Corporate Bitcoin holdings surge 35% in one quarter, Here's who is buying

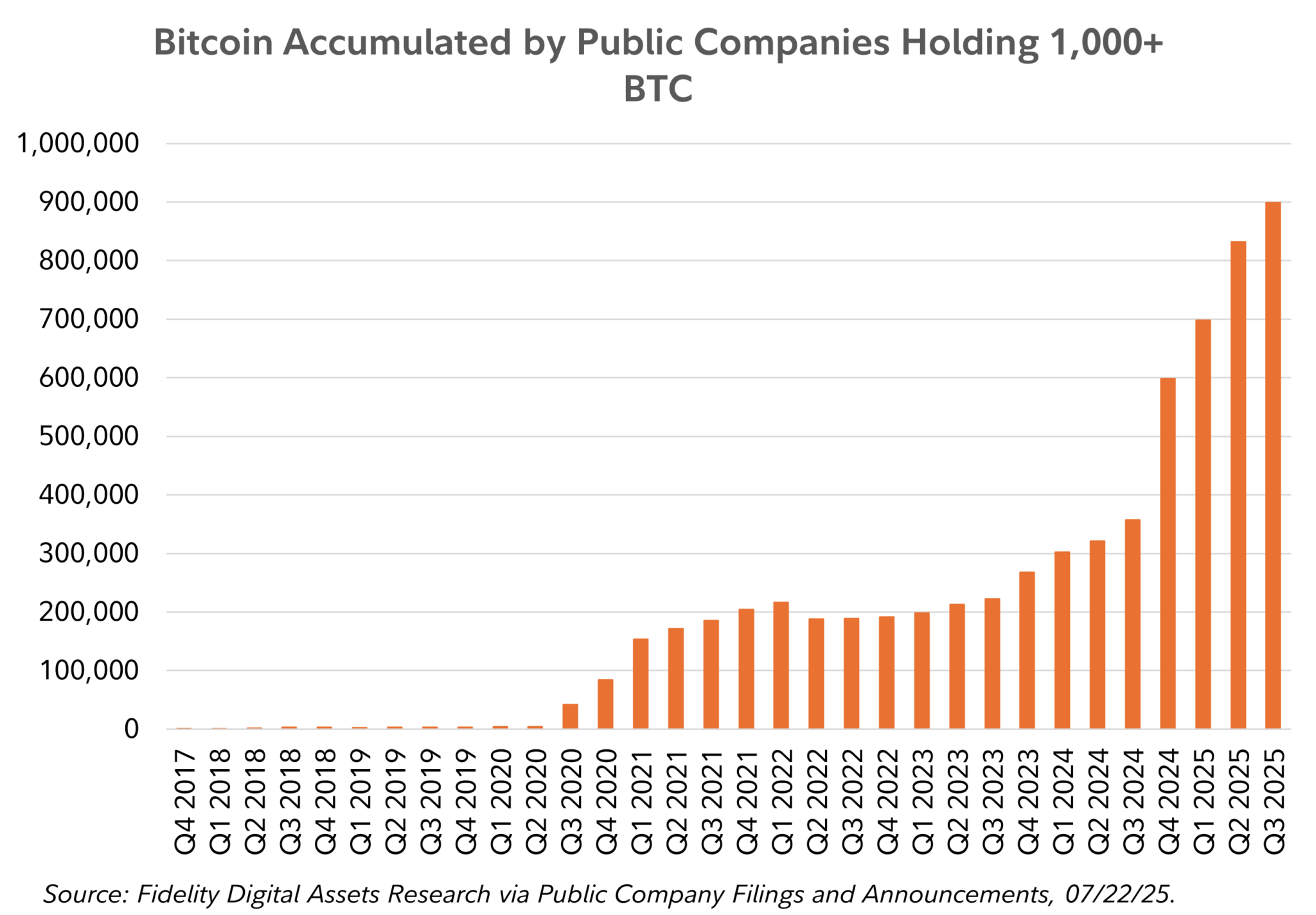

Public companies are accumulating Bitcoin (BTC) at an unprecedented pace, with corporate holdings surging 35% from Q1 to Q2 2025, according to exclusive research from Fidelity Digital Assets.

The data, compiled by analyst Zack Wainwright and distributed by Chris Kuiper on Thursday, July 24, reveals that companies now hold nearly 900,000 BTC, growing from virtually zero in 2017, with the steepest growth curve occurring in recent quarters.

Fidelity Digital Assets has been closely monitoring this trend through public company filings and announcements. The research firm’s data shows consistent growth in both the number of participating companies and total Bitcoin accumulation since tracking began.

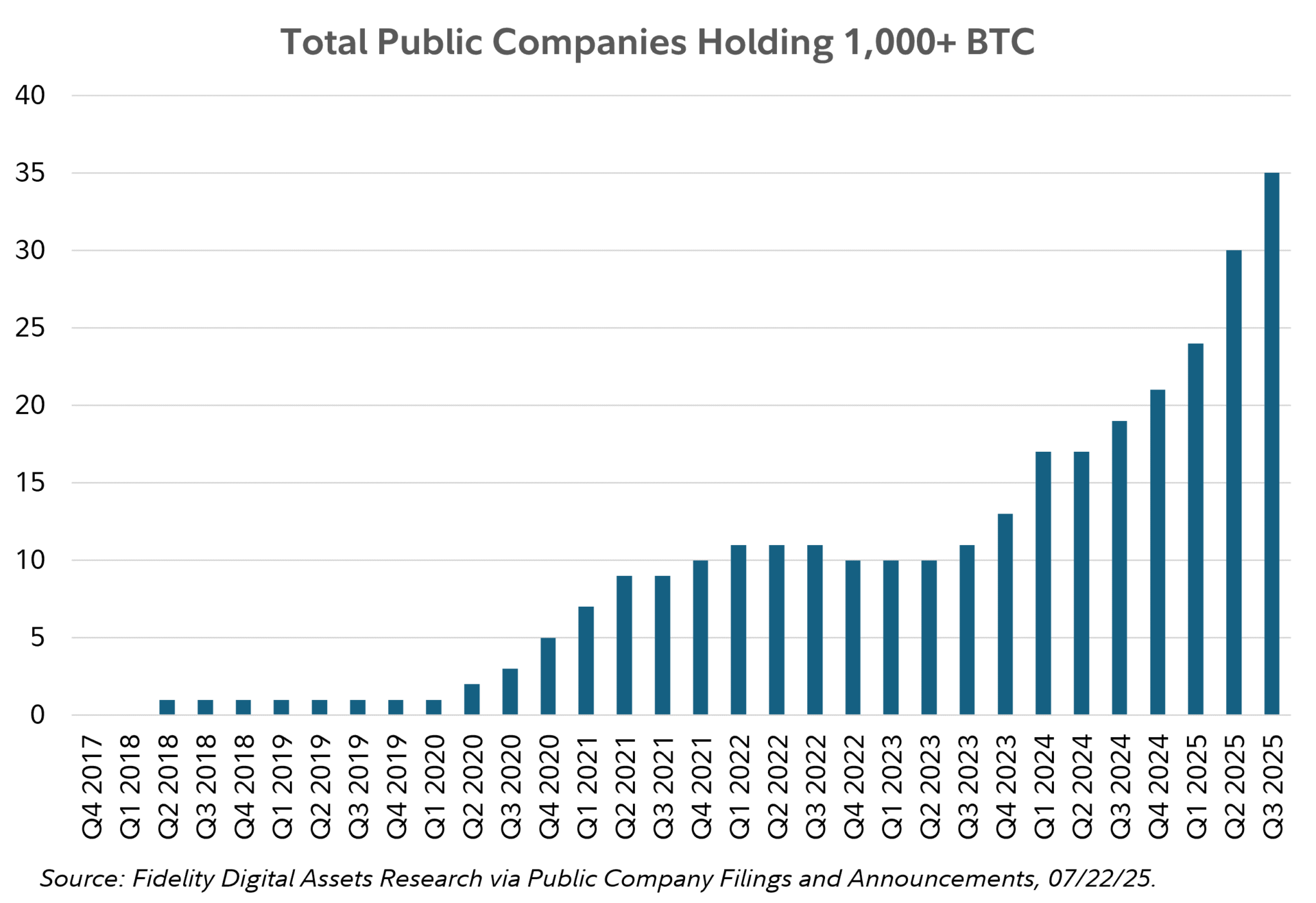

Rapid corporate adoption

Fidelity’s tracking shows the number of public companies holding 1,000+ BTC jumped from 24 companies at the end of Q1 2025 to 30 at the end of Q2, and has now reached 35 companies partway through Q3. This represents a 46% increase in participating companies in just two quarters.

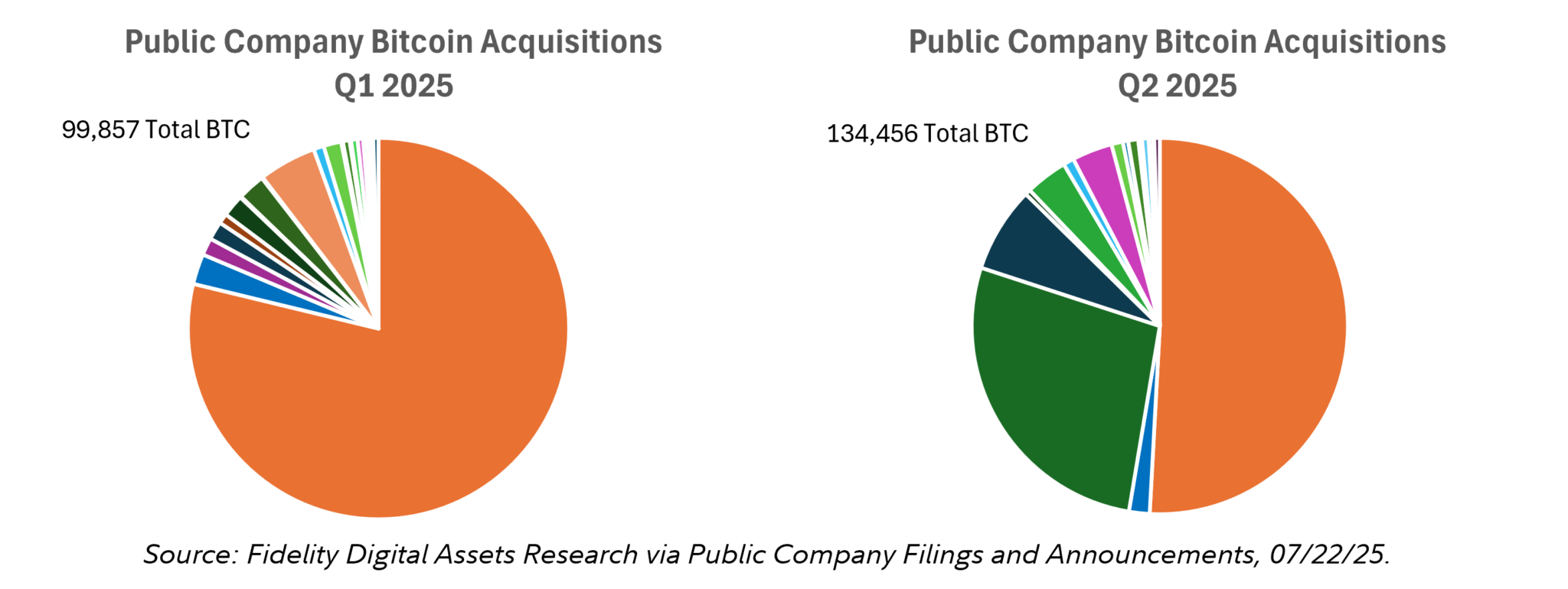

Corporate Bitcoin purchases totaled 99,857 BTC in Q1 2025 before accelerating to 134,456 BTC in Q2 2025, representing a 35% quarter-over-quarter increase.

What makes this trend particularly significant is how the buying patterns have evolved. According to Kuiper’s analysis, “from Q1 to Q2,Bitcoin purchases became more widely distributed across public companies rather than concentrated among a few large buyers.”

The pie charts accompanying Fidelity’s research show a clear shift in acquisition patterns. While Q1 2025 was dominated by one massive buyer (represented by the large orange slice), Q2 2025 shows much more diversified purchasing across multiple companies, with several medium-sized buyers entering the market.

This broadening of participation could provide more sustained demand compared to periods dominated by a single large purchaser.

Featured image via Shutterstock.