As Bitcoin (BTC) flirts with reclaiming the $120,000 mark, a trading expert has suggested the asset has more momentum left, potentially propelling it to a record high of $155,000.

This outlook is supported by insights from Bitcoin’s weekly chart, which point to a strong rally that began after BTC rebounded from the 50-week Moving Average (MA) on April 7, 2025, according to analysis by TradingShot in a TradingView post published July 28.

The rebound occurred within a broader three-year ascending channel that began in November 2022. Notably, this was the second time Bitcoin found support at the 0.236 Fibonacci level within this structure, an area historically tied to major bullish reversals.

The current setup also mirrors earlier price movements. In late 2022 and again in early 2023, Bitcoin surged approximately 106.37% following similar technical signals. A more aggressive rally between late 2023 and early 2024 resulted in a 197.23% gain.

TradingShot now suggests that the current expansion phase echoes that stronger move, implying a potential peak near $155,500 in the coming months. This would represent an upside of about 30% from current levels.

BTC facing resistance

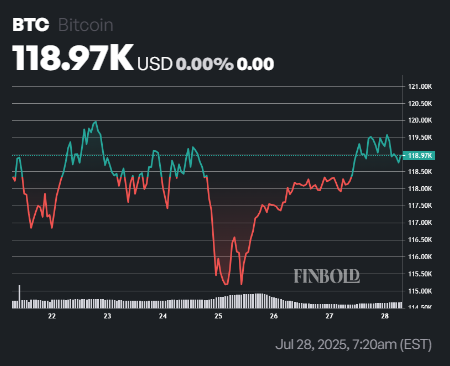

In a July 28 X post, cryptocurrency trading expert Michaël van de Poppe noted that Bitcoin has once again stalled at a key resistance zone around $119,400, facing rejection after a brief push higher in the short term.

The failure to break above this level has raised the likelihood of a short-term pullback, particularly with a CME futures gap still open around $118,500.

Additionally, the price action has created a liquidity cluster below, increasing the probability of a downward sweep before any continuation. Therefore, a correction into the $116,500 and $117,500 range could present a strong accumulation opportunity.

Bitcoin price analysis

At the time of reporting, Bitcoin was trading at $118,961, representing a 0.7% increase over the last 24 hours. On the weekly chart, it has posted a modest 0.68% gain.

Currently, Bitcoin appears poised to sustain its momentum, trading well above its 50-day Simple Moving Average (SMA) of $110,835 and its 200-day SMA of $90,530, both confirming a strong uptrend.

Meanwhile, the 14-day Relative Strength Index (RSI) sits at 64.11, indicating solid buying momentum without entering overbought territory, suggesting room for further gains.

Featured image via Shutterstock.