Bitcoin Now in Decision Zone: Will It Rally Above $116K or Fall to $100K?

As Bitcoin remains within a critical range, a prominent market analyst has noted that how it leaves this zone will determine its next move.

According to a chart shared by crypto analyst Marc Cullen, Bitcoin is trading in an inefficient price area between two weekly ranges. This zone, which spans from $112,000 to $116,000, is marked as a fair value gap on the chart.

As Bitcoin fills this gap, the price has shown no clear direction, making the area pivotal for the next Bitcoin’s action. The chart suggests that how Bitcoin breaks out of this range, either to the upside or downside, will likely determine its short-term trajectory.

A break of this level would also overcome a descending trendline visible on the chart, further supporting bullish momentum. Notably, Bitcoin trades at 114,324, a 0.7% rise in the past day following a 4% decline over the last week.

Bitcoin Drop Below $112K Could Trigger Selloff

Meanwhile, the bearish scenario shows BTC failing to reclaim $112,000 and losing the weekend low, which is also near that level. If this occurs, Cullen notes that Bitcoin would likely be “accepting back in the previous value area.”

This would place BTC back into a lower trading range, increasing the probability of a move down toward the $100,000 level. The chart shows a steep red path below that could accelerate losses, with minimal volume support below the current range.

Such a move would invalidate the bullish case and shift market sentiment decisively bearish. The outcome of this range-bound activity will likely shape BTC’s direction in the coming weeks.

Other Analysts Predict Bitcoin’s Next Move

Moreover, a chart from analyst Michael Van De Poppe also notes that Bitcoin’s short-term resistance sits at $114,755, followed by $116,813 and $119,504, levels that must be reclaimed for a bullish reversal. He also marks $110,000–$112,000 zone as a strong accumulation area.

The analyst believes this level offers a good entry, expecting Bitcoin to trade higher over the next 6 to 12 months. Liquidity between $114K and $116K may trigger short-term volatility, while failure to hold support could send BTC toward $103,190.

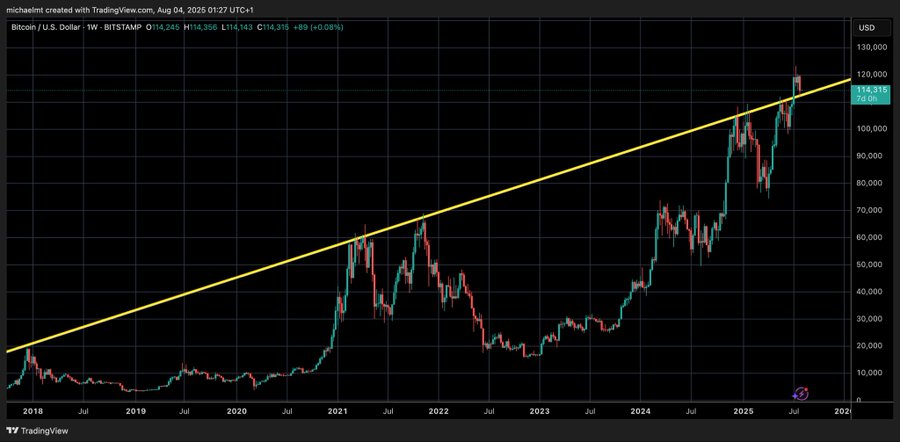

Meanwhile, a chart shared by Crypto Michael shows Bitcoin retesting a long-term ascending trendline that has guided its price action for the past eight years. The trendline, which extends from 2018, has historically acted as a key resistance level across multiple market cycles.

After setting a new all-time high above $123,000, Bitcoin has pulled back to the current level and is now testing this trendline from above. This move is a potential bullish re-test, suggesting that the former resistance may be turning into support. The outcome of this retest could determine whether Bitcoin resumes its upward momentum or faces renewed selling pressure.

While Bitcoin currently trades sideways, prominent analysts have hinted at a bullish move for Q3. For instance, CryptoGoos noted Bitcoin volatility nears historic lows, suggesting there could be a potential breakout. Meanwhile, veteran trader Peter Brandt believes a possible cycle top between $125,000 and $150,000 by Q3 2025, depending on whether Bitcoin reclaims its long-term parabolic trendline.