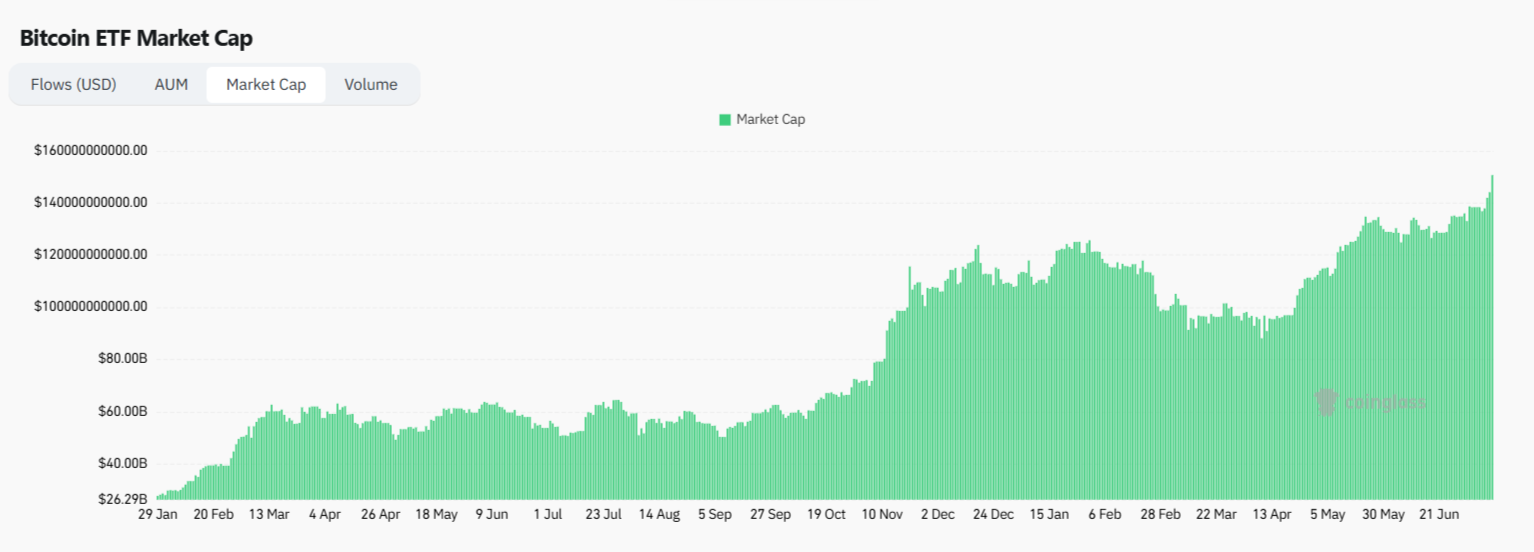

Exchange-traded products based on spot Bitcoin price are witnessing growing interest from big institutional buyers. On July 10, 2025, spot Bitcoin ETF investors injected $1.1 billion in a single session. This allowed the red-hot class of investing products to hit new records in market cap and assets under management (AUM).

$150 billion: Bitcoin spot ETFs logged market cap record

Today, on July 12, 2025, the aggregated market capitalization of Bitcoin spot ETFs exceeded $150 billion. This is a record-breaking volume, the highest levels since the ETFs launch in January 2024. The total volume of assets under management exceeded $143.1 billion.

In two recent trading sessions, investors brought a total of $2.21 billion into spot Bitcoin ETFs. IShares Bitcoin Trust (IBIT) by BlackRock, FBTC by Fidelity and ARKB by Ark Investments are the fastest-growing products here. The three ETFs are responsible for over 70% of recent inflows.

This spike of Bitcoin spot ETFs popularity is registered amid the record-breaking increase in Bitcoin’s (BTC) price. Bitcoin (BTC), the largest cryptocurrency, is up by 100% in one year. Yesterday, on July 11, 2025, BTC price jumped over $118,600 on major spot exchanges.

The trading session of July 10 was the most brutal for Bitcoin (BTC) bears in months. The net volume of short position liquidations exceeded $964 million.

Spot Ethereum ETFs target $11 billion as ETH price recovers

Spot Ethereum ETFs are also experiencing an upsurge in trading volume, AUM and total market cap. As covered by U.Today earlier today, the net amount of spot ETFs on Ether surpassed $10.6 billion in equivalent.

The upsurge of spot Ethereum ETFs ecosystem comes amid a bullish U-turn in sentiment in the ETH community. On the “digital oil” narrative, many skeptics of the second cryptocurrency started supporting ETH again.

The Ethereum (ETH) price meanwhile sits at $2,944, being up by 17% in the last week. Ethereum (ETH) still has a 40% upside compared to its previous ATH while Bitcoin (BTC) revisited record levels.