Bitcoin Price Analysis: Is a Correction Coming or Will BTC Break $120K Next?

Bitcoin has decisively broken above its previous all-time high of $111K, triggering a powerful bullish rally toward the key $120K psychological resistance.

However, as BTC approaches the $120K zone, profit-taking and distribution pressure may rise, increasing the likelihood of a short-term corrective pullback.

Technical Analysis

By ShayanMarkets

The Daily Chart

After a prolonged consolidation phase, Bitcoin has decisively broken above its previous all-time high of $111K. This breakout was backed by a notable surge in buying activity, triggering a short-squeeze that accelerated the bullish momentum. As a result, Bitcoin rapidly climbed toward the psychologically significant $120K resistance level.

While this move signals strong market confidence, the $120K region is a probable zone for profit-taking and distribution, which could temporarily slow down the rally. A short-term corrective phase is therefore expected, likely pulling the price back toward the $111K region to retest the breakout level. Based on the Fibonacci retracement tool, key resistance levels ahead are located at $120K and $131K.

The 4-Hour Chart

On the lower timeframe, Bitcoin printed a powerful bullish candle, decisively breaking above both the descending wedge pattern and the previous ATH at $111K. Following a minor pullback to retest the breakout zone, the price resumed its upward surge, reaching the $120K mark.

Such impulsive rallies are often followed by short-term corrections, as traders begin to realize profits. A healthy retracement would likely target the 0.5 ($113K) to 0.618 ($111K) Fibonacci levels, a key zone where the market may stabilize and build momentum for the next leg up.

On-chain Analysis

By ShayanMarkets

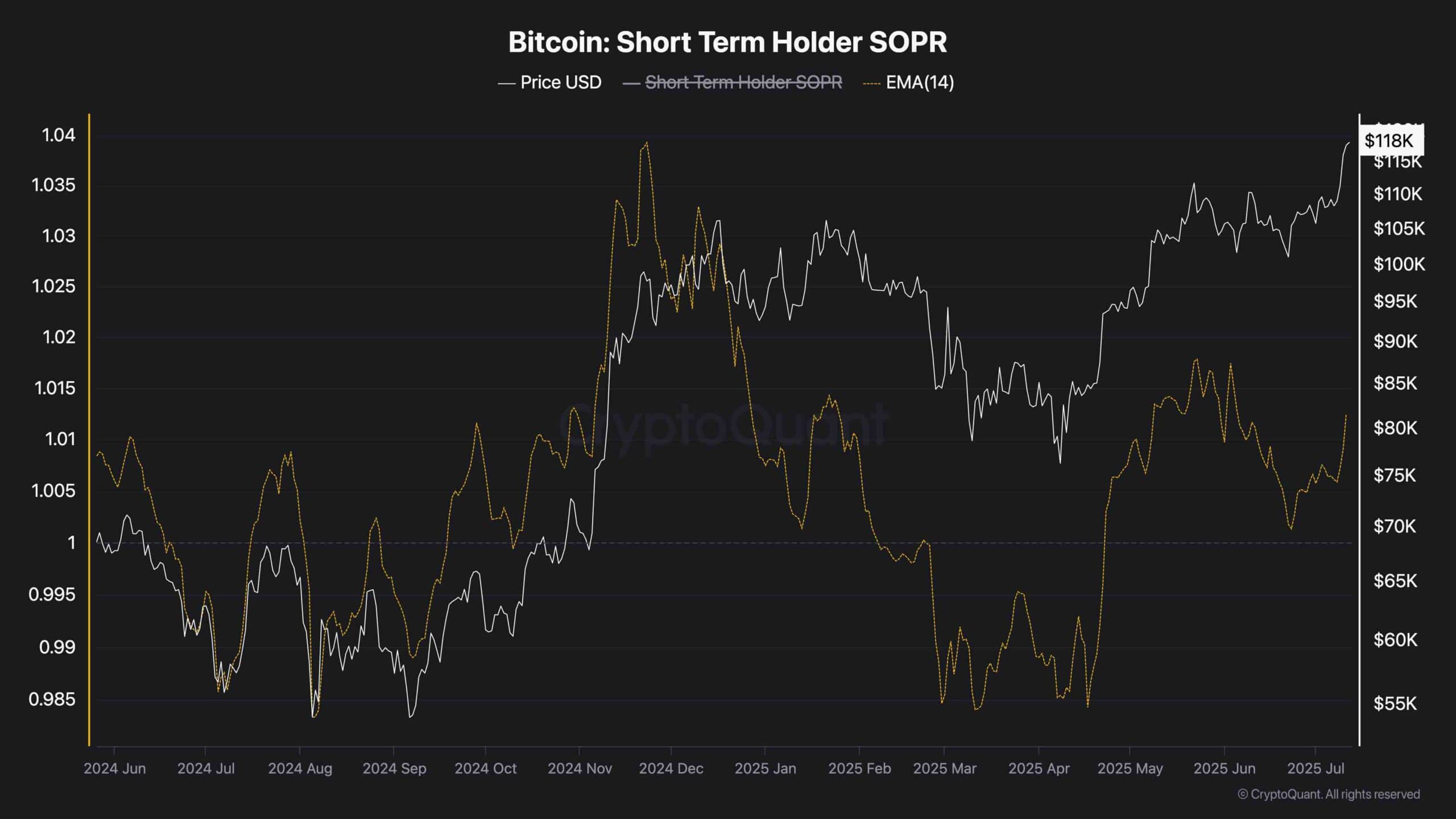

As Bitcoin trades at all-time highs near $120K, an intriguing insight emerges from the Short-Term Holder SOPR metric. This indicator, which measures realized profits from investors who’ve held BTC for less than 155 days, remains notably muted, especially when compared to November 2024, when Bitcoin first reached $111K.

Despite the recent surge, short-term holders aren’t cashing out aggressively, indicating that profit-taking is still relatively limited. Historically, the end of a bullish cycle is often accompanied by elevated SOPR values due to massive profit realization. But for now, the data suggests the market isn’t overheated, and the current rally could still have room to grow if new demand enters.