Here’s One Factor That Drove the Bitcoin Rise Above $90K and Why a Drop to $85K Is Likely

Bitcoin has recently recovered an important psychological level, but analysts insist that the market remains in a delicate position.

Bitcoin (BTC) regained momentum on Nov. 26 after it closed the day with a 3.6% jump, its strongest intraday climb in more than a month. Importantly, this push allowed the crypto firstborn to reclaim the $90,000 mark for the first time in a week.

For context, the ongoing rebound started after Bitcoin fell to $83,432 on Nov. 22 and then began moving higher. Since reclaiming $90K yesterday, it has held above the level and currently trades around $90,857. However, several analysts warn that the market currently stands on fragile ground.

Why a Bitcoin Drop to $85K May be Next

Specifically, market analyst Satoshi Stacker highlighted one major factor that boosted the recent rally. He said Bitcoin climbed above $90,000 partly because short traders saw their positions wiped out as the price moved higher.

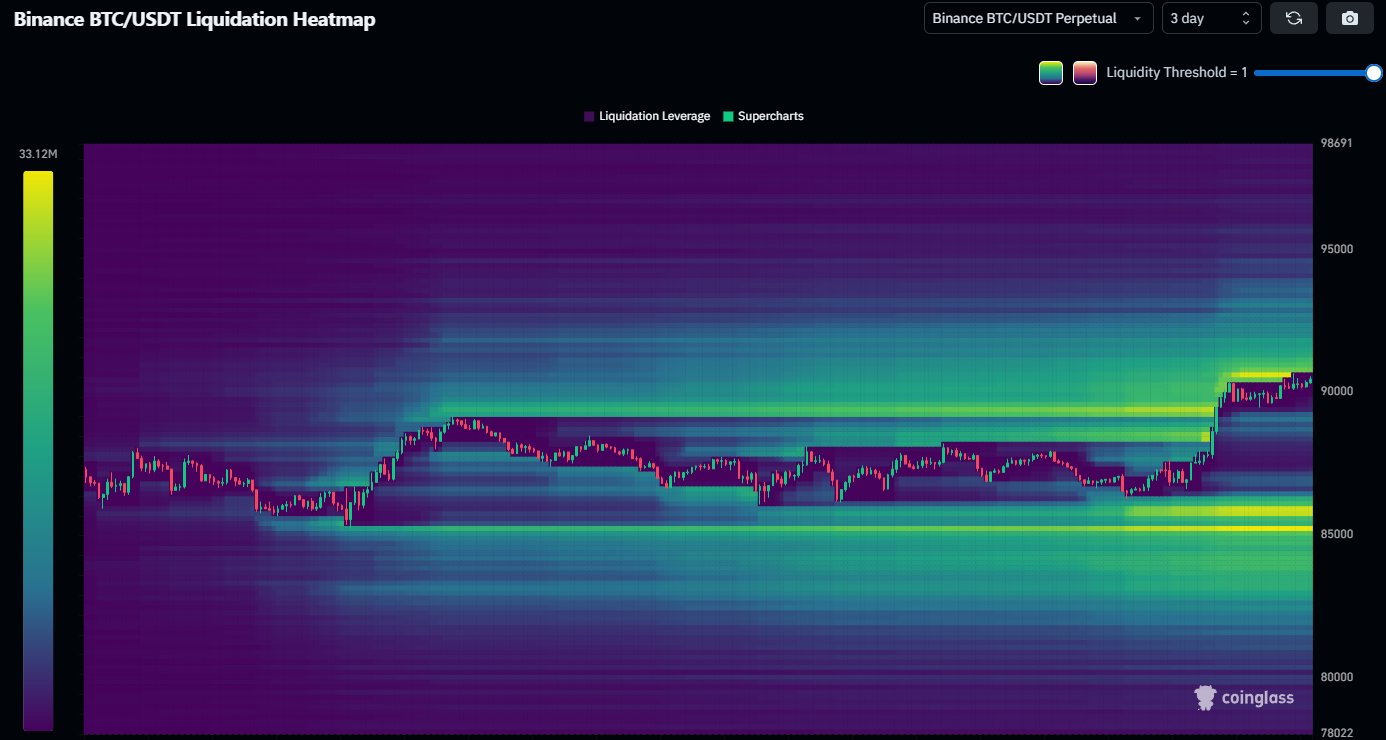

Nonetheless, citing Coinglass data, he also pointed out that the next large pocket of potential liquidations sits near $85,000, which puts this level at risk if buyers fail to keep the market supported. Essentially, bulls must stay active to stop the market from drifting toward that zone.

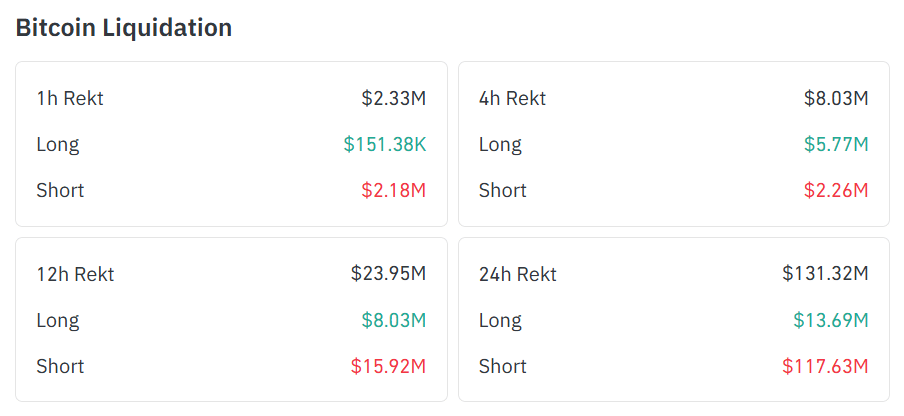

Latest figures from Coinglass support this data. Notably, the platform shows that most liquidations over the past 12 and 24 hours came from short positions, reversing the earlier pattern when long traders took most of the losses.

In the last 12 hours, the market saw $23.95 million in total liquidations, with shorts contributing $15.92 million, or 66%. Interestingly, over the past 24 hours, the gap widened further. Total liquidations hit $131.32 million, and shorts made up $117.63 million of that amount, or 89%.

Meanwhile, in the 4-hour timeframe, the trend flipped again. Long traders lost $5.77 million, while shorts lost $2.26 million. This likely reflects overconfidence from bullish traders who expected the move above $90,000 to lead to more immediate gains.

BTC Remains in a Critical Position

Speaking on the latest recovery effort, analyst Ted Pillows said a large amount of liquidity still sits above Bitcoin’s current level, although clusters have started forming around the $85,000 to $86,000 range as well, confirming Satoshi Stacker’s disclosure.

However, according to Pillows, if Bitcoin pushes past the $93,000 to $94,000 zone, the move could open the path toward $100,000 before the market pulls back.

Meanwhile, crypto insights firm Swissblock said Bitcoin’s earlier drop below the yearly open around $93,000 led to an important change in the market trend. The firm expects Bitcoin to retest the support area between $83,000 and $85,000, where strong demand needs to appear for a bottom to form.

Bitcoin’s break below the Yearly Open was the real shift.

Now it can retest the defensive zone at $83K–$85K, where strong demand must appear for a bottom to form.

But the trend only flips if BTC reclaims $94K–$95K

Defensive zone must hold, or the next downward leg opens fast. pic.twitter.com/rohwTMpqhQ

— Swissblock (@swissblock__) November 26, 2025

Swissblock added that Bitcoin must reclaim the $94,000 to $95,000 area for the trend to flip in favor of buyers. If the market fails to hold the defensive zone, the firm warns that another quick downward leg could follow.