Bitcoin Price Awaits Breakout As ETF Inflows Replicate All-Time High Behavior

Bitcoin’s price has been on a steady uptrend since the beginning of the month, with the crypto king showing resilience after recent volatility.

Currently trading above $114,000, BTC appears poised for a breakout that could echo historical rallies. Market data and ETF inflows suggest momentum is aligning for a potential surge.

Bitcoin Holders Will Need To Practice Patience.

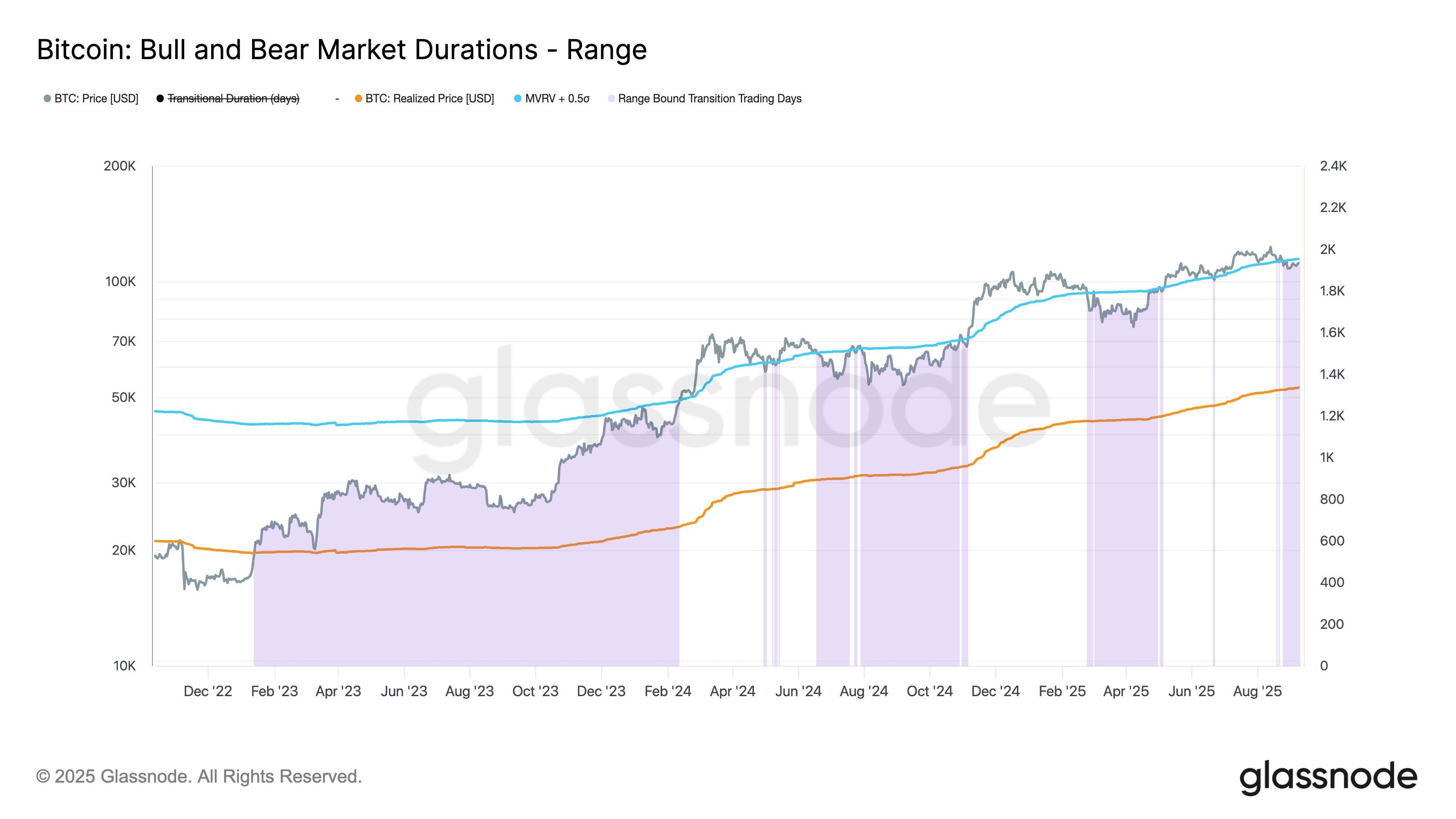

The Bull and Bear Market Durations indicator shows a bullish setup emerging for Bitcoin. In this cycle alone, BTC has endured three significant bearish stretches, some lasting for weeks or months, testing investor conviction. Historically, these downtrends tend to precede strong recoveries that culminate in new all-time highs.

If history repeats, Bitcoin may be entering the early stages of another explosive move. The consistent recovery trend since early September reflects growing confidence. Similar setups in past cycles have acted as springboards for price acceleration, positioning Bitcoin to potentially challenge $120,000 in the weeks ahead if resistance breaks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

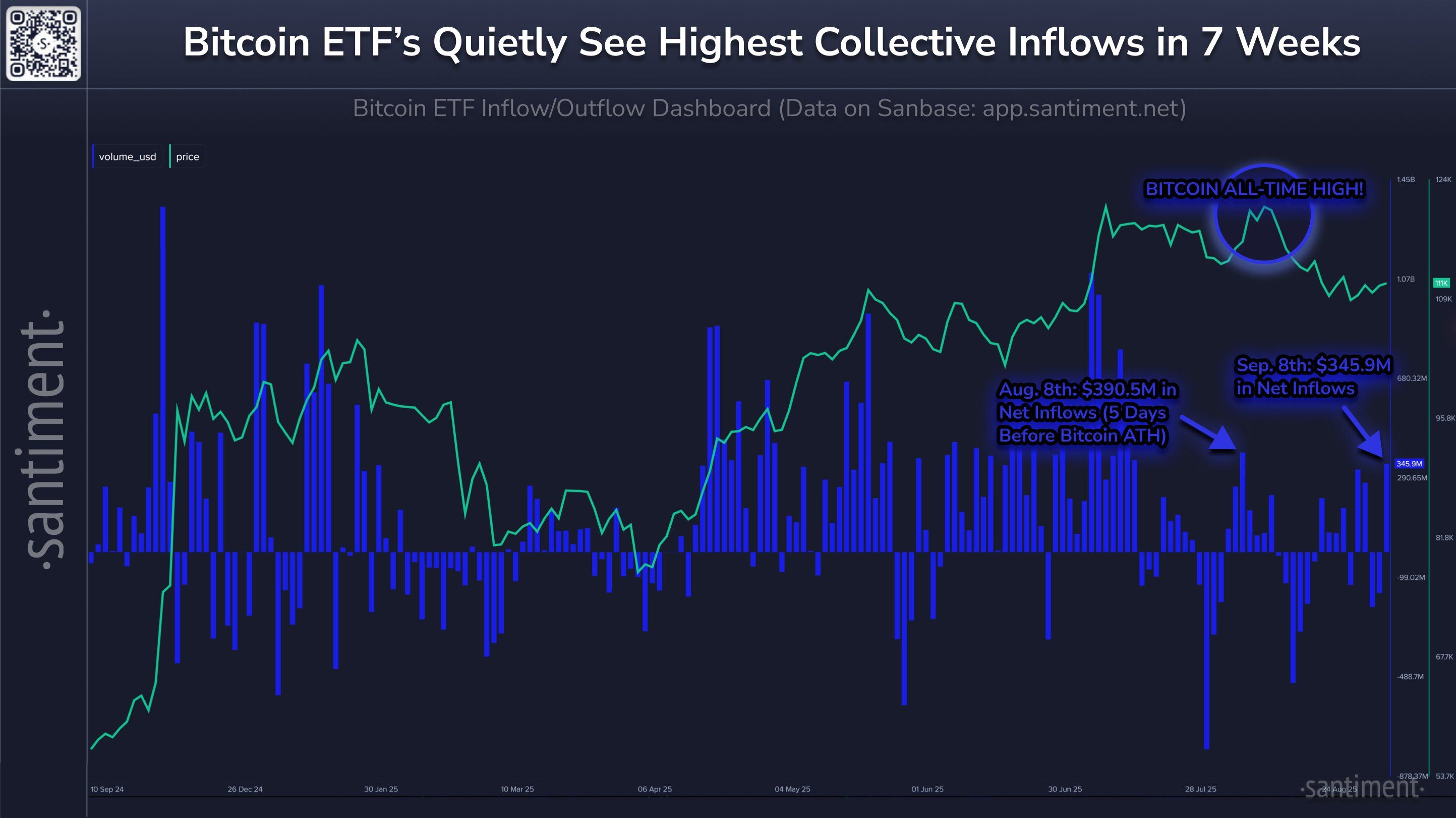

ETF flows are reinforcing the bullish narrative. Data shows money is returning quickly to Bitcoin ETFs, even as many retail investors scale back exposure. Institutional participation often signals longer-term conviction, providing stability and driving demand beyond short-term speculation.

Past surges in ETF inflows have coincided with Bitcoin breaking resistance barriers and advancing toward fresh highs. Current conditions mirror these historic moments. If inflows continue at this pace, BTC could repeat the same trend, setting the foundation for a new all-time high.

BTC Price Notes An Uptrend

Bitcoin’s price is trading at $114,192 at the time of writing, facing resistance at $115,000. Sustained buying interest at this level will be crucial to trigger the next stage of upward movement.

If ETF inflows remain strong, BTC could flip $115,000 into support and rally toward $117,261 before targeting $120,000. This level would represent a critical milestone in Bitcoin’s ongoing bull cycle.

However, if the breakout attempt fails, Bitcoin may consolidate between $112,500 and $110,000. Such a pullback would invalidate the immediate bullish thesis but still keep BTC within its broader uptrend channel.

The post Bitcoin Price Awaits Breakout As ETF Inflows Replicate All-Time High Behavior appeared first on BeInCrypto.