New Bitcoin Whales Control 45% of BTC Realized Cap — Here’s Why That’s a Problem

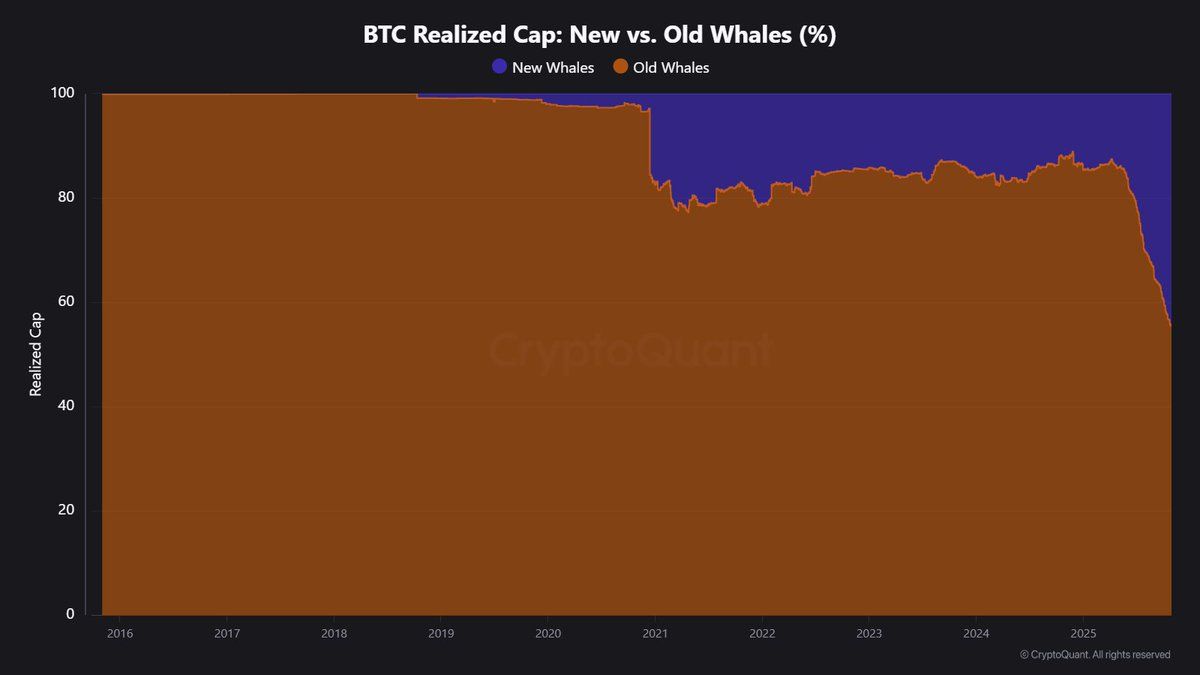

A new generation of Bitcoin whales now controls 45% of the total Whale Realized Cap, marking a clear shift in market dominance.

This shift in whale demographics could impact market psychology and increase selling pressure. Meanwhile, older whale cohorts maintain positive unrealized gains, even as they distribute Bitcoin to new investors.

Generational Shift in Bitcoin Whale Dominance

The Bitcoin market is seeing a significant generational change in its largest holders. New whales, investors who have accumulated over 1000 BTC in recent months, now make up about 45% of the Whale Realized Cap.

The Realized Cap refers to the total value of all Bitcoin based on the price at which each coin last moved on-chain. Whale Realized Cap reflects the total capital invested by large holders.

The rising share of new whales reflects new capital inflow and a shift in market control among Bitcoin’s biggest players.

In contrast, older whale cohorts have gradually reduced their holdings. As veteran holders sell to newer investors, market conditions shift.

CryptoQuant data highlights this change as a notable increase from historical levels and shows this group’s increased market presence.

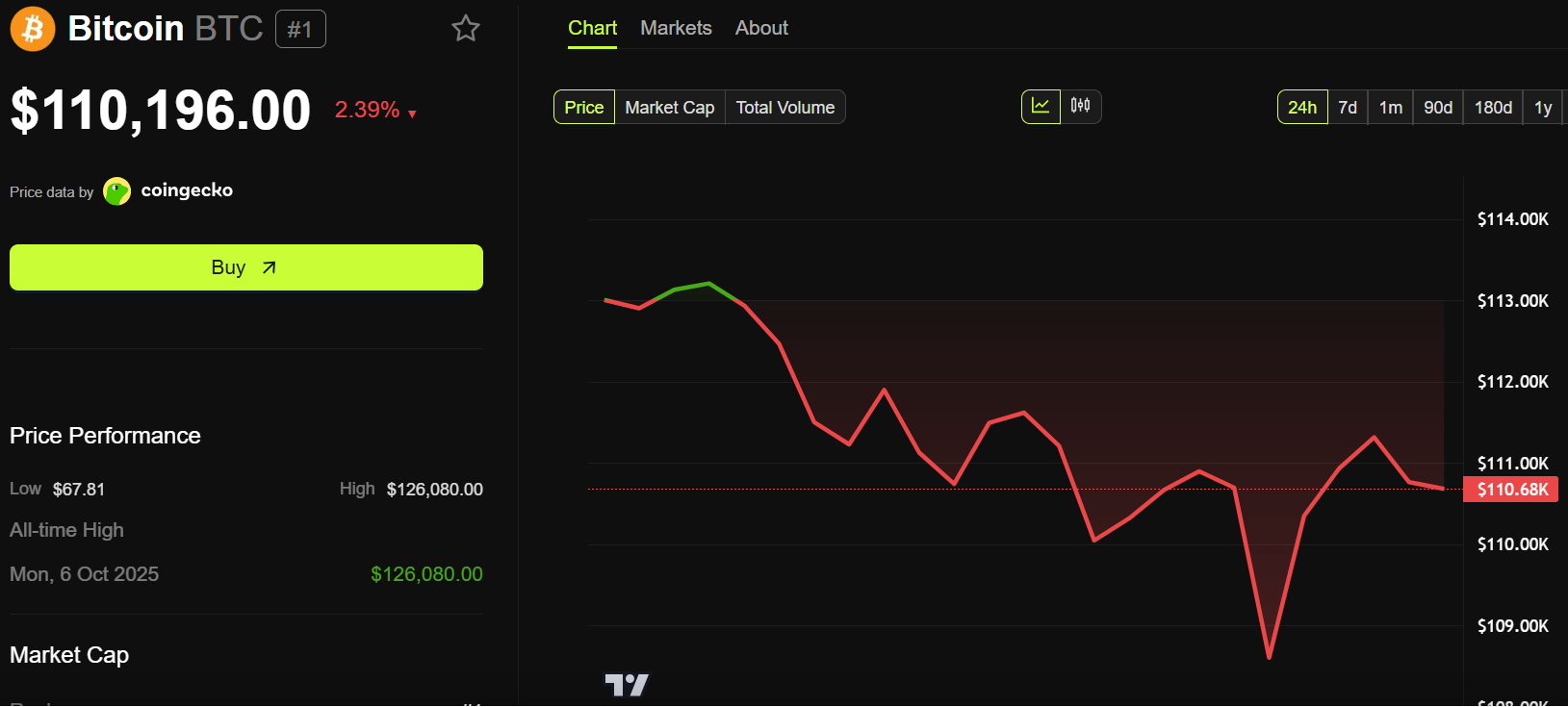

This is the first time since October 2023 that new whales have a negative Unrealized Profit Ratio. This compares the current market price to their average purchase price. A negative ratio means these investors are now underwater on their Bitcoin holdings.

Why This Shift is Concerning

The Realized Price for new whales is $112,788, the average acquisition cost for this group. As of this writing, Bitcoin’s market price fell below this key level and was trading for $110,196. This puts these holders at risk of losses for the first time in over a year.

The concern is whether new whales have the same long-term conviction as their predecessors, as such transitions often increase volatility.

New whales typically have less experience, making them more likely to react emotionally during downturns. If bearish trends persist, this could heighten market swings.

Older whale cohorts, in contrast, continue to post positive unrealized profits. They acquired Bitcoin at lower prices, giving them more resilience against market downturns. This creates an uneven risk profile between whale groups.

The drop to the $110,000 range is important psychologically. When big investors see losses, they may either hold out for recovery or decide to sell and limit further downside. This group’s actions could drive short-term price movement.

Distribution Dynamics and Market Implications

Continued distribution from old whales to new whales during weak market periods raises concerns about falling prices.

When experienced holders sell to less-established investors in a downturn, it can accelerate declines. This pattern has often come before deeper corrections.

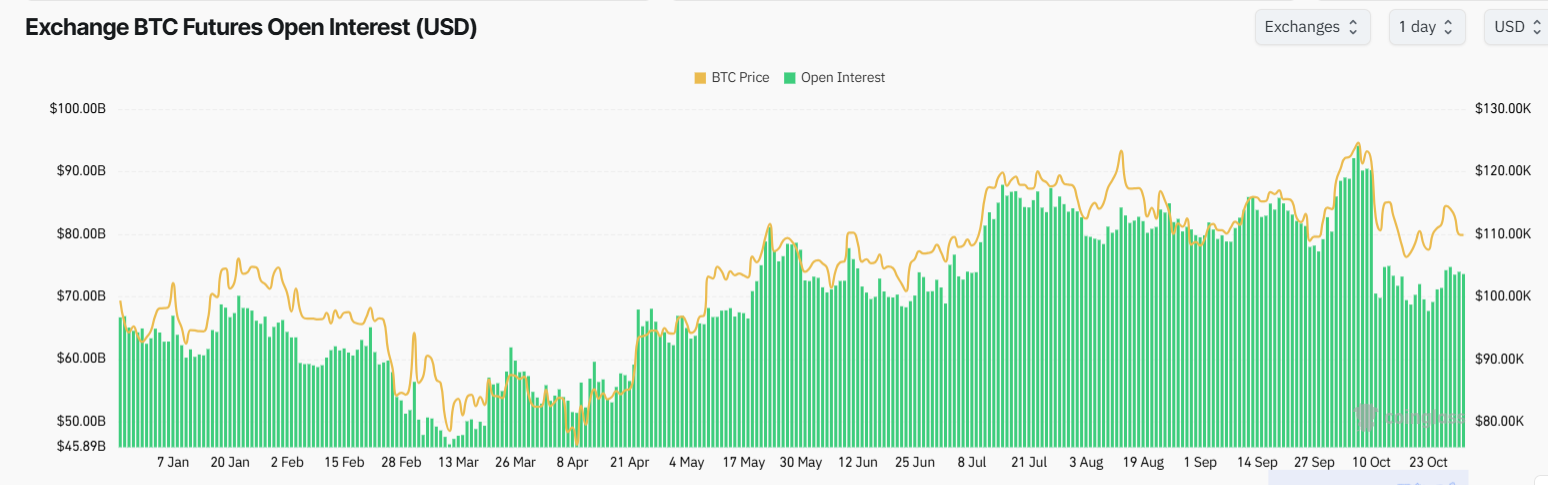

Open Interest, which tracks outstanding futures contracts, shows reduced conviction among traders. Many have exited their positions, leading to a drop in futures interest.

Lower Open Interest means less near-term volatility but also suggests fewer traders are confident about current prices.

The situation is precarious, with new whales facing losses and fewer traders in the futures market. If new whales opt to sell, further losses could follow. However, if they hold firm, the market may find stability soon.

Investors should monitor to see if the new generation of whales has the resilience of earlier holders. Their decisions in the coming weeks could set Bitcoin’s near-term direction as distribution continues and prices test key support levels.

The post New Bitcoin Whales Control 45% of BTC Realized Cap — Here’s Why That’s a Problem appeared first on BeInCrypto.