Shakeout Pattern Says Bitcoin Price Is Not Done, Why It’s Headed Above $130,000

Bitcoin’s latest bounce off a support level at $110,000 has coincided with a technical observation shared by crypto analyst CrypFlow, who highlighted a shakeout pattern that’s currently playing out, which has always preceded the strongest legs of Bitcoin’s bull runs. According to the analyst, the ongoing shakeout pattern setup may be laying the foundation for another rally that could take Bitcoin above its all-time high and beyond $130,000.

The Anatomy Of Bitcoin’s Shakeout Pattern

Bitcoin’s price action in the past 24 hours has been highlighted by intense volatility, opening the day just above $113,000 before dipping to $110,800 and quickly rebounding to now trading back above $112,000 at the time of writing. However, expanding the short-term price action into a longer one shows that Bitcoin is trying to break above a consolidation zone with a green weekly candle following a green close last week.

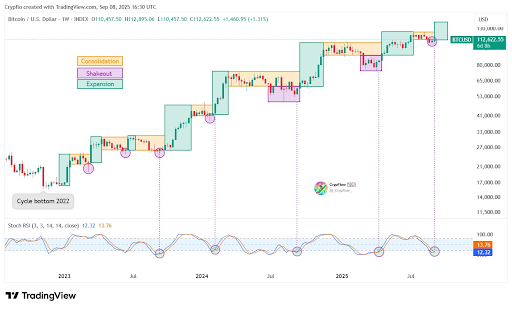

Notably, technical analysis of the weekly candlestick timeframe chart from crypto analyst CrypFlow shows that this price action is part of a shakeout pattern that’s characteristic of Bitcoin. According to the analyst, Bitcoin never trends higher in a straight line. Instead, each expansion phase in its market cycle is preceded by two steps of a consolidation and a shakeout.

Shakeouts were nothing more than quick downside wicks earlier in this cycle. More recently, however, the corrections have become deeper and longer with full-bodied weekly candlesticks that drove out many investors before the next expansion phase began.

The chart below, which was shared by the analyst, shows this repeating pattern of shakeouts in purple circles and expansions in green boxes since the cycle bottom in 2022, with the latest dip in the last week of August slotting neatly into the same framework of a purple shakeout.

Why Bitcoin Is Headed Above $130,000

As shown in the chart above, the most recent break below the consolidation box is somewhat shorter than the previous two. Now, Bitcoin is climbing back into its range, and if it follows its previous movements since 2022, it could now be at the cusp of a new uptrend.

At the time of writing, the stochastic RSI on the weekly chart has dipped to oversold levels and is on the verge of a bullish cross. If confirmed, this indicator could provide the momentum for Bitcoin’s next continuation of the step-like progression.

In terms of a price prediction, the expansion phase highlighted in the analysis projects that Bitcoin may not only retest its current all-time high but also push into new price levels above $130,000. With Bitcoin currently trading around $112,200, reaching $130,000 would translate to a gain of roughly 15.8%.

A surge to $130,000 would most likely lift Bitcoin’s support base closer to its current all-time high around $124,000 before the next consolidation and shakeout.