2021 Bitcoin Double Top? Crypto Analytics Firm Flags Two Macro Tailwinds To Fuel BTC Rallies to New All-Time Highs

Analytics platform Swissblock says that Bitcoin (BTC) may be able to blast through stiff resistance and print new all-time highs for two main reasons.

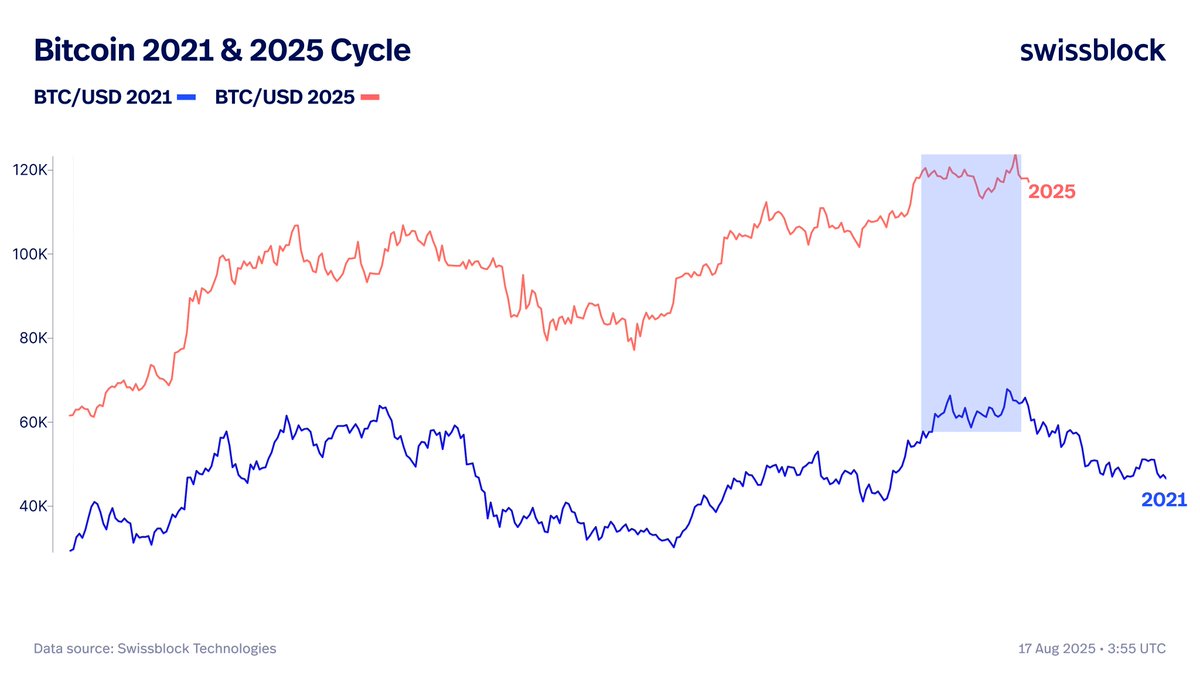

Swissblock says that while Bitcoin may be printing a similar 2021 bearish double top pattern, there are significantly different macroeconomic conditions this cycle that may instead propel BTC to fresh record levels.

“Bitcoin, what is the plan? Bitcoin faces a decisive week. The weekly close wasn’t ideal, echoing the 2021 double top. Without a reversal, distribution risk looms and rallies may stay capped.”

A double-top is an extremely bearish technical reversal pattern formed when the price of an asset forms two consecutive peaks, an indication that there’s a strong resistance level that the price is unable to pierce through.

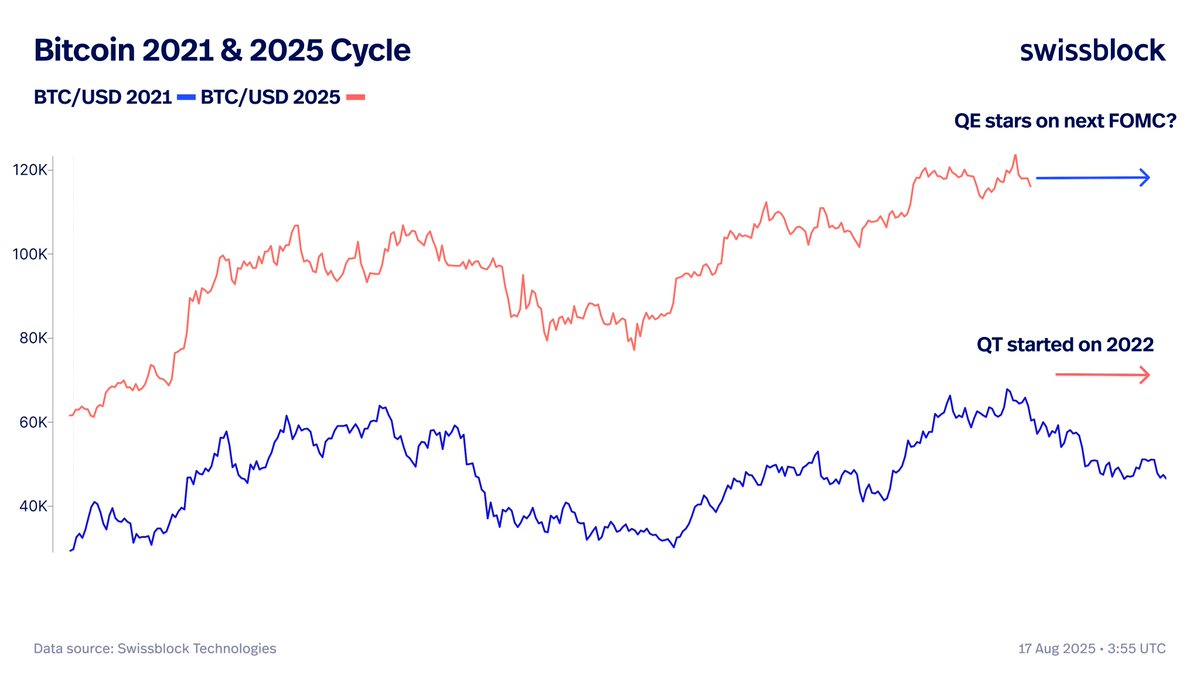

However, Swissblock says that Bitcoin is entering a period when the Fed is likely to cut rates and engage in quantitative easing (QE), suggesting Bitcoin may still have more room to run to the upside. Back in 2021, the flagship crypto asset entered a bearish phase while flashing the same double top pattern as the Fed started hiking rates and engaging in quantitative tightening (QT).

“Macro tells a different story: in 2021, BTC peaked at the start of QT and rate hikes. In 2025, we’re approaching QE and rate cuts. Technical fragility versus macro tailwinds. Short-term fragility, but macro liquidity tilts the balance.”

Widely followed crypto trader Cheds has also spotted a similar pattern for BTC, one that led to a brutal bear market in 2021.

He says that Bitcoin is flashing an upthrust pattern, or a structure widely viewed as a bull trap, warning of market weakness and potential trend reversal.

“It’s when you break a resistance level and you come back [down] and fail to hold. That’s the upthrust. We also have the outside bar. This big red candle [on August 14th].”

The trader notes that the same pattern can be observed in 2021, when Bitcoin tried to break resistance at around $69,000 but failed, triggering the start of a brutal bear market.

Bitcoin is trading for $116,811 at time of writing, up marginally in the last 24 hours.

Generated Image: Midjourney