BTC and XRP show low retail sentiment, making them potential buy-low opportunities

The crypto market is seeing Bitcoin and XRP as potential buy-low opportunities, according to on-chain analytics firm Santiment. Retail traders are showing far less excitement toward Bitcoin and XRP compared to Ethereum, seemingly more interested in the latter’s price movements heading into the weekend.

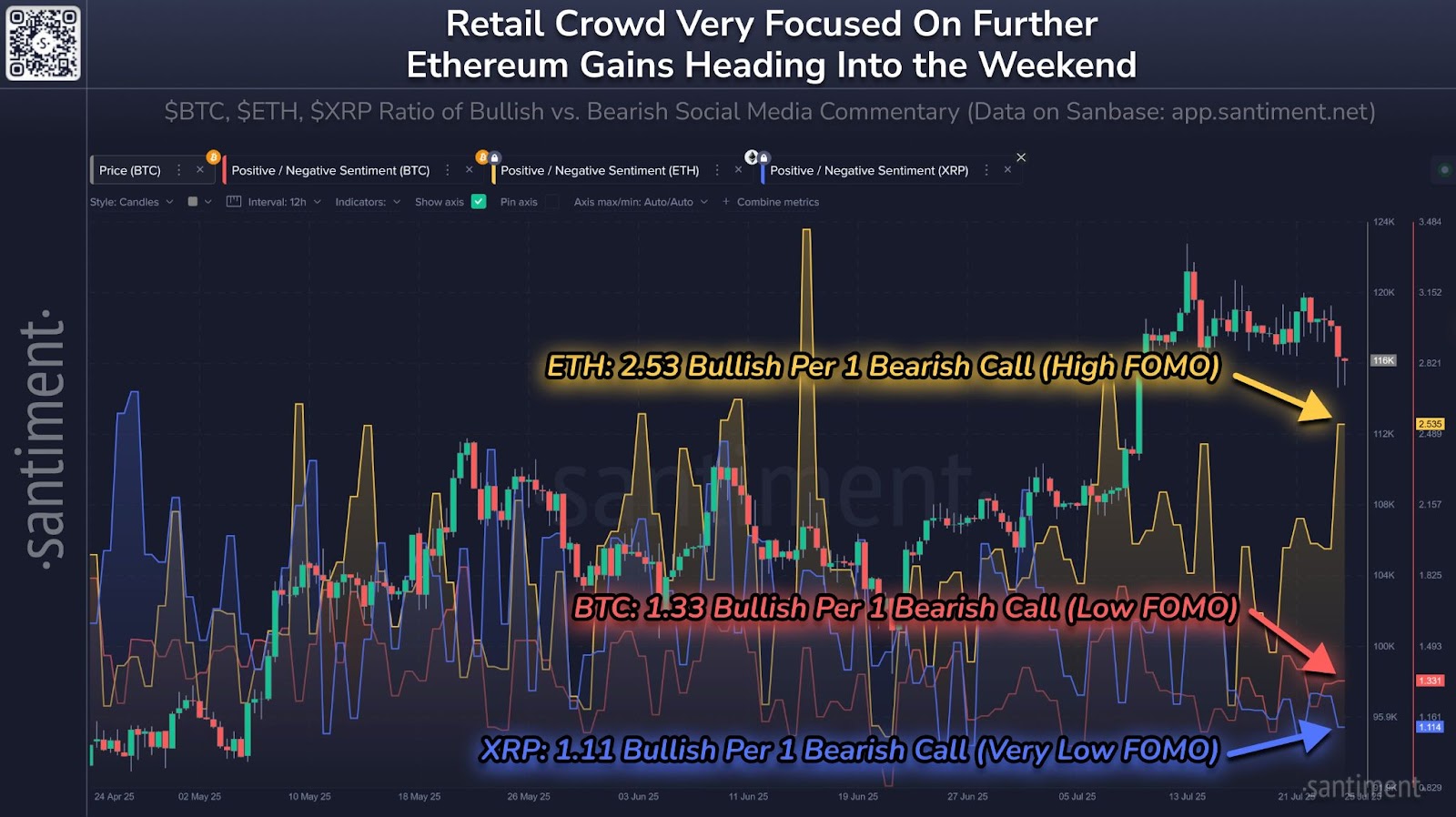

Santiment feed shared a social data chart on X Friday that shows an imbalance in how retail users are talking about the top three cryptocurrencies on social media.

Ethereum leads the sentiment index by a 2.53 to 1 ratio of bullish to bearish calls. The high level of optimism is interpreted as evidence of Ether crowd FOMO, fear of missing out, which can often precede price corrections for the associated asset.

On the flipside, Bitcoin and XRP showed more muted sentiment readings of 1.33 to 1 and a 1.11 to 1 bullish-to-bearish ratio, respectively. Santiment analysts note that such conditions often create entry points, as markets tend to move against the majority’s expectations.

Ethereum is more vulnerable to reversal, while BTC and XRP’s lower enthusiasm levels could create room for an upside price acceleration.

Bitcoin nears all-time highs, could see gains

Despite having a relatively neutral sentiment, Bitcoin has kept its strides near the all-time high $123,000 level. Over the past week, it has traded within a tight band between $123,120 and $123,471, after days of aggressive gains earlier in the month. The largest coin by market cap now points to a possible transitional phase for the market, closing Friday’s trading session.

Funding rates across major derivatives exchanges, including Binance, OKX, Bybit, Deribit, BitMEX, and HTX, have been neutral to slightly positive.

The absence of extreme long positioning or excessive leverage could mean traders are in a ”wait and see” stance, hoping for a clear price direction.

According to CryptoQuant contributor Nino, the market behavior is a seasonal lull in activity often referred to as the “summer doldrums,” which can precede heightened volatility later in Q3 2025.

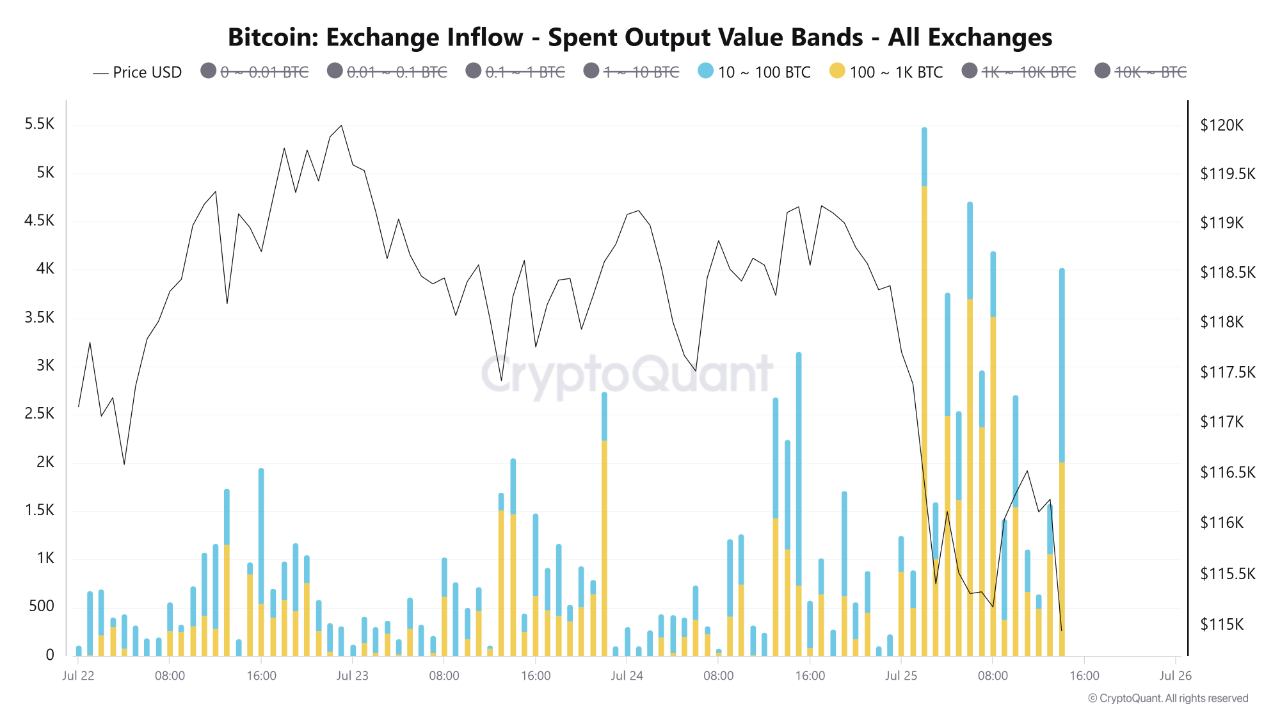

Exchange inflows show institutional activity up during price peaks

Over the period between July 22 and July 25, Bitcoin’s price ranged from $115,000 to $119,500, peaking on July 24 at 16:00 before dropping to around $115,000 by the morning of July 25.

CryptoQuant’s exchange inflow data reveals there was more activity from large holders at the time, particularly in the mid-to-large value bands. Wallets holding between 10 and 100 BTC recorded spikes in exchange deposits around the price peak on July 24.

Similarly, wallets in the 100 to 1,000 BTC and 1,000 to 10,000 BTC bands had high numbers of inflows at the same time, suggesting that large stakeholders may have contributed to the price movement through profit-taking or repositioning.

Smaller transactions, those between 0.01 and 1 BTC, were steady throughout the period, but inflows from addresses holding over 10,000 BTC remained minimal, although a slight uptick was registered during the July 24 peak.

XRP low social interest could spark short-term rally

Meanwhile, XRP has a subdued social media sentiment, as it ranks lowest among the three assets tracked by Santiment. The 1.11 to 1 bullish-to-bearish commentary ratio suggests that few traders are currently paying attention to XRP’s potential.

XRP’s price has not dropped below $2.99 in the last seven days, and bulls and bears haven’t had enough impact to sway the token in either direction by much.

Per Santiment’s analysis, this lack of attention may itself become a bullish indicator. XRP has previously staged price recoveries during times of low engagement, and current conditions may be setting the stage for a similar move.