Bitcoin $120K breakout will lead to ‘very quick move’ to $150K: Charles Edwards

Bitcoin may surge to a new all-time high of $150,000 before the end of 2025 as investors pile into safe-haven assets alongside gold, according to Capriole Investments founder Charles Edwards.

Bitcoin’s (BTC) recovery above the $120,000 psychological mark may lead to a “very quick” breakout to a $150,000 all-time high, Edwards told Cointelegraph during an interview at Token2049 in Singapore. “I wouldn’t be surprised if we went up to $150,000 in a pretty short time, like we have to break out of the $120,000 range. But that’s probably coming, potentially in the next days.”

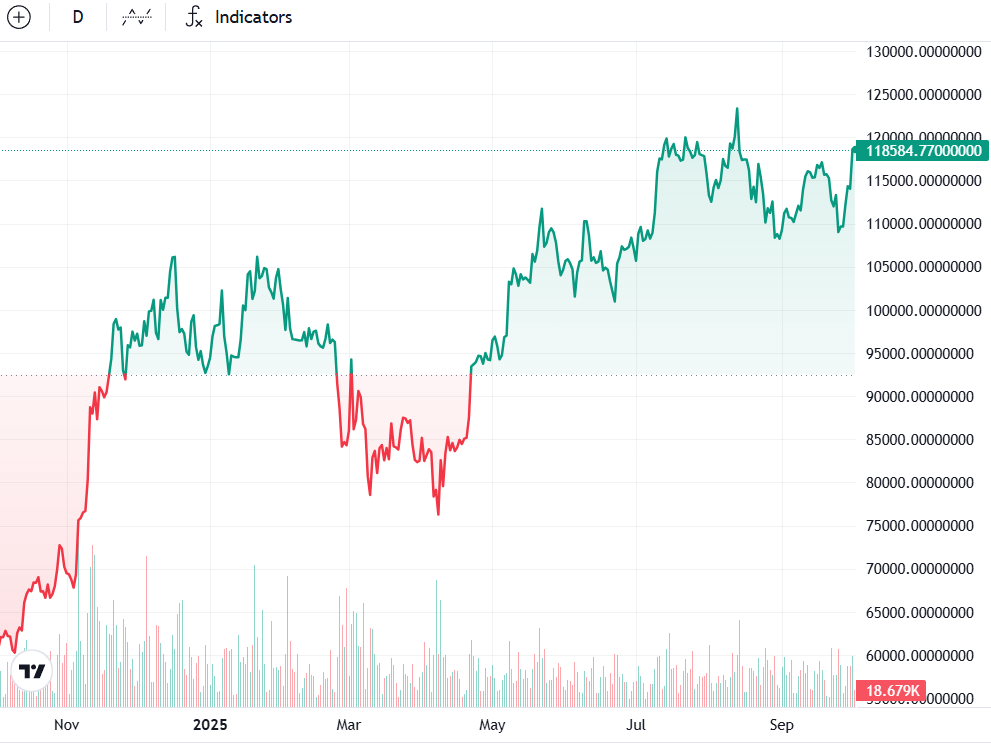

Bitcoin rose over 6% in the past week, recovering above the $118,500 mark for the first time since Aug. 15, Cointelegraph data shows.

Related: US government shutdown may signal crypto market bottom: Analysts

Edwards’ outlook is more conservative than some other analysts, who project the current cycle could push Bitcoin above $200,000.

André Dragosch, head of European research at Bitwise Asset Management, told Cointelegraph that the inclusion of crypto in US 401(k) retirement plans could unlock $122 billion in new capital. Even a 1% allocation by retirement managers, he said, could be enough to lift Bitcoin above $200,000 before year-end.

Related: Ether supercycle debate, Circle reversibility plan and Aster’s surge: Finance Redefined

Four-year crypto market cycle may be “self-fulfilling”

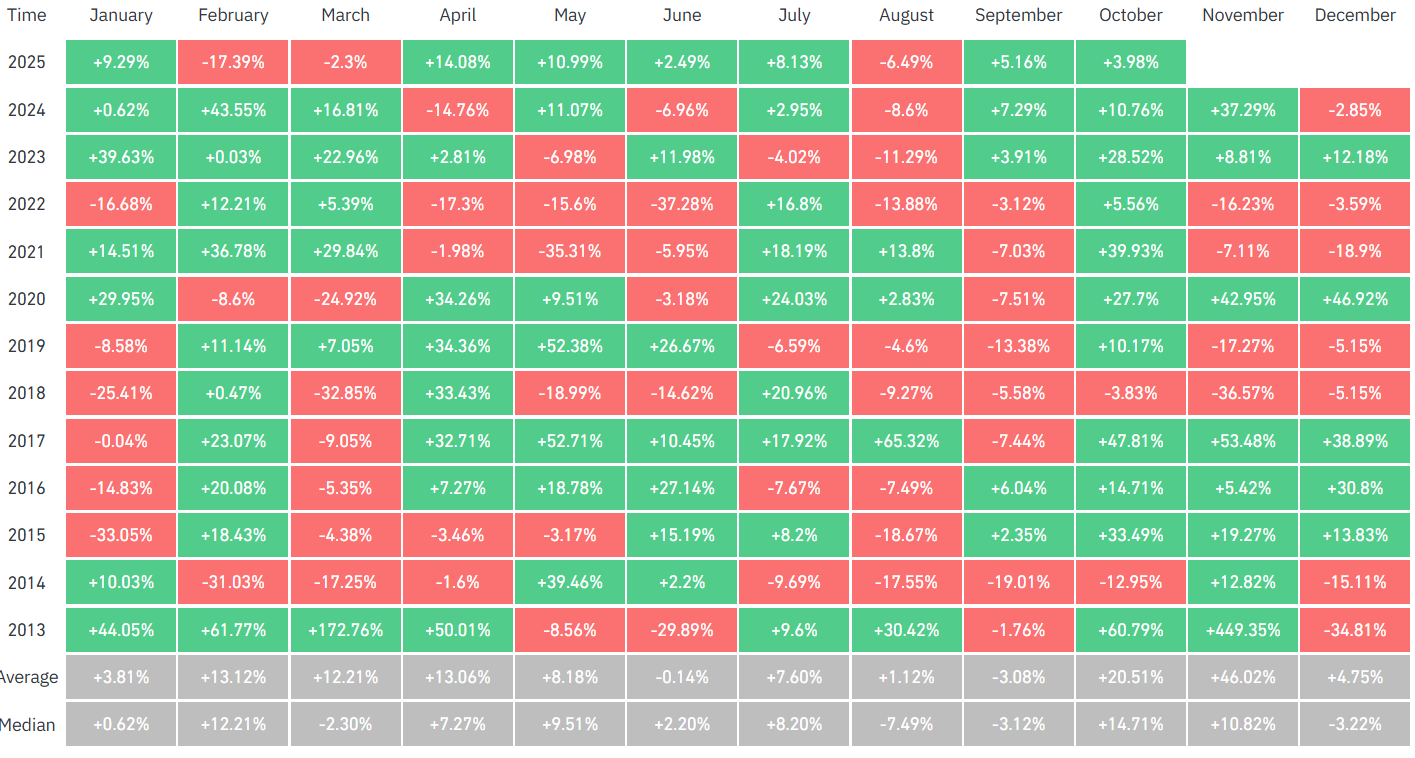

Edwards also predicted a “just over 50%” chance of three positive upward months for the crypto market to wrap up the year. He said the market’s four-year cycle theory remains relevant and may be “self-fulfilling” as investors de-risk amid expectations of cyclicality.

“But at the end of the day, the driving force is the institutional buying, and if that pivots down, my view will be very different,” he said.

Edwards’ predictions are in line with Bitcoin’s historically bullish performance during the last three months of the year.

Bitcoin has averaged historical monthly returns of around 20% in October, 46% in November and around 4% in December, according to CoinGlass data.

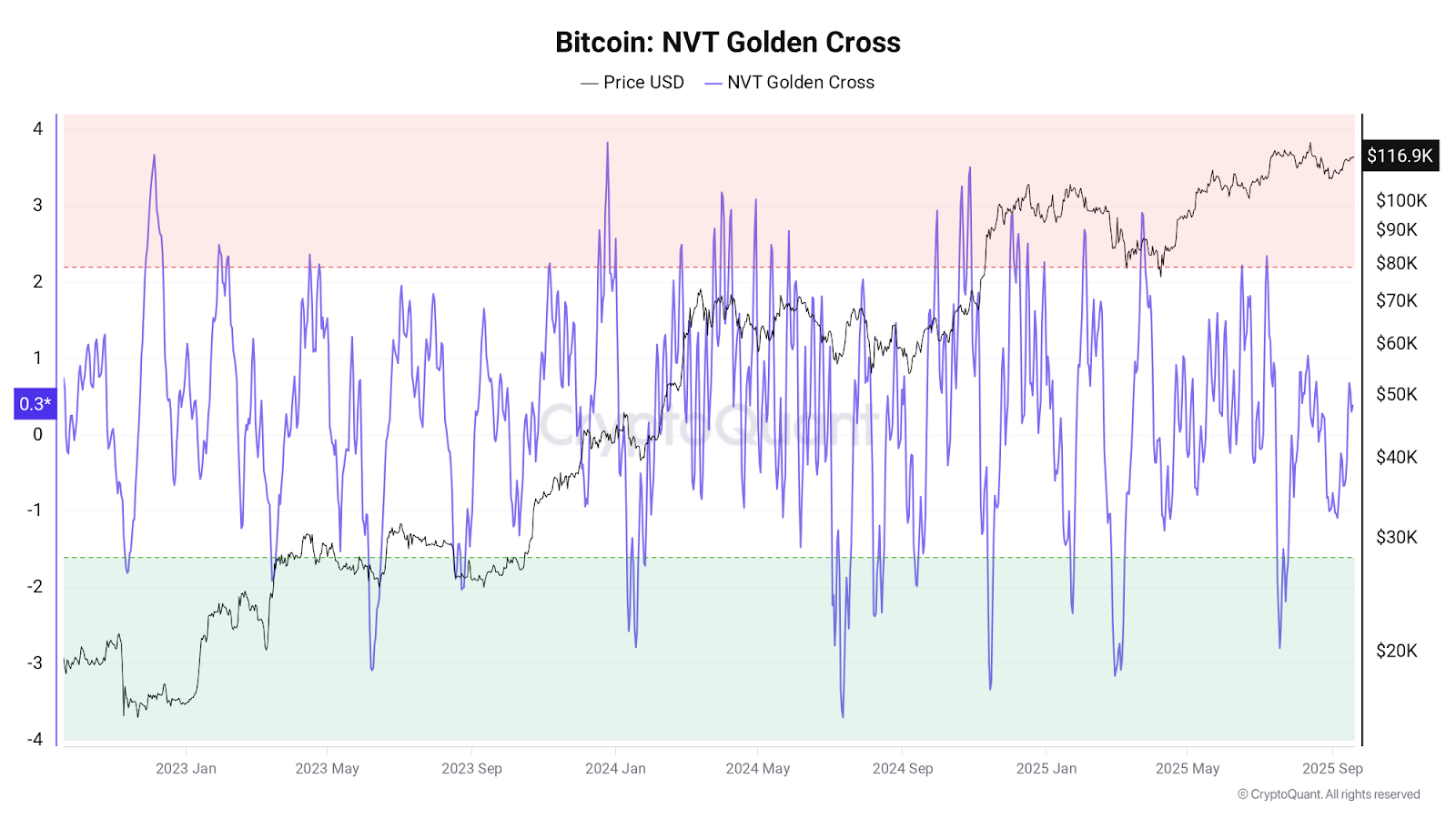

Other analysts are also pointing to technical chart patterns, including an emerging golden cross pattern, that may result in a Bitcoin price target of about $150,000 in the fourth quarter of the year, Cointelegraph recently reported.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds