Correction, Not Capitulation: Bitcoin Price Recovery To $115,000 On The Cards

Bitcoin has experienced a notable pullback since reaching its all-time high earlier this year. The cryptocurrency dipped below $110,000 briefly, raising concerns of sustained bearish pressure.

However, current data suggests the move was more of a short-term fluctuation than the beginning of a prolonged downtrend, hinting at recovery potential.

Bitcoin Is Secure

Risk signals in the Bitcoin market are easing. According to Bitcoin Vector, the Risk-Off Signal is retreating, moving toward a low-risk regime. This shift suggests that market conditions are stabilizing after weeks of volatility.

At the same time, Bitcoin has broken free from a price compression that had been in place since the $124,500 all-time high. Reclaiming $110,000 confirmed the end of this compression zone. With resistance weakened, BTC now has room to move higher, increasing the chances of recovery in the coming weeks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

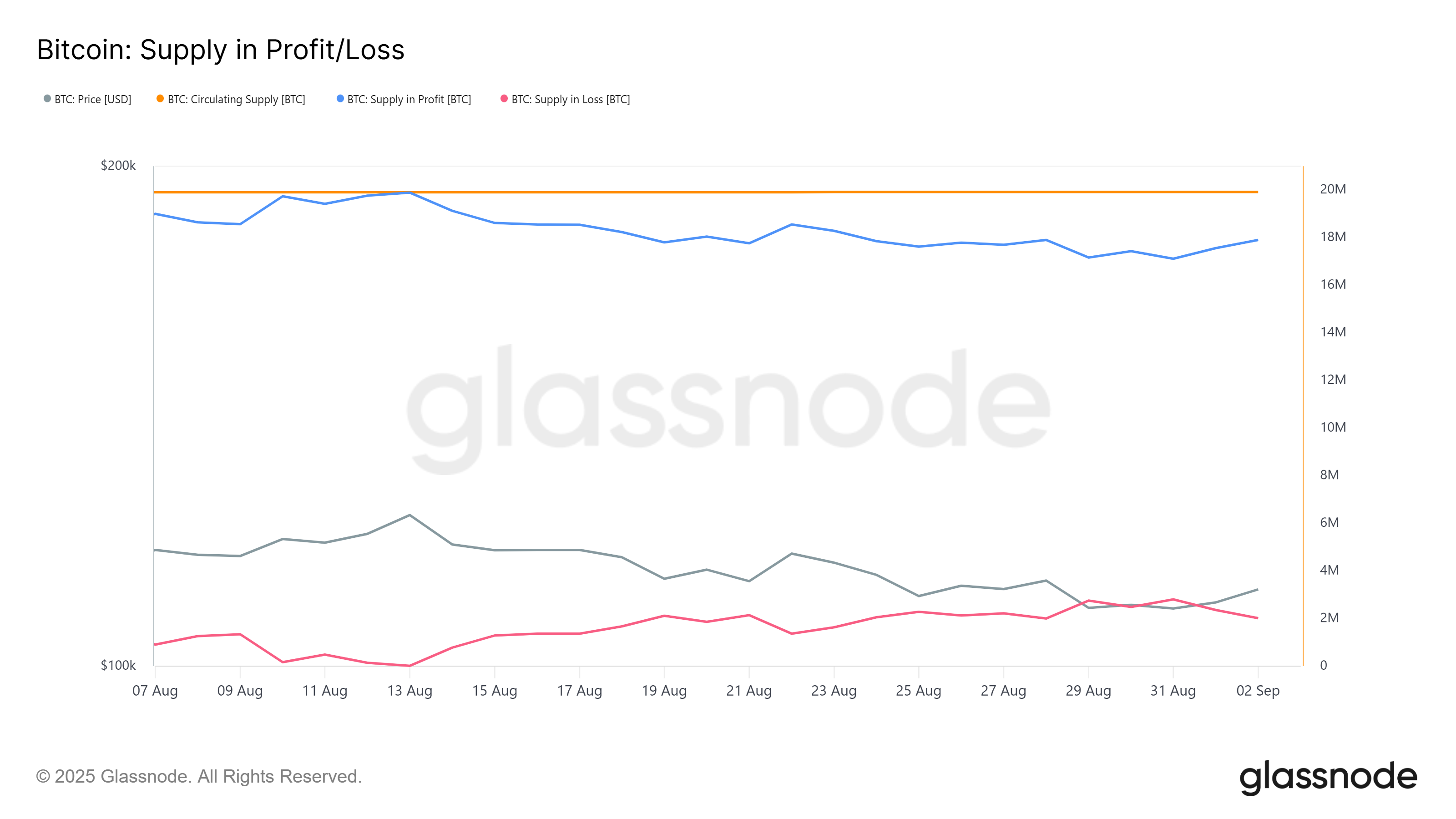

On-chain data supports this outlook. Of the 19.91 million BTC in circulation, only about 2.73 million coins are currently lost. This represents just 13.71% of supply, well below the threshold historically associated with bear markets, where losses typically extend above 50% of circulating Bitcoin.

This indicates Bitcoin is far from capitulation territory. Despite recent price dips, the vast majority of holders remain in profit, showing resilience. The limited supply in loss reflects strong investor conviction, suggesting BTC has a solid foundation to withstand selling pressure and sustain upward momentum in the near term.

BTC Price To Continue Its Rise

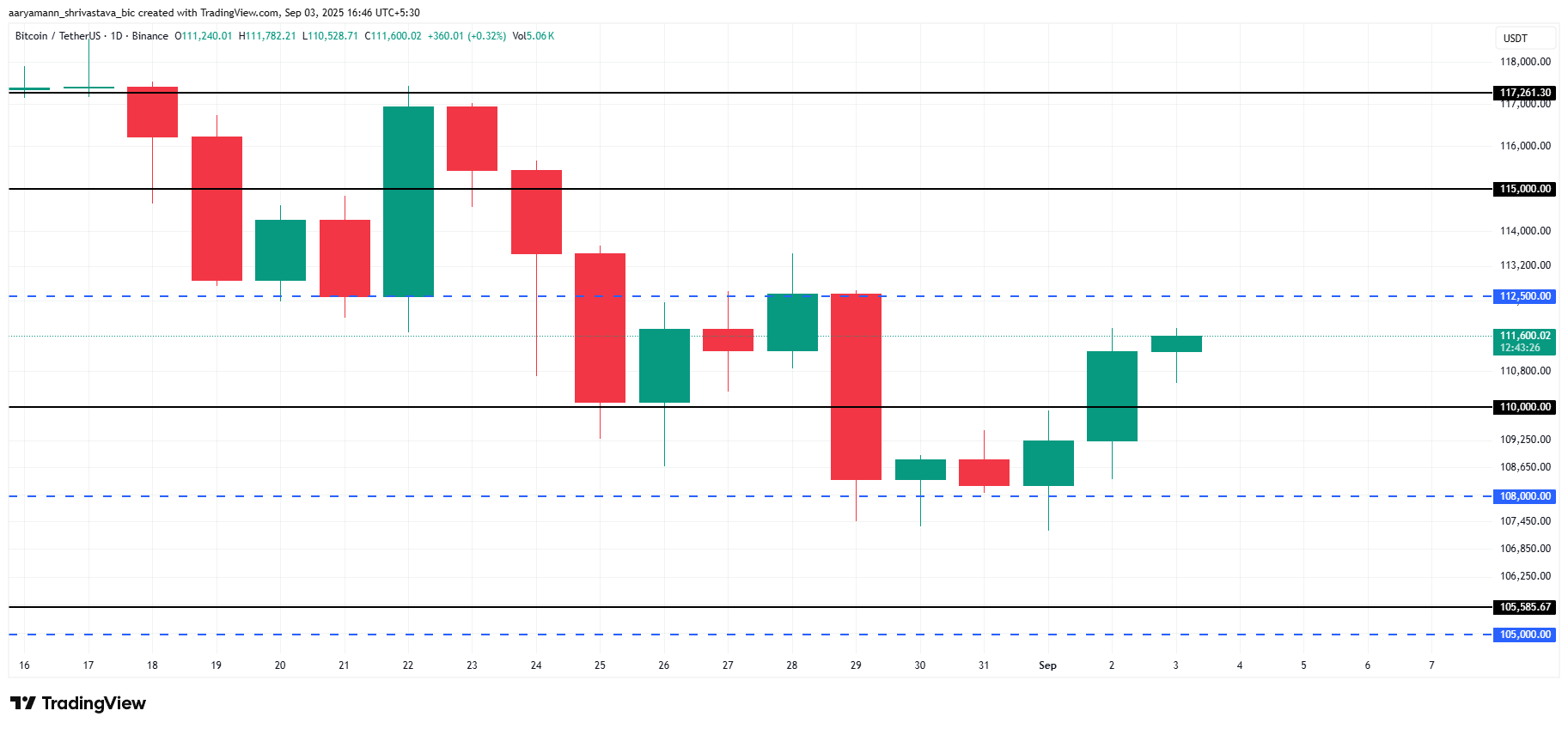

Bitcoin trades at $111,600 at the time of writing, just under the $112,500 resistance. The asset bounced back from $108,000 earlier this week, showing renewed strength. Holding above $110,000 provides stability, giving BTC the base it needs to attempt further recovery against prevailing market pressures.

If current momentum holds, Bitcoin is likely to continue climbing. A breakout above $112,500 could open the path toward $115,000, reinforcing bullish sentiment. This move would confirm the improvement of the market structure and signal a renewed attempt at recovery.

However, risks remain if selling pressure reemerges. Should Bitcoin fail to maintain momentum, a decline back to $110,000 is possible. In a deeper correction, the price could revisit $108,000, raising concerns among investors about potential short-term weakness.

The post Correction, Not Capitulation: Bitcoin Price Recovery To $115,000 On The Cards appeared first on BeInCrypto.