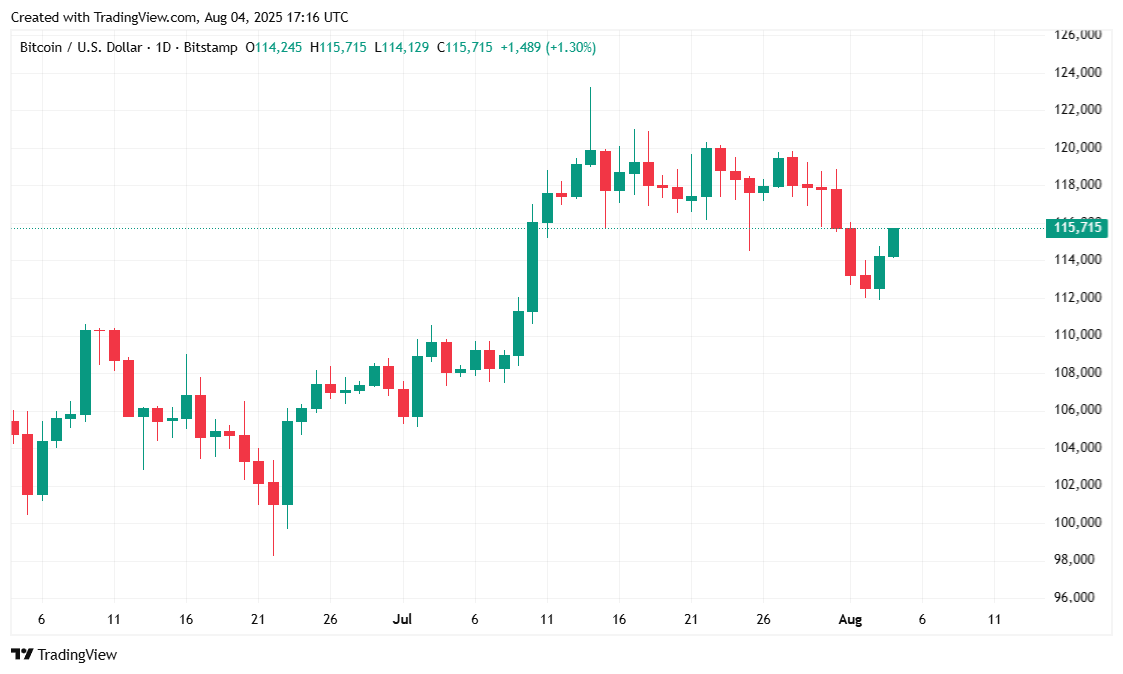

The cryptocurrency has recovered somewhat, after a tumultuous weekend that saw it plunge as low as $112K on Saturday.

BTC Weathers the Storm, Holds Near $115K

After a rollercoaster ride last week, bitcoin’s price fell off a cliff, tumbling to $112K on Saturday, before embarking on a journey back to $115K during pre-trading hours on Monday. Last week’s macro environment was a mixture of good and bad news, with strong GDP numbers getting neutralized by a weaker-than-expected jobs report. The Federal Reserve maintained its federal funds rate in the 4.25-4.50% range, which was expected, but perhaps due to increasing tensions between the central bank and the Trump administration, BTC fell sharply soon after Fed Chair Jerome Powell’s Wednesday announcement.

The U.S. economic outlook didn’t just affect crypto markets; there was a comparable bloodbath in stocks, but they, too, have since recovered. The S&P 500, Nasdaq, and Dow were all up 1.30%, 1.75%, and 1.12%, respectively, at the time of reporting. Coinmarketcap data also shows crypto markets up 1.88%.

Some experts, such as Bloomberg analyst Eric Balchunas, are crediting institutional capital with decreased BTC volatility. The approval and launch of the first spot bitcoin exchanged-traded funds (ETFs) in January 2024 injected billions into the cryptocurrency’s ecosystem. This was followed by the emergence of bitcoin treasury companies; firms that hold large amounts of BTC on their balance sheets. If Balchunas is correct, it could mean the days of sickening swings in bitcoin’s price are long gone.

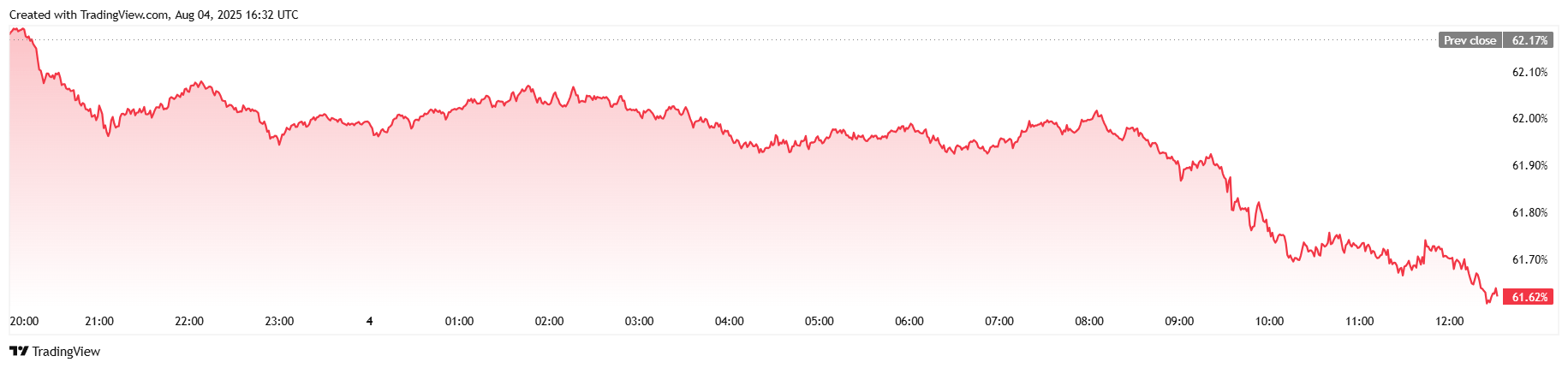

“Since the launch of the ETFs the volatility on bitcoin has plummeted,” Balchunas wrote in a post on X. “The 90-day rolling vol[atility] is below 40 for the first time, it was over 60 when the ETFs launched.”

Overview of Market Metrics

Bitcoin was trading at $$115,491.54 at the time of writing, up 1.24% since Sunday, according to Coinmarketcap. However, the digital asset is down 2.05% for the week and has been hovering between $113,966.97 and $$115,561.82 over the past 24 hours.

Trading volume for the day has been surprisingly flat at $53.43 billion, a 2.21% decrease since yesterday. Market capitalization rose slightly by 0.89% and stood at $2.28 trillion at the time of reporting. Bitcoin dominance fell 0.91% to 61.56% over 24 hours.

Total BTC futures open interest came in at $79.89 million for the day, a decline of 0.47%. Bitcoin liquidations since Sunday stood at $39.25 million overall, of which $34.40 million was from short positions, while long liquidations made up $4.85 million of that total figure.