As Bitcoin (BTC) stabilizes around the $90,000 mark, technical indicators suggest the asset is likely to see a correction toward the $70,000 area.

This outlook comes from cryptocurrency analyst Ali Martinez, who highlighted a 12-hour chart showing Bitcoin consolidating in a tightening formation resembling a bearish flag, an indicator often linked to continued downside after a major drop.

In a December 9 X post, he noted that the pattern emerged following Bitcoin’s sharp pullback from recent highs, with repeated failures to break past the mid-$90,000 resistance.

Meanwhile, the rising lower trendline is forming a wedge structure that typically signals weakening momentum and the risk of a breakdown.

If this formation breaks lower, technical projections point to a potential target near $70,000, which would mark Bitcoin’s deepest pullback in months.

With market sentiment already fragile after weeks of stagnation and failed attempts to reclaim higher levels, the emergence of this bearish flag places Bitcoin at a critical juncture.

Therefore, a decisive break below the pattern’s support could trigger a significant correction, making the coming sessions pivotal for traders and long-term holders alike.

Bitcoin’s most important level

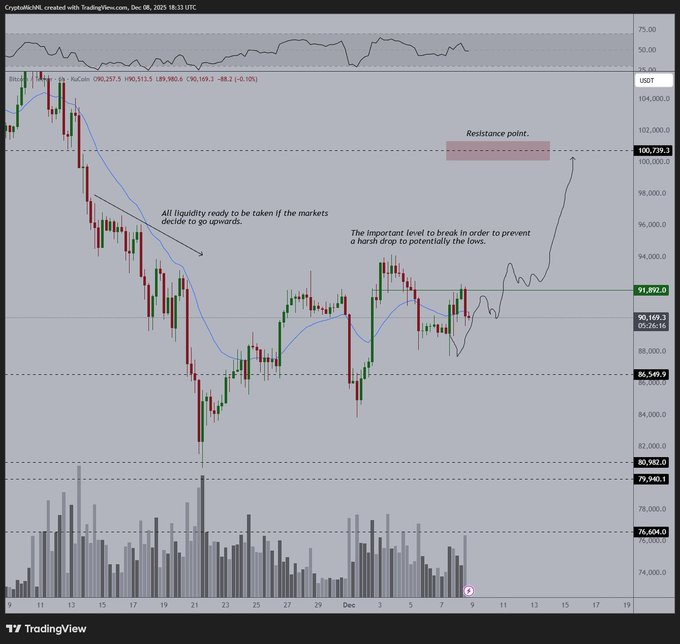

Another analyst, Michaël van de Poppe, noted in a December 8 X post that Bitcoin is nearing a decisive point, with $92,000 emerging as the key level that will determine whether the market stabilizes or slips into a deeper correction.

He highlighted that BTC has already been rejected in this area, signaling weakening short-term momentum.

Poppe outlined two main scenarios ahead of next week’s Federal Reserve decision. The bullish outcome requires a clear break above $92,000, which would signal renewed strength and open the door toward the $100,000 resistance zone.

The current structure also shows significant liquidity above market price, meaning a confirmed breakout could accelerate Bitcoin’s move higher.

However, Poppe warned that failing to reclaim this level increases the risk of a broader correction. With multiple untested lows stacked below current price levels, a hawkish message from Federal Reserve Chair Jerome Powell could spark a typical sell-the-news reaction.

In this scenario, the market could sweep liquidity beneath recent support, pushing Bitcoin into the $78,000–$82,000 range before any significant rebound.

Bitcoin price analysis

By press time, Bitcoin was trading at $90,522, down over 1% in the past 24 hours, while on the weekly chart the cryptocurrency is up 3.2%.

As things stand, bulls need to defend the $90,000 support zone, as it is crucial to opening the way toward the $92,000 resistance.

Featured image via Shutterstock