Bitcoin Price Dips Below $100,000, Losses Climb To 9-Month High

Bitcoin (BTC) has continued its downward trajectory this week, with the crypto king losing more than 8% in value over the past 48 hours. The decline has confirmed a bearish pattern that could lead to further losses if selling pressure persists.

The final outcome, however, hinges on how investors respond as Bitcoin hovers around key psychological levels.

Bitcoin Holders Have A Shot

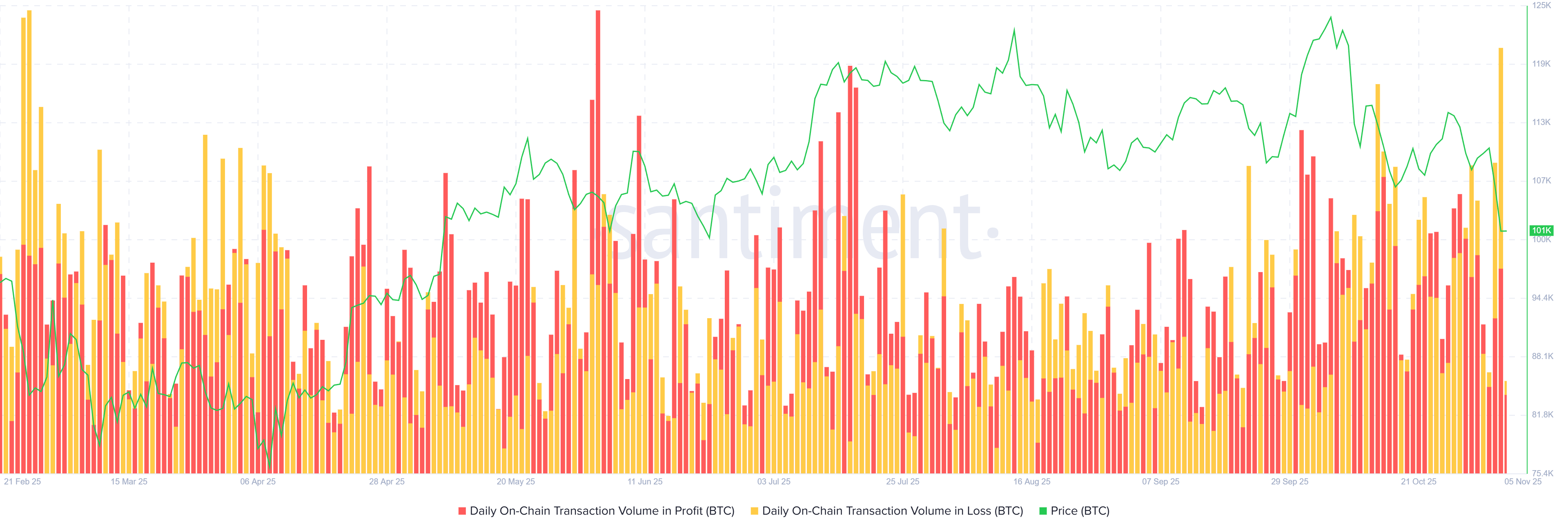

The current market sentiment around Bitcoin is turning increasingly negative. On-chain data shows that the total transaction volume in losses has surged to a nine-month high. More than 235,850 BTC, valued at approximately $24 billion, have been moved at a loss in the last 24 hours, reflecting widespread panic selling among investors.

This large-scale movement of Bitcoin at a loss signals diminishing investor confidence and rising fear in the market. If this behavior continues, it could accelerate Bitcoin’s decline, eroding capital and triggering deeper losses across the broader crypto market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

From a macro perspective, Bitcoin’s MVRV Ratio—a key profitability metric—has fallen into the “opportunity zone” for the first time since March. The ratio, currently between 6% and 17%, typically indicates a market bottom, suggesting selling activity has reached saturation levels.

This development could signal a turning point if market participants begin viewing Bitcoin’s current price as a value-buying opportunity. However, the broader macroeconomic sentiment and investor behavior over the next few days will be critical in determining whether BTC stabilizes or continues its descent.

BTC Price Is Holding On

Bitcoin is trading at $101,729 at the time of writing, sitting just above the critical $100,000 support. Earlier, BTC slipped below this level, forming an intraday low of $98,966 before rebounding slightly.

The recent 8% drop has validated a head-and-shoulders pattern, which projects a potential 13.6% decline targeting $89,948. However, if investors begin buying at lower levels, Bitcoin could bounce from $100,000 and retest $105,000 or higher.

Conversely, continued selling pressure and weak market conditions could send BTC below $100,000 again. A breach under $98,000 may lead to further losses toward $95,000 or lower, undermining any short-term recovery hopes.

The post Bitcoin Price Dips Below $100,000, Losses Climb To 9-Month High appeared first on BeInCrypto.