Bitcoin Soars $15K Post-Spending Bill as Dollar Slides, Kobeissi Letter Notes

Bitcoin’s unprecedented surge, diverging sharply from traditional economic indicators like a weakening U.S. dollar and rising deficits, signals a market in “crisis mode,” according to an X analysis from financial newsletter The Kobeissi Letter.

Deficit Spending Drives Bitcoin Rally Into ‘Abnormal’ Territory, Kobeissi Letter States

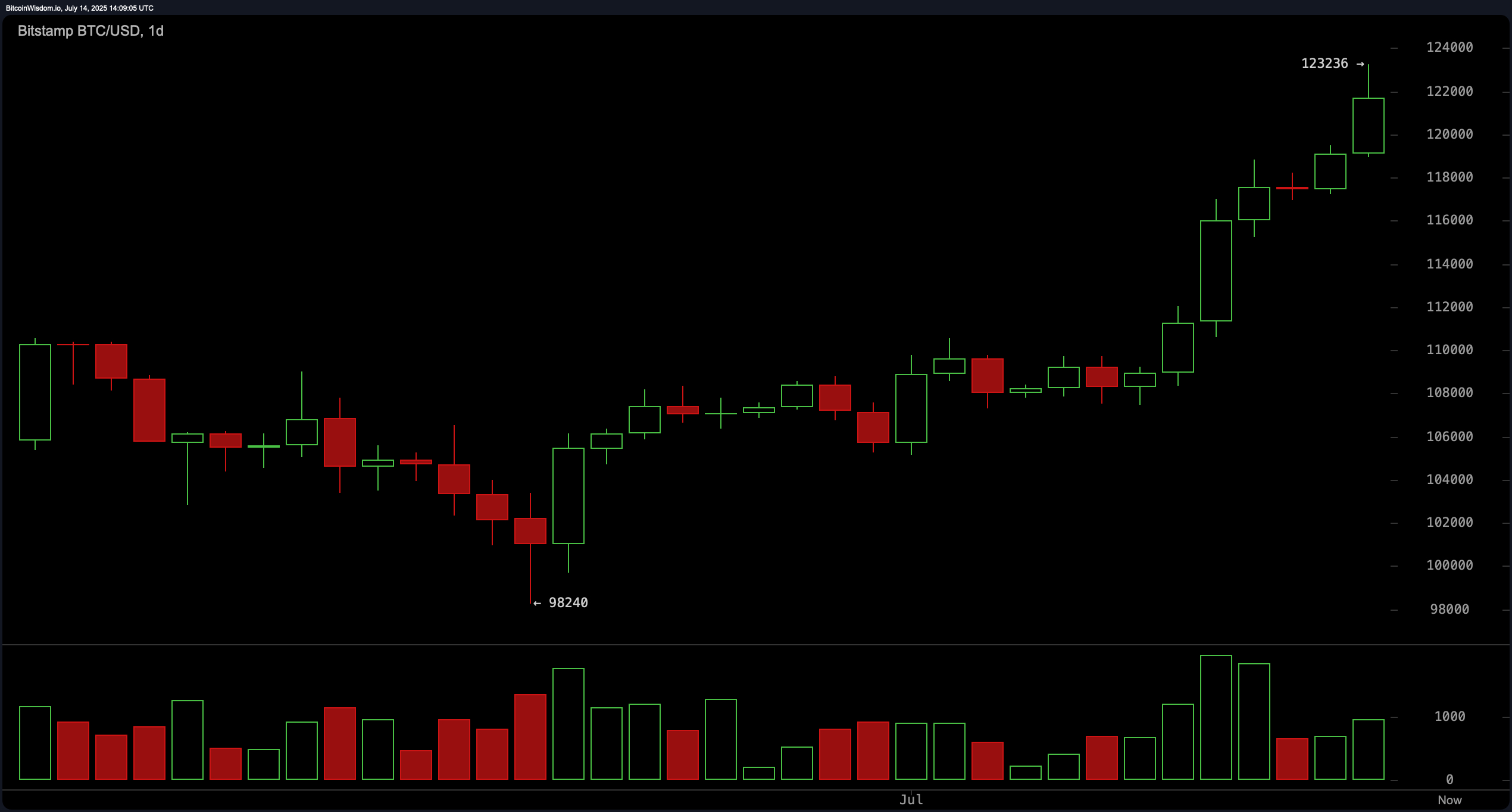

The Kobeissi Letter, a subscription service providing fundamental and technical analysis on global capital markets for investors and institutions, highlighted bitcoin’s rapid ascent in a July 14, 2025, X thread. The cryptocurrency gained approximately $15,000 after July 3rd, when the U.S. House passed a significant spending bill referred to as the “Big Beautiful Bill.”

Kobeissi noted the rally occurred despite data showing a $316 billion U.S. deficit for May 2023 alone, the third largest on record at that time. The analyst pointed to a clear divergence starting April 9th, following a tariff pause, and intensifying after the spending bill’s passage. Bitcoin made new highs multiple times daily this week, Kobeissi remarked, while the U.S. Dollar Index (DXY) fell 11% over six months.

Kobeissi stressed bitcoin‘s rise coincided with gains in gold and rising yields, describing the combined movement as abnormal. It reported significant institutional interest, with the Ishares Bitcoin Trust (IBIT) reaching a record $76 billion in assets under management in under 350 days – a milestone that took the largest gold exchange-traded fund (ETF) over 15 years.

According to the analysis, institutional investors, including family offices and hedge funds, are increasingly allocating capital to bitcoin (BTC), with even conservative funds considering ~1% allocations. Kobeissi’s analysts attributed the surge to market pricing in ongoing U.S. deficit spending, suggesting capital is rotating significantly.

“Furthermore, when we say bitcoin has entered ‘crisis mode’ this isn’t necessarily a bearish call for other assets,” Kobeissi said on X. The thread added:

“In fact, risky assets will continue to run higher as the short-term effects of more deficit spending are ‘bullish.’ The long-term effects certainly are not.”

The Kobeissi Letter stated it capitalized on the trend, buying BTC dips at $80,000, $90,000, and $100,000, raising its target to $120,000+ after initially calling for $115,000. It also observed record-high leverage shorts on ether, reminiscent of conditions before a prior market bottom, raising the possibility of a major crypto short squeeze.