-date total to $1.26 billion and assets under management (AUM) to $2.75 billion.

Solana followed with $12 million, pushing its monthly inflows to $211 million and AUM to about $2.9 billion. At the same time, Cardano also secured fresh allocations.